Titan Machinery (TITN) Q1 Earnings Top Estimates, Sales Miss

Titan Machinery Inc. TITN reported first-quarter fiscal 2024 (ended Apr 30, 2023) earnings per share (EPS) of $1.19, beating the Zacks Consensus Estimate of $1.00. The bottom line improved 55% from earnings per share of 78 cents reported in the last fiscal year’s comparable quarter.

Total revenues in the reported quarter were $570 million, up 23.6% from the levels reported in the previous fiscal year’s comparable quarter. The top line, however, missed the consensus mark of $586 million.

Equipment revenues rose 20.5% year over year to $429 million and parts revenues were up 41% to $97 million. Revenues generated from services were $35 million in the reported quarter, up 18% from the year-ago quarter’s levels. Meanwhile, rental revenues were up 32% year over year to $8.7 million.

Titan Machinery Inc. Price, Consensus and EPS Surprise

Titan Machinery Inc. price-consensus-eps-surprise-chart | Titan Machinery Inc. Quote

Costs and Margins

Cost of sales was up 21.2% to $451 million from the prior fiscal year’s quarterly reading. The gross profit increased 33.7% year over year to $119 million. The gross margin was 20.9%, up from 19.3% in the last fiscal year’s quarter.

Operating expenses increased 26.6% from the earlier fiscal year to $81 million. The adjusted EBITDA rose 45.8% year over year to $44 million. The adjusted EBITDA margin in the fiscal first quarter was 7.6% compared with 6.5% in the prior fiscal year’s relevant quarter.

Segmental Performance

Agriculture revenues rose 32.9% to $423 million from the last fiscal year’s comparable quarter on strong customer demand and recent acquisitions. The segment’s income before taxes improved by 46.8% year over year to $24.2 million.

Construction revenues were $72 million in the fiscal first quarter, up 7.5% from the comparable quarter in the prior fiscal year. Same-store sales increased 9.9% on strong equipment demand, offset by the lost contributions from the divestiture of its consumer products store in North Dakota. The segment reported an adjusted income before taxes of $4.5 million, up from the prior-year quarter’s $3.2 million.

International revenues were $74 million, reflecting a year-on-year fall of 1.4%. Growth was impacted by foreign currency fluctuations. The segment reported income before taxes of $6.4 million, which was higher than $4.3 million reported in the previous fiscal year’s quarter.

Financial Position

Cash used for operating activities was $77.7 million in the first quarter of fiscal 2024 against cash inflow of $5.3 million in the prior fiscal year’s quarter. The downside was driven by an increase in inventory. Titan Machinery ended the reported quarter with a cash balance of around $38 million. Long-term debt as of Apr 30, 2023, was around $93 million compared with $89.9 million as of Jan 31, 2023.

Fiscal 2024 Guidance

The company reaffirmed its earnings per share guidance to be in the range of $4.50-$5.10 for fiscal 2024. The Agriculture segment’s revenues are projected to grow 20-25%. The Construction segment’s revenues are projected to be flat to up 5% in fiscal 2023. International revenues are expected to increase 8-13%.

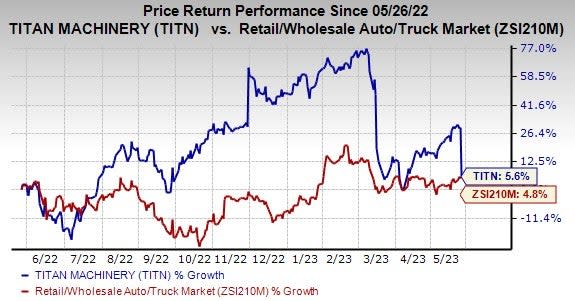

Price Performance

In the past year, shares of Titan Machinery have gained 5.6% against the industry’s fall of 4.8%.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Titan Machinery currently carries a Zacks Rank #2 (Buy).

Some better-ranked stocks from the Retail — Wholesale sector are Yum China, Inc. YUMC, Chuy's Holdings, Inc. CHUY and Arcos Dorados Holdings Inc. ARCO. YUMC flaunts a Zacks Rank #1 (Strong Buy) at present, whereas CHUY and ARCO have the same rank as TITN. You can see the complete list of today’s Zacks #1 Rank stocks here.

Yum China has an average trailing four-quarter earnings surprise of 301.6%. The Zacks Consensus Estimate for YUMC’s 2023 earnings is pegged at $1.99 per share. This indicates an 89.5% increase from the prior-year reported figure. The consensus estimate for 2023 earnings has moved north by 11% in the past 60 days. Its shares gained 31.6% in the last year.

Chuy’s has an average trailing four-quarter earnings surprise of 23.4%. The Zacks Consensus Estimate for CHUY’s 2023 earnings is pegged at $1.71 per share. This indicates a 24.8% increase from the prior-year reported figure. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days. CHUY’s shares gained 66.6% in the last year.

The Zacks Consensus Estimate for Arcos Dorados’ fiscal 2023 earnings per share is pegged at 72 cents, suggesting an increase of 4.3% from that reported in the last year. The consensus estimate for fiscal 2023 earnings moved 9% upward in the last 60 days. ARCO has a trailing four-quarter average earnings surprise of 23.4%. Its shares gained 14.1% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Titan Machinery Inc. (TITN) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report