Top 4th-Quarter Buys of Joel Greenblatt's Gotham Asset Management

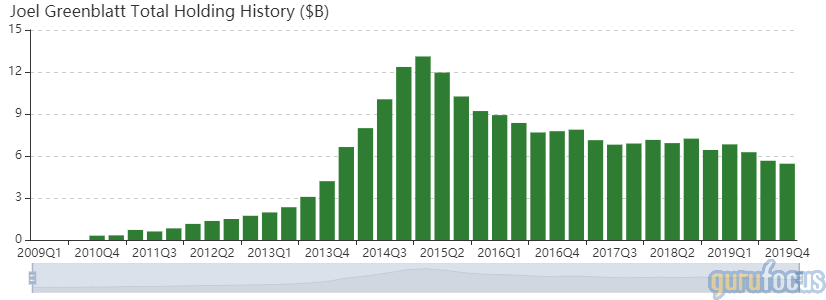

Joel Greenblatt (Trades, Portfolio), managing principal and co-chief investment officer of Gotham Asset Management and inventor of the "Magic Formula" investing strategy, recently disclosed the firm's portfolio updates for the fourth quarter of 2019.

Gotham Asset Management offers a range of both long-only and long-short funds, all of which are based on valuation. The group holds that stock prices can be volatile and emotion-based in the short term, but that they will general trade closer to their fair value after a period averaging around two to three years. The funds that are centered on the U.S. large and mid-cap companies are trading at the biggest discount to the managers' assessment of their value, based on factors such as return on capital, earnings yield and risk.

Based on the above criteria, the firm added 216 new positions to its $4.8 billion equity portfolio during the quarter.

Among those new buys, some of the firm's top picks were Square Inc. (NYSE:SQ), Allegion PLC (NYSE:ALLE), AECOM (NYSE:ACM), GoDaddy Inc. (NYSE:GDDY) and Navistar International Corp. (NYSE:NAV).

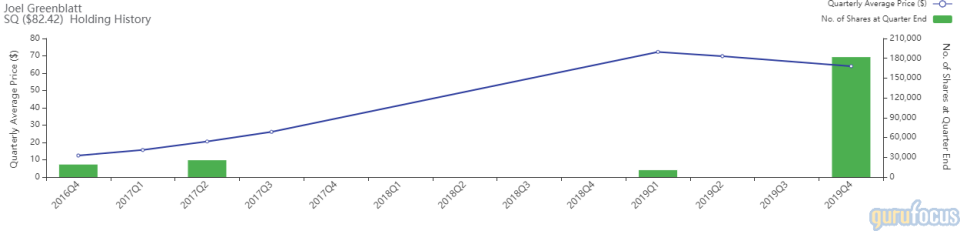

Square

The firm bought 181,820 shares of Square, impacting the equity portfolio by 0.21%. Shares of the stock traded at an average price of $64.02 during the quarter.

Square is a San Francisco-based company that provides financial services, merchant services aggregation and mobile payment services to small businesses. Its offerings include mobile credit card processors, online stores, payroll solutions and marketing.

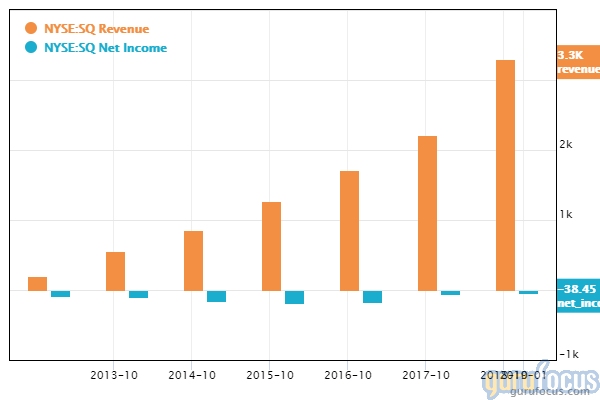

On Feb. 19, shares of Square traded around $85.87 for a market cap of $36.86 billion. GuruFocus has assigned the company a financial strength score of 6 out of 10 and a profitability score of 4 out of 10.

The cash-debt ratio of 1.73 and current ratio of 1.68 are average for the industry, while the Altman Z-score of 8.81 suggests that the company can meet its financial obligations.

Square has a low operating margin at 0.14%. The three-year revenue growth rate is 3%, while the three-year earnings per share without non-recurring items growth rate is 58.3%.

