Is It Too Late To Buy Applied Industrial Technologies Inc (NYSE:AIT)?

Applied Industrial Technologies Inc (NYSE:AIT), a trade distributors company based in United States, saw a double-digit share price rise of over 10% in the past couple of months on the NYSE. As a well-established company, which tends to be well-covered by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. But what if there is still an opportunity to buy? Let’s examine Applied Industrial Technologies’s valuation and outlook in more detail to determine if there’s still a bargain opportunity. View our latest analysis for Applied Industrial Technologies

What’s the opportunity in Applied Industrial Technologies?

Good news, investors! Applied Industrial Technologies is still a bargain right now. My valuation model shows that the intrinsic value for the stock is $1816.21, which is above what the market is valuing the company at the moment. This indicates a potential opportunity to buy low. What’s more interesting is that, Applied Industrial Technologies’s share price is quite stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be less chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market given its low beta.

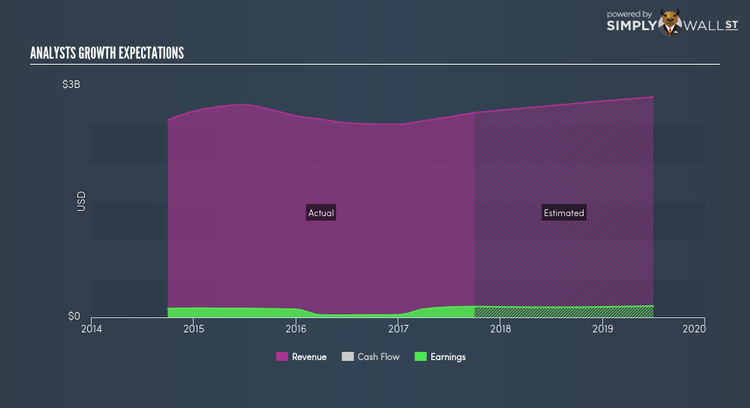

Can we expect growth from Applied Industrial Technologies?

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company’s future expectations. However, with a negative profit growth of -3.70% expected next year, near-term growth certainly doesn’t appear to be a driver for a buy decision for Applied Industrial Technologies. This certainty tips the risk-return scale towards higher risk.

What this means for you:

Are you a shareholder? Although Applied Industrial Technologies is currently undervalued, the negative outlook does bring on some uncertainty, which equates to higher risk. I recommend you think about whether you want to increase your portfolio exposure to Applied Industrial Technologies, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping an eye on Applied Industrial Technologies for a while, but hesitant on making the leap, I recommend you research further into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Applied Industrial Technologies. You can find everything you need to know about Applied Industrial Technologies in the latest infographic research report. If you are no longer interested in Applied Industrial Technologies, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.