Top 3rd-Quarter Buys of Steven Cohen's Firm

- By Margaret Moran

Steven Cohen (Trades, Portfolio)'s Point72 Asset Management recently disclosed its portfolio updates for the third quarter of 2020, which ended on Sept. 30.

Point72 is a hedge fund that was formed in 2014 when SAC Capital Advisors converted its investment operations into a family office. In 2018, the firm re-opened to external investors. Point72 invests via a wide range of asset classes and strategies worldwide. Its core investing strategy is based on bottom-up research with a focus on fundamentals and macroeconomic conditions. Steven Cohen (Trades, Portfolio) serves as the President, CEO and Chairman of the firm.

The firm's top buys for the quarter were for Palantir Technologies Inc. (NYSE:PLTR) and Alphabet Inc. (NASDAQ:GOOGL), while its top sells were for Merck & Co Inc. (NYSE:MRK) and Immunomedics Inc. (NASDAQ:IMMU).

Palantir Technologies Inc.

The firm bought 29,904,230 shares of Palantir Technologies Inc., impacting the equity portfolio by 1.45%. During the quarter, shares traded for an average price of $9.50.

Palantir is a data mining, analytics and software company based in Denver, Colorado. It mainly makes its money from government contracts and has drawn criticism for business activities that have a very strong political agenda.

On Nov. 27, shares of Palantir traded around $27.66 for a market cap of $51.94 billion. Since its IPO on Sept. 30, the stock has gained more than 176%.

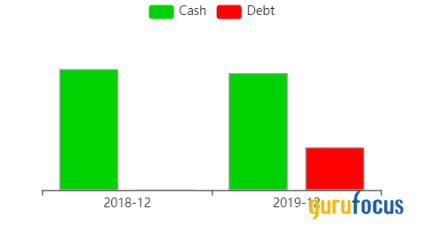

GuruFocus gives the company a financial strength rating of 5 out of 10; with a cash-debt ratio of 9.1 and a current ratio of 2.54, the company still has plenty of cash that it has raised through its IPO and various other funding sources. With an operating margin of -160.64%, the company is not yet profitable. In fact, when it applied for a direct listing in August, the company warned investors that it might never be profitable.

Alphabet Inc.

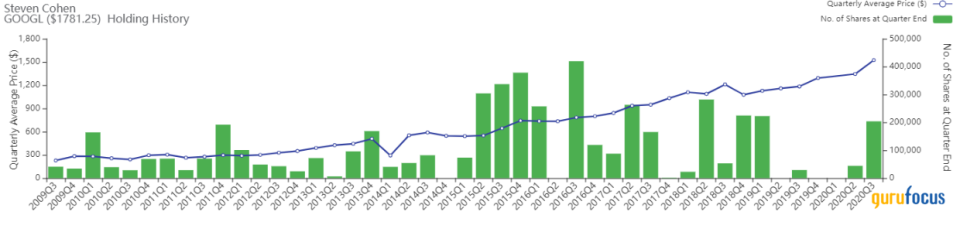

The firm upped its stake in Alphabet Inc. by 159,683 shares, or 361.81%, for a total holding of 203,818 shares. The trade had a 1.20% impact on the equity portfolio. Share traded for an average price of $1.523.87 during the quarter.

Based in Mountain View, California, Alphabet is a multinational conglomerate that was formed as part of a restructuring of Google in 2015, in which Alphabet became the parent company of Google and several former Google subsidiaries.

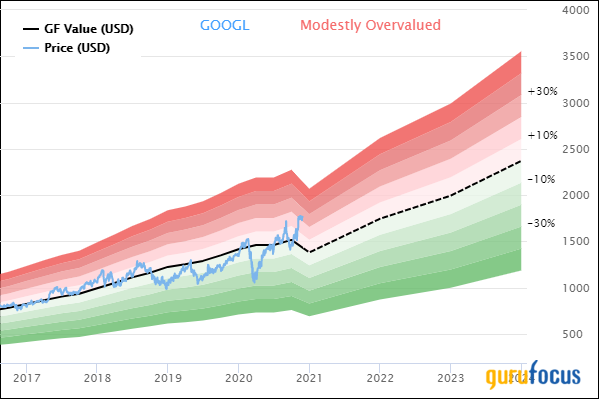

On Nov. 27, shares of Alphabet traded around $1,787.02 for a market cap of $1.21 trillion. The GuruFocus Value chart rates the stock as "modestly overvalued."

The company has a financial strength rating of 8 out of 10 and a profitability rating of 9 out of 10. The cash-debt ratio of 5.02 and Altman Z-Score of 10.52 both indicate a fortress-like balance sheet. The three-year revenue growth rate is 21.5%, while the three-year Ebitda growth rate is 19.2%.

Merck & Co Inc.

The firm cut its investment in Merck & Co. by 2,053,133 shares, or 57.09%, for a remaining holding of 1,543,449 shares. The trade had a -1.03% impact on the equity portfolio. During the quarter, shares traded for an average price of $82.09.

Merck & Co. is a pharmaceutical giant based in Kenilworth, New Jersey. Merck Sharp & Dohme outside of the U.S. and Canada, the company focuses its research and production primarily on vaccines, oncology, infectious diseases and cardio-metabolic disorders.

