Top 3 Growth Stocks For The Month

Individual investors like stocks with a high growth potential. These companies have a strong outlook that can bring a significant upside to your portfolio, regardless of market cyclicality. Investment in growth companies can benefit your current holdings, whether it be in established tech giants or undiscovered micro-caps. Here, I’ve put together a few companies the market is particularly optimistic towards.

Caledonia Mining Corporation Plc (TSX:CAL)

Caledonia Mining Corporation Plc primarily engages in the exploration and development of gold properties. Caledonia Mining was established in 1992 and with the company’s market cap sitting at CAD CA$95.96M, it falls under the small-cap stocks category.

CAL’s forecasted bottom line growth is an optimistic 46.73%, driven by the underlying double-digit sales growth of 24.60% over the next few years. It appears that CAL’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 18.40%. CAL’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Thinking of investing in CAL? Take a look at its other fundamentals here.

Avigilon Corporation (TSX:AVO)

Avigilon Corporation designs, develops, and manufactures video analytics, network video management software and hardware, surveillance cameras, and access control solutions. Established in 2004, and now run by Alexander Fernandes, the company provides employment to 1,181 people and with the company’s market cap sitting at CAD CA$1.20B, it falls under the small-cap category.

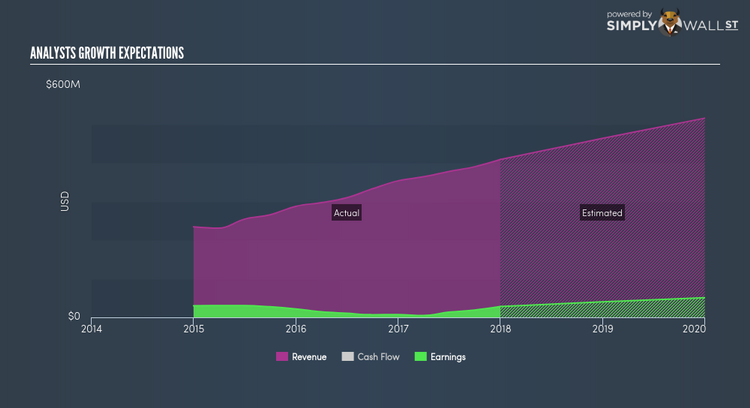

AVO’s forecasted bottom line growth is an optimistic 28.69%, driven by the underlying double-digit sales growth of 26.23% over the next few years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. AVO ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about AVO? Other fundamental factors you should also consider can be found here.

Solium Capital Inc. (TSX:SUM)

Solium Capital Inc. provides cloud-enabled services for administration, financial reporting, and compliance related to equity-based incentive plans in Canada, the United States, and internationally. Established in 1999, and now led by CEO Marcos Lopez, the company size now stands at 677 people and with the stock’s market cap sitting at CAD CA$615.02M, it comes under the small-cap group.

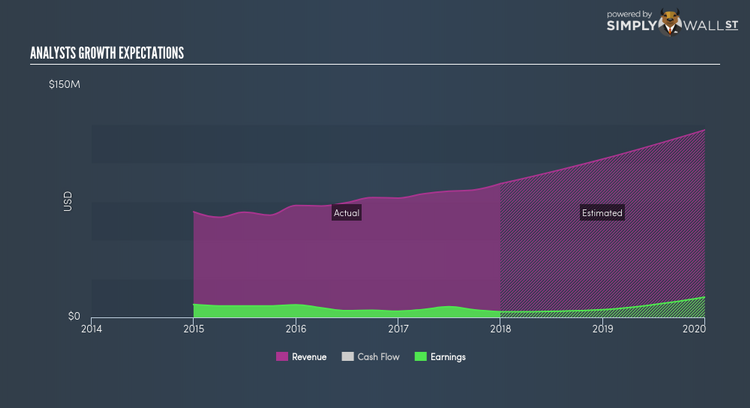

An outstanding 65.85% earnings growth is forecasted for SUM, driven by an underlying sales growth of 40.25% over the next few years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 6.80%. SUM’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Should you add SUM to your portfolio? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.