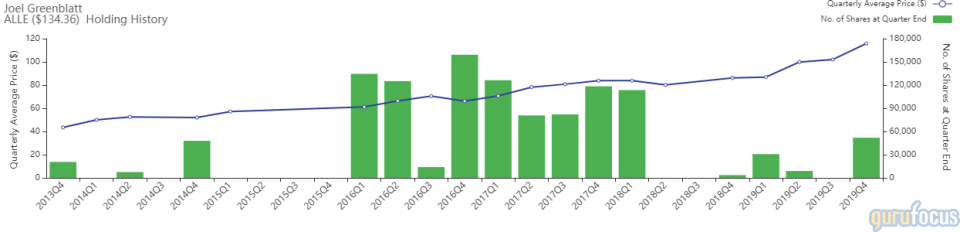

Allegion

The firm bought 51,896 shares of Allegion, impacting the equity portfolio by 0.12%. Shares of the stock traded at an average price of $115.82 during the quarter.

Based in Dublin, Ireland, Allegion is a provider of security products for homes and businesses. Its products are sold in 130 countries around the world.

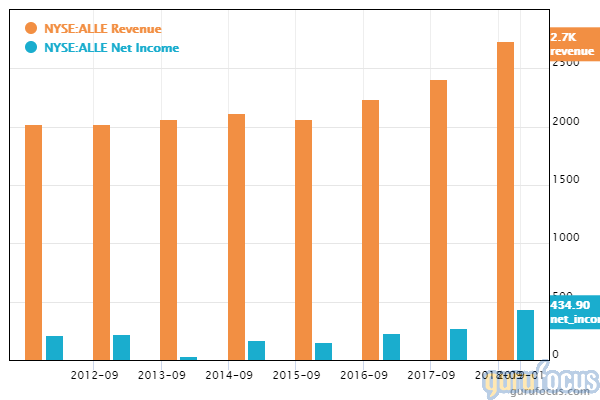

On Feb. 19, shares of the company traded around $130.76 for a market cap of $12.15 billion and a price-earnings ratio of 27.29. Allegion has a GuruFocus financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10.

The cash-debt ratio of 0.16 is underperforming 75.76% of competitors, but the interest coverage of 9.99% and Altman Z-score of 5.73 mean that it is not in financial danger.

Allegion has a three-year revenue growth rate of 10.2% and a three-year earnings per share without non-recurring items growth rate of 41.9%. Net income has also grown steadily over the last several years.

AECOM

The firm bought 125,621 shares of AECOM, impacting the equity portfolio by 0.10%. Shares of the stock traded at an average price of $41.58 during the quarter.

AECOM is a multinational engineering company based in Los Angeles. As one of the world's largest infrastructure company, its job is to design and build roads, light structures, water pipelines, bridges and other mainstays of modern communities.

On Feb. 19, AECOM shares traded around $50.46 for a market cap of $7.91 billion. GuruFocus has assigned the company a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10.

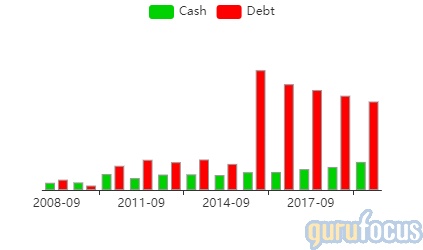

The company's cash-debt ratio of 0.17 and interest coverage of 3.1% are underperforming 76.37% of competitors. The Altman Z-score of 1.74 suggests that AECOM may not be in the best position financially, but it has reduced debt in recent years, and the low debt-revenue ratio of 0.23 is also a positive sign.

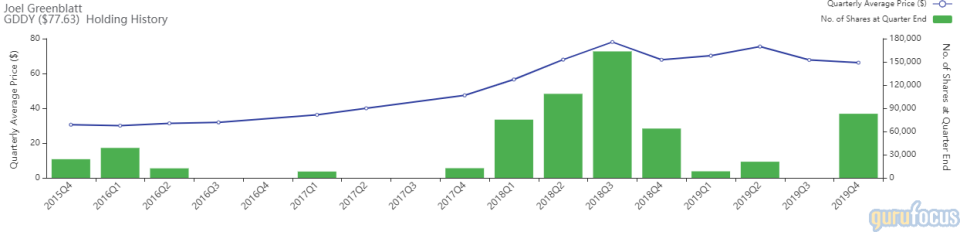

GoDaddy

The firm bought 82,889 shares of GoDaddy, impacting the equity portfolio by 0.10%. Shares of the stock traded at an average price of $66.20 during the quarter.