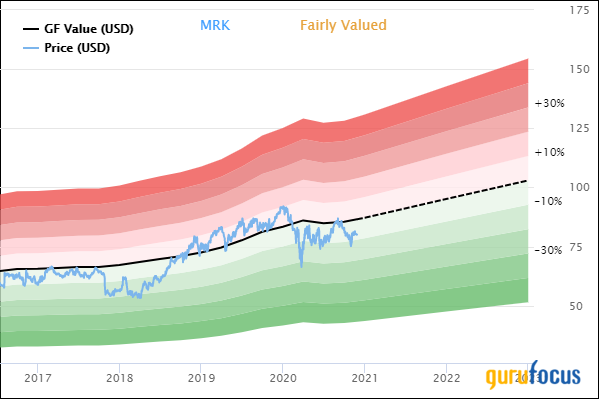

On Nov. 27, shares of Merck & Co. traded around $79.86 for a market cap of $202.05 billion. The GuruFocus Value chart rates the stock as "fairly valued."

The company has a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 0.26 is lower than 71% of competitors, but the Altman Z-Score of 3.94 indicates the company is not likely in danger of bankruptcy. The return on invested capital (ROIC) greatly exceeds the weighted average cost of capital (WACC), meaning the company is creating value for shareholders.

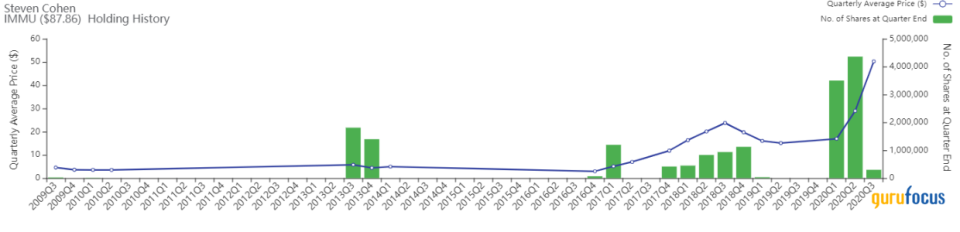

Immunomedics Inc.

The firm also reduced its Immunomedics Inc. investment by 4,057,664 shares, or 93.12%, for a remaining holding of 300,000 shares. The trade had a -0.94% impact on the equity portfolio. Shares traded for an average price of $50.24 during the quarter.

Immunomedics is a biotechnology company that focuses on antibody-drug conjugates for cancer treatment. On Oct. 23, months after Trodelvy became its first FDA-approved treatment, Immunomedics was acquired by Gilead Sciences (NASDAQ:GILD) in an all-cash transaction valued at approximately $21 billion.

On Nov. 27, shares of Gilead (which Immunomedics is now a part of) traded around $60.03 for a market cap of $75.25 billion. Due to the acquisition, Immunomedics saw a sharp increase up to the purchase price as investors sought to profit from the special situation.

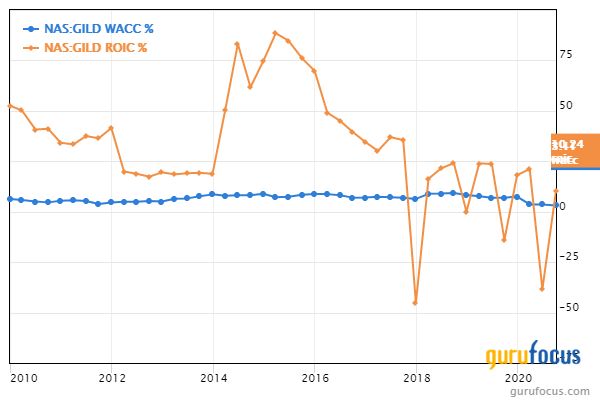

Gilead has a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The cash-debt ratio of 0.82 and Altman Z-Score of 2.3 show that the company is not likely to face bankruptcy in the near future. For the most recent quarter, the company's ROIC exceeded its weighted average cost of capital WACC, indicating overall profitability, though that has not always been the case in recent years.

Portfolio overview

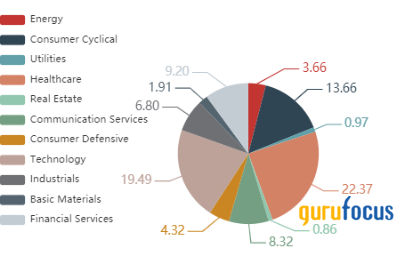

In total, Point72 established 356 new positions, sold out of 264 holdings and added to or reduced many other positions for a turnover of 44% for the quarter. As of the quarter's end, the firm held common stock shares in 894 companies valued at a total of $19.52 billion.

The top holdings were Amazon.com Inc. (NASDAQ:AMZN) with 2.53% of the equity portfolio, Alibaba Group Holding Ltd (NYSE:BABA) with 2.12% and Alphabet with 1.53%. In terms of sector weighting, the firm was most invested in health care, technology and consumer cyclical.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Philippe Laffont's Firm Buys Snowflake, Sells Boeing

Top 3rd-Quarter Trades of John Rogers' Ariel Investments

Top 3rd-Quarter Buys of Frank Sands' Firm

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.