Top 3 Growth Stocks For The Month

High-growth stocks that are financially stable are attractive for many reasons. They provide a strong upside to your portfolio, with less likelihood of downside risks compared to less financially robust companies. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

Howard Bancorp, Inc. (NASDAQ:HBMD)

Howard Bancorp, Inc. operates as the bank holding company for Howard Bank that provides commercial banking, mortgage banking, and consumer finance products and services to businesses, business owners, professionals, and other consumers. Established in 2004, and now run by Mary Scully, the company size now stands at 297 people and with the company’s market cap sitting at USD $214.95M, it falls under the small-cap group.

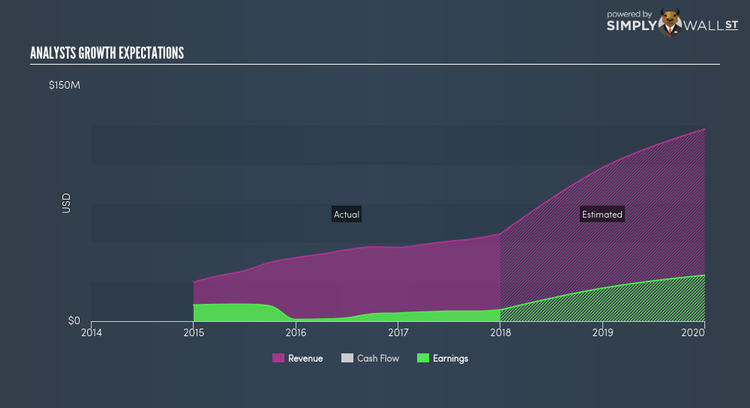

Driven by exceptional sales, which is expected to more than double over the next few years, HBMD is expected to deliver an excellent earnings growth of 57.10%. It appears that HBMD’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 11.14%. HBMD ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. A potential addition to your portfolio? Take a look at its other fundamentals here.

Atossa Genetics Inc. (NASDAQ:ATOS)

Atossa Genetics Inc. a clinical-stage pharmaceutical company, focuses on the development and sale of novel therapeutics and delivery methods for the treatment of breast cancer and other breast conditions in the United States. The company was established in 2009 and has a market cap of USD $13.37M, putting it in the small-cap group.

ATOS is expected to deliver a buoyant earnings growth over the next couple of years of 22.55%, bolstered by a significant revenue which is expected to more than double. It appears that ATOS’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. ATOS ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering ATOS as a potential investment? Check out its fundamental factors here.

Stemline Therapeutics, Inc. (NASDAQ:STML)

Stemline Therapeutics, Inc., a clinical-stage biopharmaceutical company, focuses on the discovering, acquiring, developing, and commercialization of proprietary oncology therapeutics in the United States. Established in 2003, and currently headed by CEO Ivan Bergstein, the company size now stands at 32 people and has a market cap of USD $480.93M, putting it in the small-cap category.

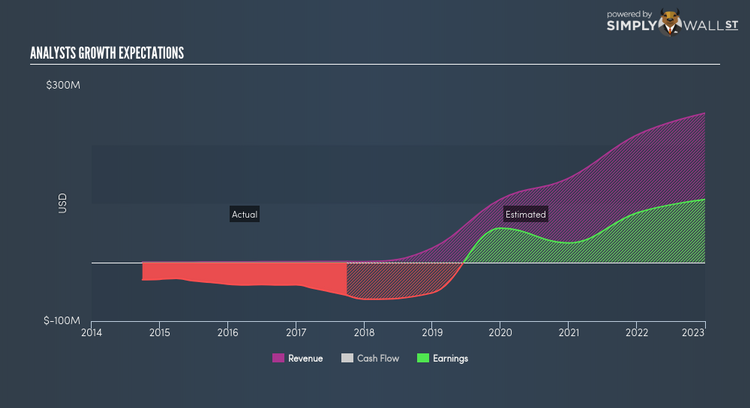

STML is expected to deliver an extremely high earnings growth over the next couple of years of 55.24%, bolstered by a significant revenue which is expected to more than double. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. STML’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Could this stock be your next pick? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.