Top 3 Stocks Insiders Bought More Of

Company executives, directors and large existing shareholders ramping up shares in a particular company could signal higher confidence in the future outlook of the business. Generally, when insiders buy, their stock tends to outperform the market afterwards (The MIT Press, 1998). Should you followsuit? Below, I’ve chosen three NasdaqGS companies which insiders have recently accumulated more shares in.

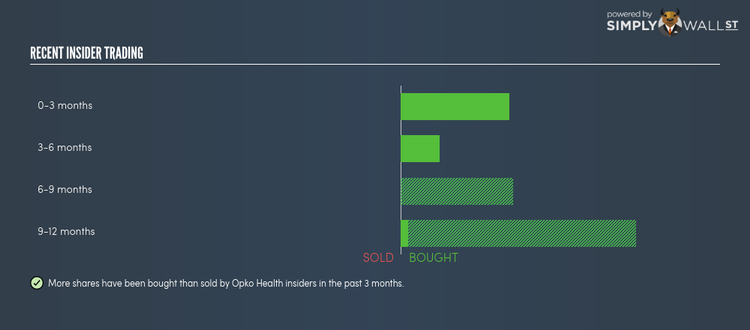

Opko Health, Inc. (NASDAQ:OPK)

OPKO Health, Inc., a healthcare company, engages in the diagnostics and pharmaceuticals business in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally. Started in 1991, and run by CEO Philip Frost, the company provides employment to 6,041 people and with the company’s market capitalisation at USD $1.98B, we can put it in the small-cap stocks category.

Opko Health Inc (NASDAQ:OPK) is one of United States’s large-cap stocks that saw some insider buying over the past three months, with insiders investing in more than 1 million shares during this period. In total, individual insiders own over 38 million shares in the business, which makes up around 6.84% of total shares outstanding.

The insider that recently bought more shares is Philip Frost (management and board member) .

Analysts anticipate an impressive double-digit top-line growth over the next three years, which appears to flow through to a large earnings growth rate of 42.64% from today’s level. If insiders believe these benefits are defensible, this could be a motivation for the net buying activity. Interested in Opko Health? Find out more here.

J.Jill, Inc. (NYSE:JILL)

J.Jill, Inc. operates as a specialty retailer of women’s apparel under the J.Jill brand in the United States. The company provides employment to 2604 people and has a market cap of USD $381.48M, putting it in the small-cap group.

JJill Inc.’s (NYSE:JILL) insiders have invested 37,500 shares in the small-cap stocks within the past three months. In total, individual insiders own over 4 million shares in the business, which makes up around 8.85% of total shares outstanding.

Insiders that have recently ramped up their holdings are: David Biese (management and board member) . and Paula Bennett (management) .

With a relatively flat top-line forecasted for the upcoming year, but a robust earnings growth rate of 22.83%, insiders may have strong conviction in management’s cost initiatives moving forward. This underlying driver of growth could be one of the reasons why insiders have bought more shares over the past couple of months. Interested in J.Jill? Find out more here.

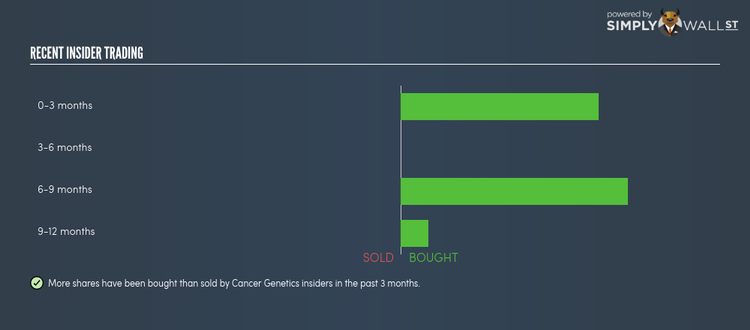

Cancer Genetics, Inc. (NASDAQ:CGIX)

Cancer Genetics, Inc. develops, commercializes, and provides molecular and biomarker-based tests and services in the United States, India, and China. Established in 1999, and now led by CEO John Roberts, the company size now stands at 149 people and with the market cap of USD $43.66M, it falls under the small-cap group.

Cancer Genetics Inc’s (NASDAQ:CGIX) insiders have invested 162,200 shares in the small-cap stocks within the past three months. In total, individual insiders own over 5 million shares in the business, which makes up around 20.26% of total shares outstanding.

Insiders that have recently ramped up their holdings are: John Pappajohn (management) . and John Roberts (board member) .

Analysts anticipate an impressive double-digit top-line growth next year, which appears to flow through to a large earnings growth rate of 41.38%. If insiders believe these benefits are defensible, this could be a motivation for the net buying activity. More on Cancer Genetics here.

For more stocks with high, positive trading volume by insiders, take a look at our free platform to explore the interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.