Top 5 Buys of Steve Mandel's Lone Pine

Lone Pine Capital, the hedge fund founded by Steve Mandel (Trades, Portfolio), disclosed last week its top five new buys for the third quarter were Netflix Inc. (NASDAQ:NFLX), Global Payments Inc. (NYSE:GPN), Equifax Inc. (NYSE:EFX), Humana Inc. (NYSE:HUM) and Herbalife Nutrition Ltd. (NYSE:HLF).

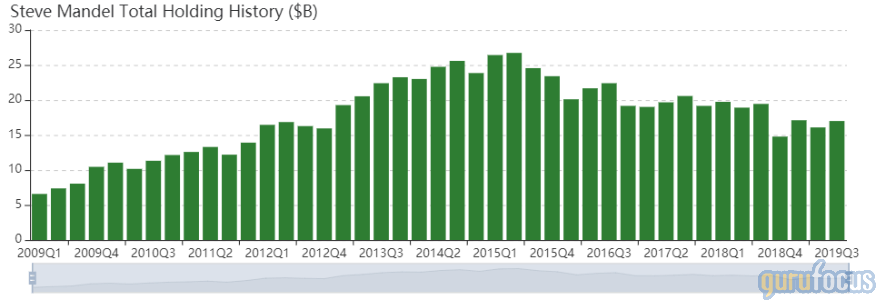

A protege of Tiger Management's Julian Robertson (Trades, Portfolio), Mandel founded Lone Pine, a long-short fund that builds its portfolio through fundamental analysis and bottom-up stock picking, in 1997. While he stepped down from a day-to-day management role earlier this year, Mandel still remains a managing partner of the Greenwich, Connecticut-based firm.

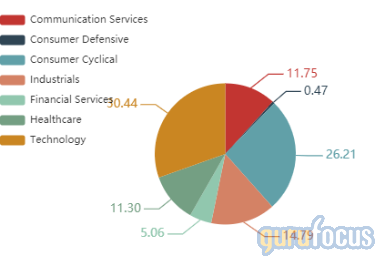

The equity portfolio of Lone Pine, which seeks long-term capital appreciation through value and growth methodologies, contains 37 stocks as of quarter-end, including eight new positions. The portfolio's top three sectors in terms of weight are technology, consumer cyclical and industrials, with weights of 30.44%, 26.21% and 14.79%.

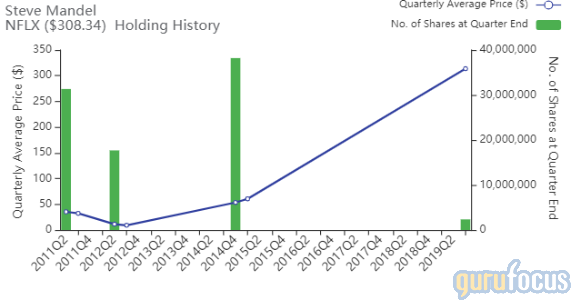

Netflix

Lone Pine purchased 2,355,038 shares of Netflix, giving the stake 3.71% weight in the equity portfolio. Shares averaged $313.64 during the quarter.

The Los Gatos, California-based company said on Oct. 25 that for the quarter ending Sept. 30, average streaming paid memberships and average revenue per user increased 22% and 9% from comparable quarter of 2018. Key TV series driving strong results included "Stranger Things," "Unbelievable" and "La Casa de Papel."

GuruFocus ranks Netflix's profitability 9 out of 10 on several positive investing signs, which include expanding profit margins and a 4.5-star business predictability rank. Despite this, Netflix has a weak Piotroski F-score of 3.

Gurus with large holdings in Netflix include Andreas Halvorsen (Trades, Portfolio) and Spiros Segalas (Trades, Portfolio).

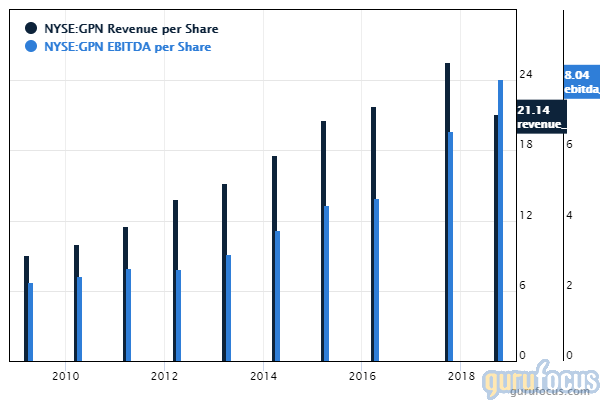

Global Payments

The firm purchased 3,655,380 shares of Global Payments, giving the position 3.42% equity portfolio weight. Shares averaged $163.24 during the quarter.

The Atlanta-based company provides payment processing services primarily to U.S. small and midsize merchants. GuruFocus ranks Global Payments' profitability 9 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank and operating margins that have increased approximately 4.10% per year on average over the past five years and outperform over 88% of global competitors.

Fellow Tiger Cub Philippe Laffont (Trades, Portfolio) also has a holding in Global Payments.

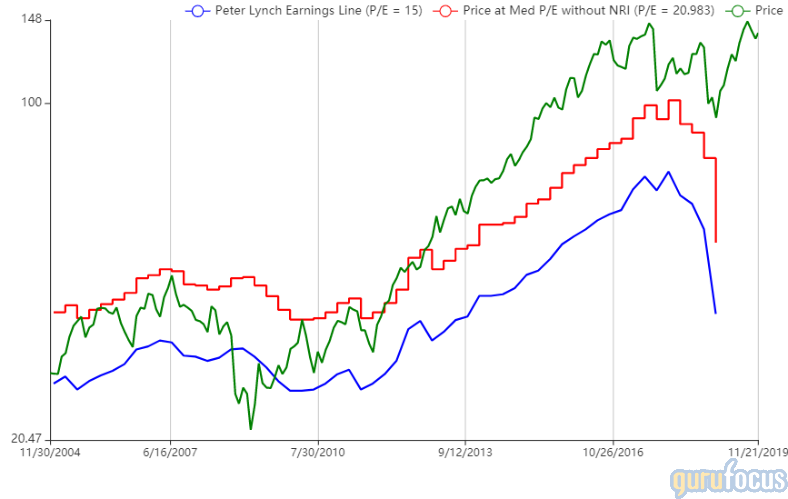

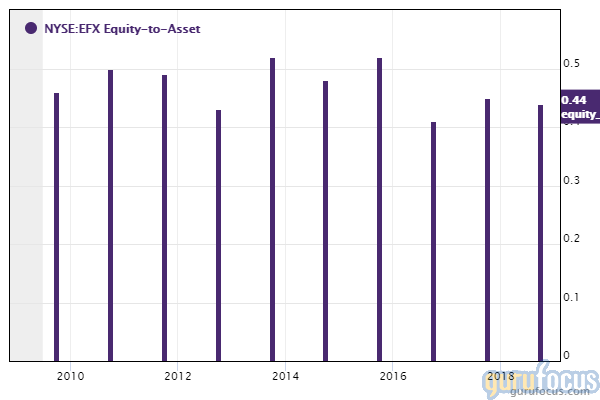

Equifax

Lone Pine purchased 3,068,747 shares of Equifax, giving the holding 2.54% weight in the equity portfolio. Shares averaged $140.96 during the quarter.

The Atlanta-based credit bureau provides database management, fraud detection, marketing, business credit and analytical services for the basis of granting credit. GuruFocus ranks Equifax's financial strength 3 out of 10 on several weak signs, which include a poor Piotroski F-score of 3 and an equity-to-asset ratio that underperforms 70.61% of global competitors.

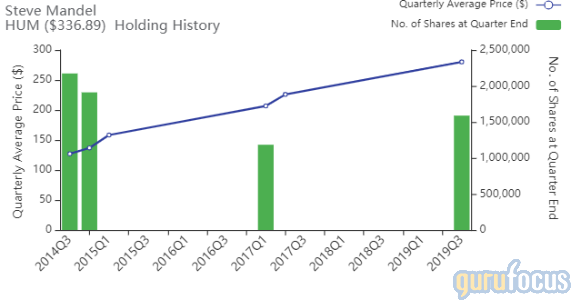

Humana

Lone Pine purchased 1,588,743 shares of Humana, giving the stake 2.39% weight in the equity portfolio. Shares averaged $280.13 during the quarter.

The Louisville, Kentucky-based company provides government-sponsored plans, with approximately 75% of its membership tied to Medicare, Medicaid and other government health care programs. According to GuruFocus, Humana has a 4.5-star business predictability rank and a return on equity that outperforms 75% of global competitors, suggesting good profitability potential.

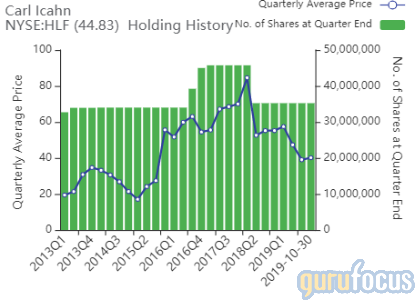

Herbalife

Lone Pine purchased 2,101,639 shares of Herbalife, giving the position 0.47% weight in the equity portfolio. Shares averaged $39.02 during the quarter.

Herbalife, the company that Bill Ackman (Trades, Portfolio) had a five-year short position in, has five reporting segments: weight management; targeted nutrition; energy, sports and fitness; outer nutrition; and literature, promotional and other. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 7, consistent revenue growth and an operating margin that has increased approximately 0.60% per year on average over the past five years and is outperforming 80.11% of global competitors.

Other gurus with holdings in Herbalife include Paul Tudor Jones (Trades, Portfolio) and activist investor Carl Icahn (Trades, Portfolio).

Disclosure: No positions.

Read more here:

Louis Moore Bacon's Top 6 Buys in the 3rd Quarter

David Tepper Bites Into Alibaba, Boosts 3 Positions in 3rd Quarter

Top 5 Buys of George Soros' Firm in 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.