Top 1st-Quarter Buys of Ken Heebner's CGM

Ken Heebner (Trades, Portfolio)'s Capital Growth Management recently disclosed its portfolio updates for the first quarter of 2020, which ended on March 31.

Boston-based Capital Growth Management specializes in swift and bold sector calls, typically establishing large short-term positions in companies that it expects will see strong growth in the near future. Heebner is the co-founder of the firm and believes that placing large bets on his convictions is the way to investing success.

Based on the above criteria, CGM's biggest new buys for the fourth quarter were in D.R. Horton Inc. (NYSE:DHI) and Lennar Corp. (NYSE:LEN), while its biggest sells were in Petroleo Brasileiro SA Petrobras (NYSE:PBR) and Thor Industries Inc. (NYSE:THO). In total, the firm established 29 new holdings, sold out of 35 holdings and added to or reduced several other positions for a quarterly turnover ratio of 70%.

D.R. Horton

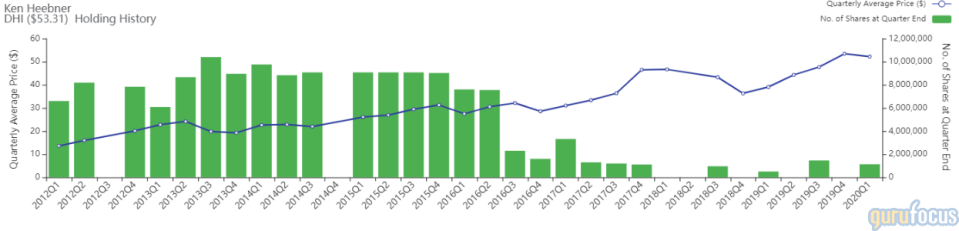

The firm established a new stake of 1,135,000 shares in D.R. Horton after selling out of its previous investment in the company in the fourth quarter of 2019. The trade had a 5.42% impact on the equity portfolio. During the quarter, shares traded for an average price of $52.18.

Headquartered in Arlington, Texas, D.R. Horton is the largest homebuilder in the U.S. by number of closings. It builds new homes and sells both new and old homes through four brands: Express, Emerald, Freedom and D.R. Horton, which are all marketed toward different age and wealth demographics.

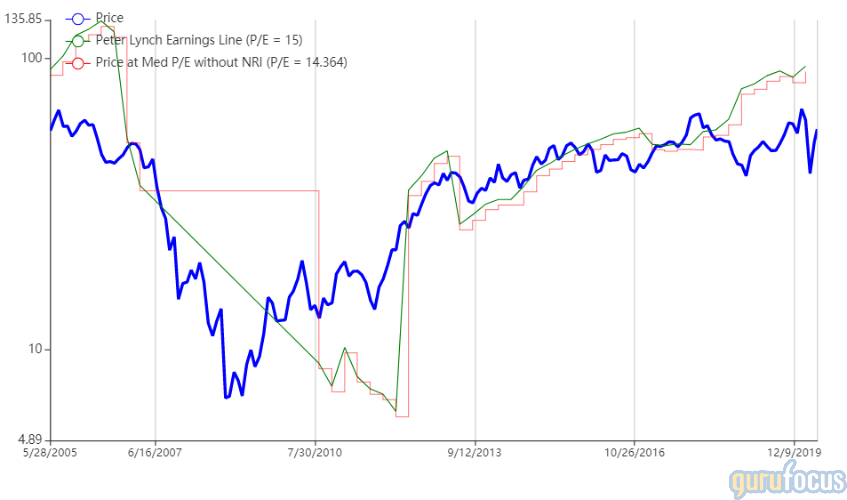

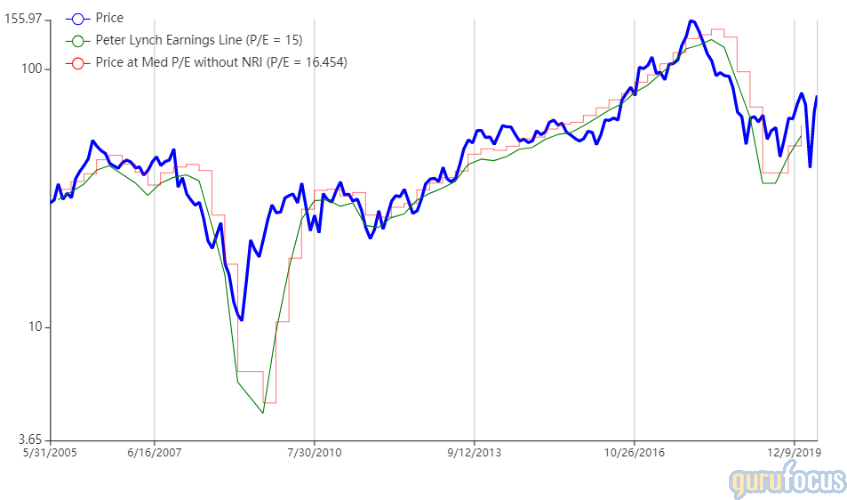

On May 21, shares of D.R. Horton traded around $53.23 for a market cap of $19.38 billion and a price-earnings ratio of 10.5. According to the Peter Lynch chart, the stock is trading below its intrinsic value.

