Top 4th-Quarter Buys of Frank Sands' Firm

- By Margaret Moran

Sands Capital Management recently disclosed its portfolio updates for the fourth quarter of 2020, which ended on Dec. 31.

Founded in 1992 by Frank M. Sands Sr., Sands Capital Management is a staff-owned independent investment management firm that invests in high-quality growth business. Frank Sands (Trades, Portfolio) Jr. joined the firm in 2000 and now serves as CEO and chief investment officer. The Arlington, Virginia-based firm has two main concentrated growth strategies: Select Growth, which chooses innovative businesses, and Global Growth, which diversifies holdings in countries outside of the U.S. Sands Capital Management has achieved success by focusing on its six investment criteria: sustainable above-average earnings growth, leadership position in a promising business space, a clear mission with a focus on value, good financial strength, rational valuation and significant competitive advantages.

Based on the firm's investment criteria, its top buys for the third quarter were Sea Ltd. (NYSE:SE), Visa Inc. (NYSE:V), MercadoLibre Inc. (NASDAQ:MELI) and Uber Technologies Inc. (NYSE:UBER).

Sea

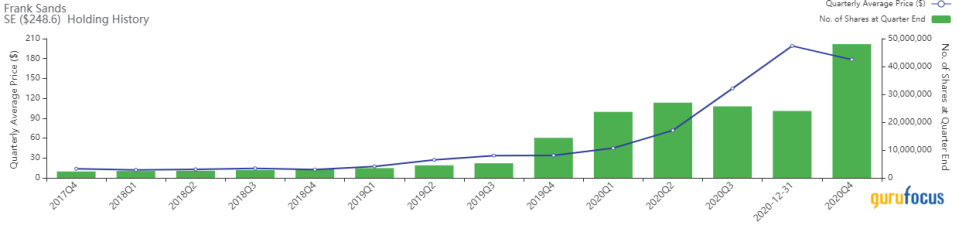

The firm added another 24,018,708 shares, or 87.04%, to its top holding Sea Ltd. (NYSE:SE) for a total investment of 48,037,304 shares. The trade had a 4.23% impact on the equity portfolio. During the quarter, shares traded for an average price of $178.34.

Sea is a Singapore-based internet company. It serves as an internet platform provider for customers in Southeast Asia and Taiwan, with an integrated platform consisting of digital entertainment, e-commerce and digital financial services.

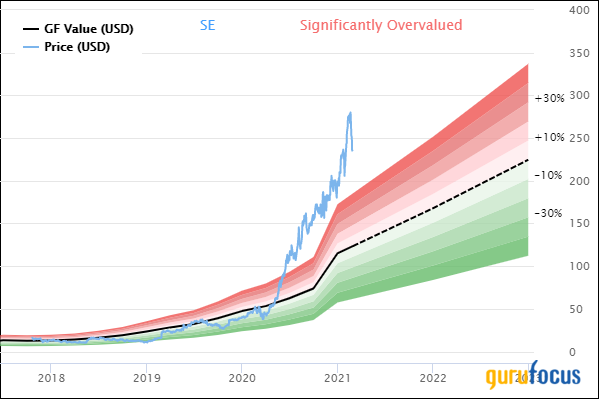

On March 1, shares of Sea traded around $250.11 for a market cap of $127.82 billion. According to the GuruFocus Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 3 out of 10. The Piotroski F-Score of 5 out of 9 and Altman Z-Score of 11.06 show a stable financial situation. The operating margin of -40.97% and net margin of -67.24% indicate that the company is not yet profitable.

Visa

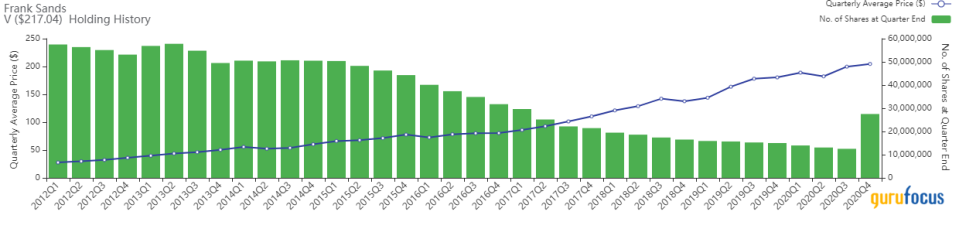

The firm also increased its Visa (NYSE:V) investment by 15,000,995 shares, or 119.77%, for a total holding of 27,526,312 shares. The trade impacted the equity portfolio by 3.12%. Shares traded for an average price of $204.66 during the quarter.

