Top 3 Undervalued Stocks For The Month

Companies, such as CRH Medical, are deemed to be undervalued because their shares are currently trading below their true values. There’s a few ways you can value a company. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good investments.

CRH Medical Corporation (TSX:CRH)

CRH Medical Corporation provides products and services to physicians for the treatment of gastrointestinal diseases in the United States. Established in 2000, and now run by Edward Wright, the company employs 17 people and with the market cap of CAD CA$268.71M, it falls under the small-cap group.

CRH’s shares are currently hovering at around -60% under its real value of $9.03, at a price of CA$3.57, based on my discounted cash flow model. The difference between value and price signals a potential opportunity to buy CRH shares at a discount. Furthermore, CRH’s PE ratio is trading at around 30.46x compared to its Medical Equipment peer level of, 32.67x implying that relative to its peers, CRH can be bought at a cheaper price right now. CRH also has a healthy balance sheet, with short-term assets covering liabilities in the near future as well as in the long run.

More on CRH Medical here.

Aberdeen International Inc. (TSX:AAB)

Aberdeen International Inc. operates as a resource investment company and merchant bank focusing on small capitalization companies in the metals and mining sector. Aberdeen International was founded in 1987 and with the company’s market capitalisation at CAD CA$17.29M, we can put it in the small-cap category.

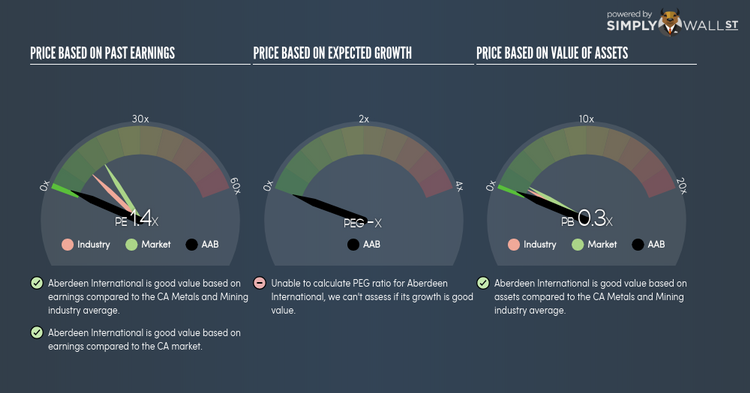

AAB’s shares are now hovering at around -31% under its intrinsic value of $0.25, at a price of CA$0.17, based on its expected future cash flows. This mismatch indicates a chance to invest in AAB at a discounted price. Furthermore, AAB’s PE ratio is around 1.43x against its its Metals and Mining peer level of, 10.27x implying that relative to its comparable set of companies, we can buy AAB’s stock at a cheaper price today. AAB is also in good financial health, as short-term assets amply cover upcoming and long-term liabilities. AAB also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. Continue research on Aberdeen International here.

Q Investments Ltd. (TSXV:QI)

Q Investments Ltd. is a venture capital firm specializing in investments in early stage. Q Investments was established in 1980 and with the company’s market cap sitting at CAD CA$703.82K, it falls under the small-cap category.

QI’s shares are now trading at -94% under its intrinsic level of $3.89, at a price of CA$0.23, based on my discounted cash flow model. The mismatch signals a potential chance to invest in QI at a discounted price. Moreover, QI’s PE ratio stands at 1.38x compared to its Capital Markets peer level of, 14.03x meaning that relative to other stocks in the industry, we can invest in QI at a lower price. QI is also a financially healthy company, with near-term assets able to cover upcoming and long-term liabilities.

Dig deeper into Q Investments here.

For more financially sound, undervalued companies to add to your portfolio, you can use our free platform to explore our interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.