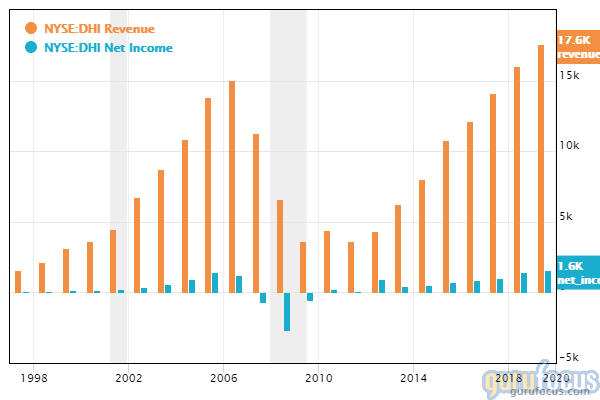

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 0.35 and current ratio of 10.81 suggest cash position strength, while the Altman Z-Score of 4.9 indicates that the company is safe from bankruptcy. With an operating margin of 12.51%, which is higher than the industry median of 8.14%, the company has consistently grown its revenue and net income since the 2008 recession.

Lennar

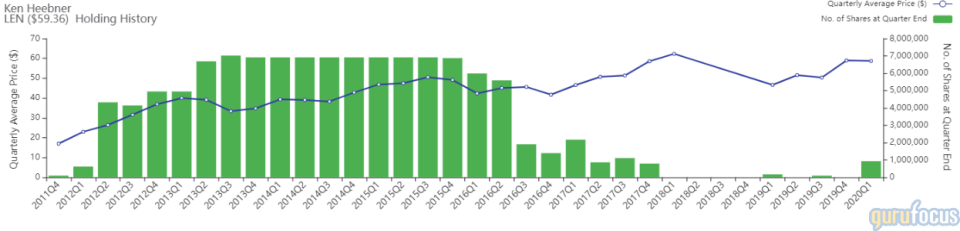

CGM also purchased 930,000 shares of Lennar after selling out of its previous holding in the company in the fourth quarter of 2019. The trade impacted the equity portfolio by 4.99%. Shares traded for an average price of $58.69 during the quarter.

Lennar is the second-largest homebuilder in the U.S. Headquartered in Miami, Florida, the company is a national leader in the construction of new homes in the most desirable real estate markets. It also owns an international arm, which it launched in 2014.

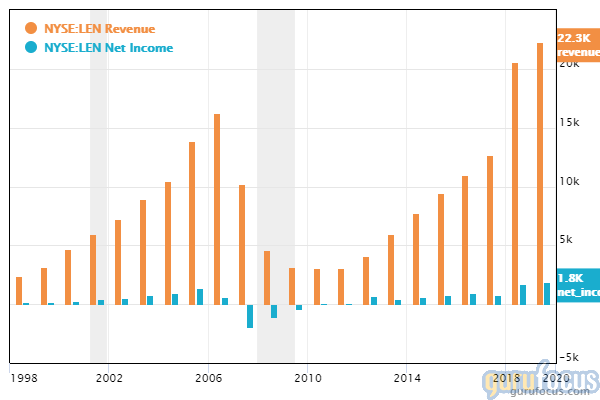

On May 21, shares of Lennar traded around $59.13 for a market cap of $17.91 billion and a price-earnings ratio of 9.41. The Peter Lynch chart indicates that the stock is trading below its intrinsic value.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 0.12 is lower than 79.13% of industry competitors, but the Altman Z-Score of 3.13 shows that the company is unlikely to go bankrupt. Revenue and net income have shown strong growth in recent years, with the extra boost in 2018 due to acquisitions.

Petroleo Brasileiro SA Petrobras

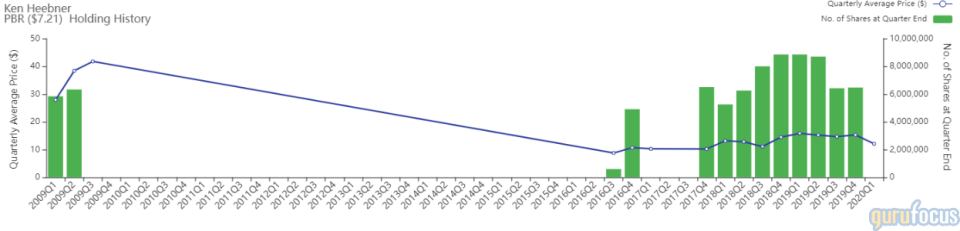

The firm sold out of its 6,470,000-share stake in Petroleo Brasileiro SA Petrobras, impacting the equity portfolio by -8.34%. During the quarter, shares traded for an average price of $12.09.