Visa is a major financial services and electronic payments provider based in San Francisco. The company facilitates funds transfers primarily through credit, debit and prepaid cards.

On March 1, shares of Visa traded around $217.25 for a market cap of $479 billion. According to the GF Value chart, the stock is modestly overvalued.

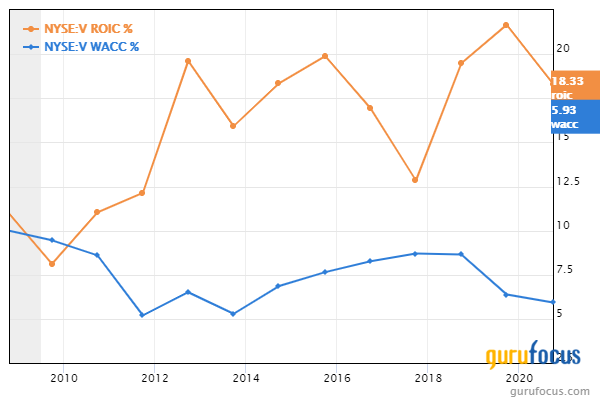

The company has a financial strength rating of 6 out of 10 and a profitability rating of 9 out of 10. The cash-debt ratio of 0.86 is better than 67% of industry peers, while the Altman Z-Score of 7.88 shows the company has a strong financial situation. The return on invested capital consistently outperforms the weighted average cost of capital, indicating the company is creating value for shareholders.

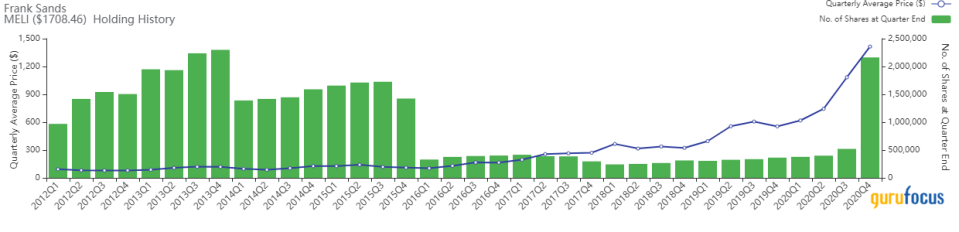

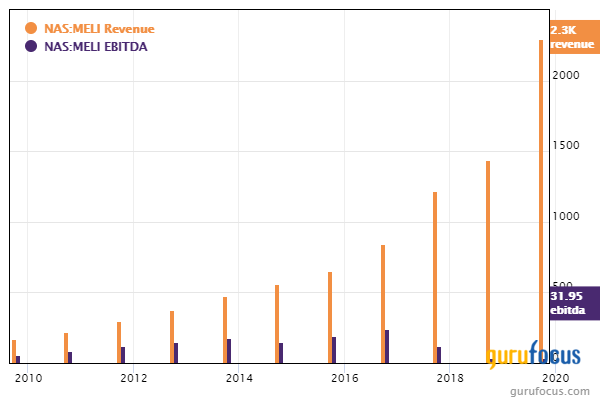

MercadoLibre

The firm purchased another 1,643,201 shares of MercadoLibre Inc. (NASDAQ:MELI), increasing the position by 315.8% for a total of 2,163,532 shares. The trade had a 2.62% impact on the equity portfolio. During the quarter, shares traded for an average price of $1,414.87.

MercadoLibre is an Argentinian online marketplace company that operates e-commerce and online option websites, including mercadolibre.com. It is headquartered in Buenos Aires, Argentina but incorporated in the U.S.