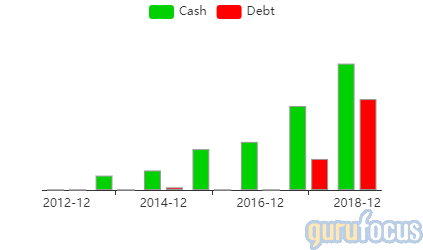

GoDaddy is an internet domain registrar and web hosting company based in Scottsdale, Arizona. It is the world's largest registrar of domain names and also offers products such as a website builder, email addresses and web security.

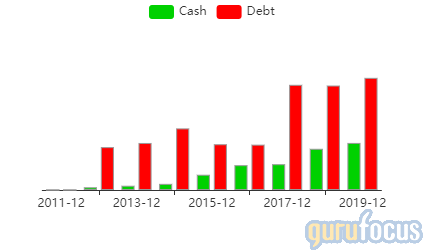

On Feb. 19, shares of the company traded around $77.59 for a market cap of $13.54 billion and a price-earnings ratio of 101.64. GuruFocus has assigned it a financial strength score of 3 out of 10 and a profitability score of 4 out of 10.

The cash-debt ratio of 0.42, interest coverage of 2.2% and Altman Z-score of 1.94 are all on the low end of the spectrum compared to industry competitors, indicating a weak balance sheet.

GoDaddy has a return on capital of 54.21%, beating 66.51% of competitors. Both revenue and net income have shown growth in recent years, with net income turning to the positive range beginning in 2017.

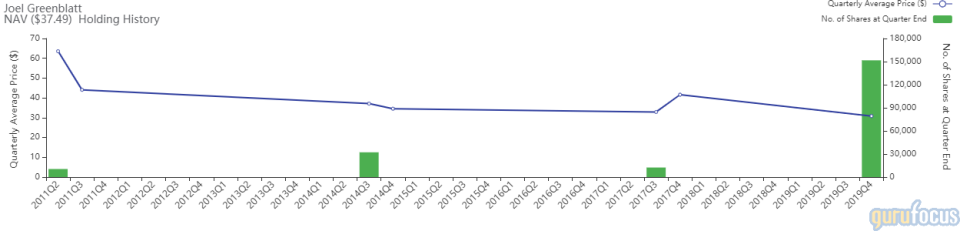

Navistar International

The firm bought 151,647 shares of Navistar International, impacting the equity portfolio by 0.08%. Shares of the stock traded at an average price of $30.84 during the quarter.

Navistar International is a manufacturing holding company based in Lisle, Illinois. The majority of profits come from vehicles such as school buses, 18-wheeler trucks, military vehicles and agricultural machinery.

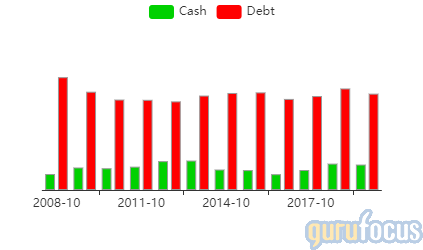

On Feb. 19, Navistar shares traded around $37.50 for a market cap of $3.73 billion and a price-earnings ratio of 16.97. The company has a GuruFocus financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10.

Navistar has a cash-debt ratio of 0.26, interest coverage of 2.41% and an Altman Z-score of 1.46, indicating financial weakness.

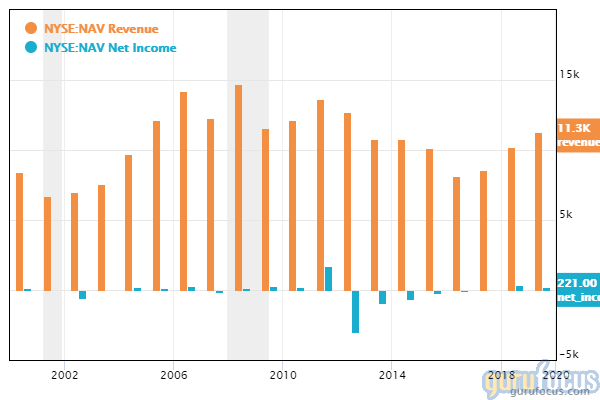

The return on capital of 24.82% is higher than 76.84% of competitors. Both revenue and net income have shown strong growth in recent years.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Frank Sands' Firm Sells 4 Stocks in 4th Quarter

Bill Ackman's Pershing Square: 4th-Quarter Update

Chuck Akre's Firm's Biggest 4th-Quarter Buys

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.