Petroleo Brasileiro is a semi-public Brazilian petroleum company, 64% of which is owned by the Brazilian government. Commonly known as Petrobras, the company explores for, extracts, refines, markets and supplies oil and natural gas products.

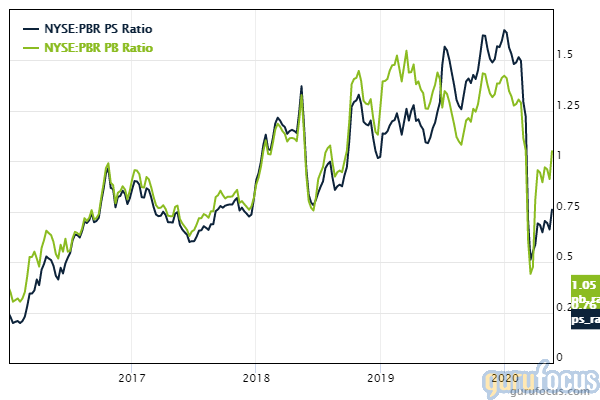

On May 21, shares of Petrobras traded around $7.21 for a market cap of $45.87 billion. The price-book ratio of 1.05 suggests the company is fairly valued, though the price-sales ratio of 0.76 indicates a potential undervaluation.

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 7 out of 10. The Altman Z-Score of 0.47 suggests that the company has a risk of going bankrupt, but the interest coverage ratio of 2.95 indicates that it can likely make interest payments. The operating margin of 27.81% is higher than 82.58% of competitors, and the weighted average cost of capital is lower than the return on invested capital, which indicates overall profitability.

Thor Industries

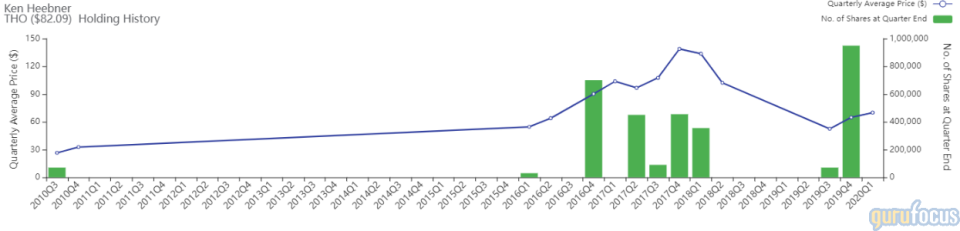

The firm also exited its 949,000-share holding in Thor Industries, which had a -5.70% impact on the equity portfolio. Shares traded for an average price of $69.96 during the quarter.

Thor Industries is one of the world's leading manufacturers and sellers of motorized and towable recreation vehicles (RVs). The Elkhart, Indiana-based company sells its products through its subsidiary brands, which include Heartland, Jayco, Livin Lite and Airstream.

As of May 21, shares of Thor Industries traded around $81.41 for a market cap of $4.53 billion and a price-earnings ratio of 22.19. According to the Peter Lynch chart, the stock may be trading above its intrinsic value.

GuruFocus has assigned the company a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. The low cash-debt ratio of 0.14 is balanced out by the Altman Z-score of 3.23, which indicates that the company is not in financial distress. The operating margin of 3.48% is lower than the industry median of 4.16%, while the WACC is higher than the ROIC, indicating lack of profitability.

Portfolio overview

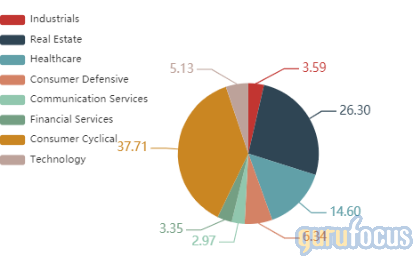

As of the quarter's end, the fund held shares in 42 stocks valued at a total of $712 million. The top holdings were D.R. Horton with 5.42% of the equity portfolio, M.D.C. Holdings Inc. (MDC) with 5.24% and Lennar with 4.99%.

In terms of sector weighting, the firm was most invested in consumer cyclicals, real estate and health care.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Tiger Global Management's Top 1st-Quarter Updates

Mason Hawkins' Southeastern Buys Hyatt, DuPont

Carl Icahn's Firm Buys Hertz, Occidental

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.