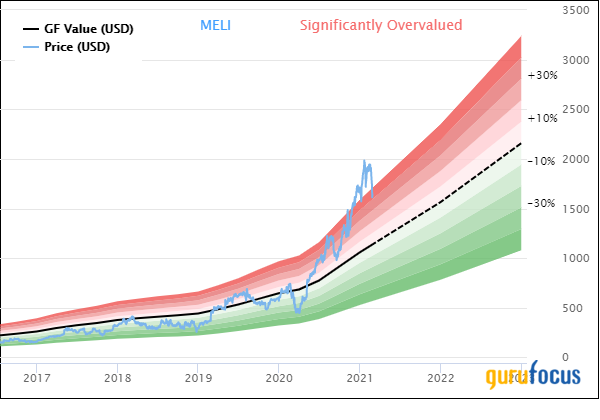

On March 1, shares of MercadoLibre traded around $1,712.31 for a market cap of $85.52 billion. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10. While the interest coverage ratio of 0.87 indicates the company's operating income is not enough to cover its interest expense at the moment, but the Altman Z-Score of 13.59 implies the company should be able to use its cash reserves and other assets to pick up the slack for at least the next couple of years. The three-year revenue growth rate is 35.1% while the three-year Ebitda growth rate is -50.6%.

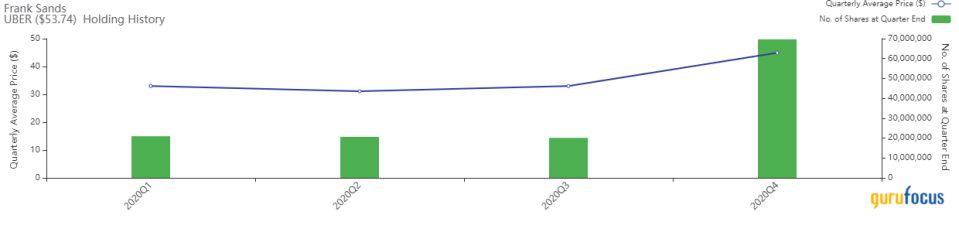

Uber Technologies

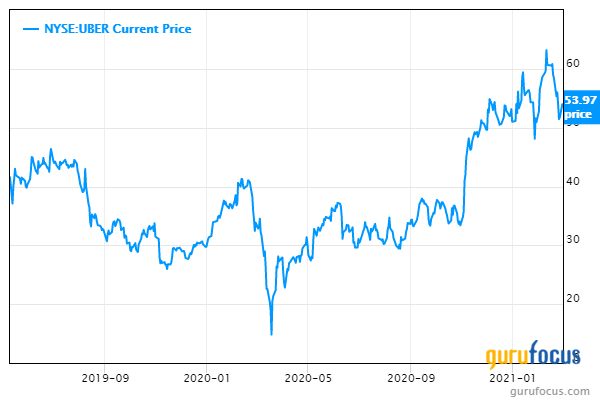

The firm upped its stake in Uber Technologies (NYSE:UBER) by 49,562,352 shares, or 246.52%, for a total holding of 69,666,806 shares. The trade impacted the equity portfolio by 2.40%. Shares traded for an average price of $44.94 during the quarter.

Most famous for being the world's largest ridesharing company, Uber also offers food delivery, electric bikes and scooters and has various technology projects. The company is based in San Francisco and operates in 63 countries worldwide.

On March 1, shares of Uber traded around $53.97 for a market cap of $100.09 billion. Since the company's public offering in May of 2019, shares have gained 29%.

The company has a financial strength rating of 4 out of 10 and a profitability rating of 1 out of 10. The Piotroski F-Score of 3 out of 9 and Altman Z-Score of 1.69 imply poor business operations. The operating margin of -43.66% and net margin of -60.76% show the company is not yet profitable.

Portfolio overview

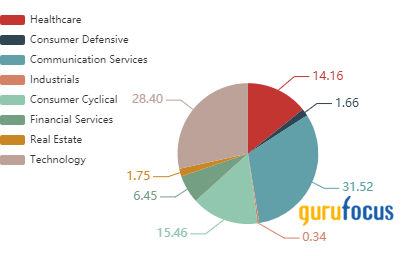

As of the quarter's end, the firm held shares in 84 stocks valued at $105.02 billion. The top holdings were Sea with 9.10% of the equity portfolio, Visa with 5.73% and Amazon.com Inc. (NASDAQ:AMZN) with 4.99%.

In terms of sector weighting, the firm was most invested in communication services, technology and consumer cyclical.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Hillman Capital's Top 4 Buys of the 4th Quarter

The Top New Buys of Larry Robbins' Firm

Top 4th-Quarter Trades of Tudor Investment Corp

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.