Is There Too Much Froth in the Safe, Steady Healthcare Sector?

This article was originally published on ETFTrends.com.

The healthcare sector has been a sure, but steady performer and a common safe haven sector when stocks head to the downside, but will future regulatory risks expose too much froth via overvaluation in the sector?

One prevailing factor to watch is the upcoming 2020 elections, which could affect the winning candidates’ views on health care. U.S. President Donald Trump, for example, made reducing health care costs part of his campaign prior to winning the 2016 Election.

“Morningstar's US Healthcare Index has increased 22% over the trailing 12 months amid solid underlying fundamental performance (Exhibit 1),” wrote Damien Conover in Morningstar. “However, the returns have underperformed the broader equity market performance of 31%. We believe concerns around potential changes in U.S. healthcare policies have become more elevated, with politicians increasing rhetoric for the upcoming presidential election. The heightened fears around potential healthcare policy changes have increased the sector’s uncertainty and weighed on healthcare’s relative performance.”

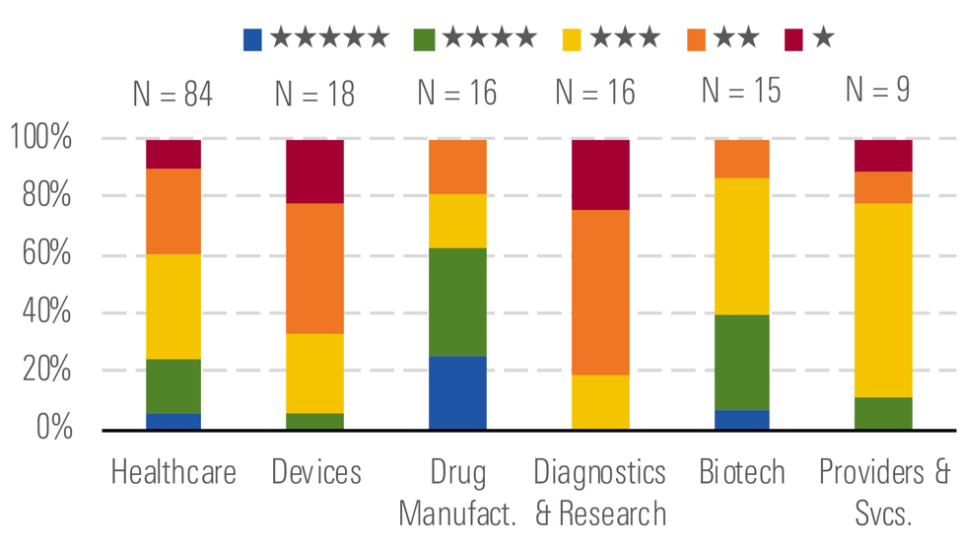

“Overall, we view the healthcare sector as slightly overvalued. Our coverage trades at a slight premium to our overall estimate of intrinsic value, with the median price/fair value at 1.05,” added Conover. “Given the slightly higher valuations in the sector, we only see a few buys, with only 12% of our coverage rated 5 stars (Exhibit 2).”

Conover also identified which subareas of the healthcare sector could be overvalued.

“The most overvalued stocks are in the device and diagnostics industries, where performance has generally been strong, but not strong enough to support current valuations,” Conover said. “We believe the valuations in these industries show overly optimistic projections and could reflect the market's desire for exposure to healthcare but not in the pharmaceutical industry that is facing potential policy changes in the U.S.”

ETF investors can look for opportunities in the Health Care Select Sector SPDR ETF (XLV) , Vanguard Health Care ETF (VHT) and the iShares US Medical Devices ETF (IHI) .

XLV seeks investment results that correspond generally to the Health Care Select Sector Index. The index includes companies from the following industries: pharmaceuticals; health care equipment & supplies; health care providers & services; biotechnology; life sciences tools & services; and health care technology.

VHT employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index (IMI)/Health Care 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the health care sector, as classified under the Global Industry Classification Standard (GICS).

IHI seeks to track the investment results of the Dow Jones U.S. Select Medical Equipment Index composed of U.S. equities in the medical devices sector. The underlying index includes medical equipment companies, including manufacturers and distributors of medical devices such as magnetic resonance imaging (MRI) scanners, prosthetics, pacemakers, X-ray machines, and other non-disposable medical devices.

For more market trends, visit ETF Trends.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM