Top 5 S&P 500 Stocks With Double-Digit Returns Year to Date

The welcome rally of U.S. stocks that we have seen from the beginning of January to mid-February is fading out gradually. Market participants are concerned about a higher interest regime for a longer period and the possibility of a recession in 2023. Market participants confidence in risky assets like equities has been dampened to some extent. Volatility is likely to continue in the near term.

Year to date, the S&P 500 Index is up 4.5%. However, the broad-market index was up nearly 8% in early February. The benchmark is currently down by 15.6% from its all-time high of 4,637.30. Despite these headwinds, a handful of S&P 500 stocks are flying high with double-digit returns year to date.

Strong Economic Data is Bad for Wall Street

Wall Street is currently in a “Catch 22 Situation.” Strong economic data will ensure solid fundamentals for the U.S. economy. On the other hand, it will give the Fed a reason to continue its aggressive rate hike and monetary tightening to combat inflation.

Strong economic data for January has unnerved investors as a higher wage rate will raise aggregate demand, making inflation stubborn. The consumer price index and the producer price index of January were reported last week. These two key inflation measures were higher than the consensus mark, indicating that the Fed has to go a long way to tame inflation to near 2%.

Fears of higher interest rate hikes flared up further following comments from St. Louis Federal Reserve President James Bullard. He said that he had proposed a 50-basis point rate hike in the Fed’s last meeting and such a hike could be expected in the March meeting. Bullard’s sentiments were echoed by Cleveland Fed President Loretta Mester, saying that she also supports a steeper rate hike in the next meeting, which further weighed on stocks.

On Feb 17, Federal Reserve Governor Michelle Bowman said “I think there’s a long way to go before we reach our 2% inflation objective and I think we’ll have to continue to raise the federal funds rate until we see a lot more progress on that.”

On Feb 22, in an interview with CNBC, Bullard said that going higher sooner would be more effective. Per Bullard, the terminal interest rate should be around 5.375% instead of 5.1% expected by the Fed earlier.

Our Top Picks

On Feb 23, the S&P 500 Index closed at 4,012.32. Despite the recent decline, the market’s benchmark stays well above its 50-days and 200-days moving averages of 3,980.89 and 3,940.23, respectively. Therefore, the index has a solid potential to bounce back.

At this stage, we have narrowed our search to five U.S. corporate giants (market capital > $30 billion) from the S&P 500 stable with year-to-date returns of more than 10%. These stocks have strong growth potential for 2023 and have seen positive earnings estimate revisions in the last 30 days. Finally, each of our picks carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

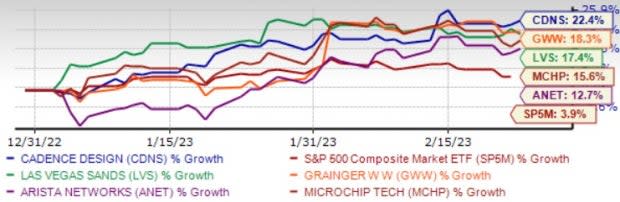

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Cadence Design Systems Inc. CDNS offers products and tools that help customers design electronic products. Through the System Design Enablement strategy, CDNS offers software, hardware, services and reusable IC design blocks to electronic systems and semiconductor customers.

Cadence’s performance is being driven by strength across segments like digital & signoff solutions and functional verification suite. CDNS is also gaining from higher investments in emerging trends like IoT and autonomous vehicle sub-systems along with strength in the semiconductor end-market. Frequent product launches are expected to help CDNS sustain top-line growth.

Cadence Design Systems has an expected revenue and earnings growth rate of 13.3% and 13.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.9% over the last 30 days. The stock price of CDNS has jumped 22.4% year to date.

W.W. Grainger Inc. GWW has been benefiting from volume growth in the High Touch Solutions segment and customer growth in the Endless Assortment segment. GWW expects earnings per share between $32.00 and $34.50 for 2023, indicating year-over-year growth of 12% at the mid-point. W.W. Grainger projects net sales between $16.2 billion and $16.8 billion for the year. Total daily sales growth is expected to be 7-12%, backed by the ongoing momentum in both segments.

We expect GWW’s 2023 adjusted earnings per share and revenues to grow 8.6% and 6.6%, respectively. Gains from an improved non-pandemic product mix, price and cost-control efforts are likely to help offset headwinds like supply-chain challenges, and higher material and operating costs. GWW’s initiatives to manage inventory effectively and invest in marketing will drive profitability.

W.W. Grainger has an expected revenue and earnings growth rate of 8.8% and 10.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.4% over the last 30 days. The stock price of GWW has climbed 18.3% year to date.

Las Vegas Sands Corp. LVS benefits from a solid business model, extensive non-gaming revenue opportunities, high-quality assets and attractive property locations. LVS is optimistic about Macao’s recovery on the back of resilient customer demand and spending.

With the future easing of restrictions coupled with recovery in travel and tourism, Las Vegas Sands anticipates generating strong positive cash flows from the region in the days ahead. Also, LVS emphasized increasing its investment in the Singapore market and boosting offerings throughout 2023.

Las Vegas Sands has both expected revenue and earnings growth rate of more than 100%, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 35.6% over the last 30 days. The stock price of LVS has surged 17.4% year to date.

Microchip Technology Inc. MCHP is riding on consistent strength in its analog and microcontroller businesses. MCHP’s dominance in 8,16 and 32-bit microcontrollers is driving top-line growth.

Strategic acquisitions like Microsemi and Atmel have expanded the product portfolio. MCHP is gaining from a recovery in demand across industrial, automotive and consumer end-markets, on the reopening of economies, globally. Collaboration with the likes of AWS is another positive.

Microchip Technology has an expected revenue and earnings growth rates of 2.4% and 2.6%, respectively, for next year (ending March 2024). The Zacks Consensus Estimate for next-year earnings has improved 6.3% over the last 30 days. The stock price of MCHP has advanced 15.6% year to date.

Arista Networks Inc. ANET develops markets and sells cloud networking solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. ANET benefits from the expanding cloud networking market, driven by strong demand for scalable infrastructure. The company recently joined the Microsoft Intelligent Security Association.

Arista Networks continues to gain from solid momentum and diversification across its top verticals and product lines. It is well-poised for growth in the data-driven cloud networking business, with proactive platforms and predictive operations. ANET introduced an enterprise-grade Software-as-a-Service offering for its flagship CloudVision platform.

Arista Networks has an expected revenue and earnings growth rate of 25.3% and 25.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.3% over the last 30 days. The stock price of ANET has appreciated 12.7% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report