The Top 5 Trades of the Eaton Vance Worldwide Health Sciences Fund

Last week, the Eaton Vance Worldwide Health Sciences Fund (Trades, Portfolio) disclosed its portfolio for the second quarter of the year.

Managed by Jason Kritzer and Samantha Pandolfi, the fund, which is part of Boston-based Eaton Vance, invests heavily in the health care space. The portfolio managers look around the world for securities that are not only reasonably priced, but which they believe will grow in value over time.

Keeping these criteria in mind, the fund's most notable trades for the three months ended May 31 included additions to the Novartis AG (NYSE:NVS), UnitedHealth Group Inc. (NYSE:UNH) and Edwards Lifesciences Corp. (NYSE:EW) positions, a reduction of the Bristol-Myers Squibb Co. (NYSE:BMY) holding and a new investment in Centene Corp. (NYSE:CNC). In all, the fund established seven new positions during the quarter.

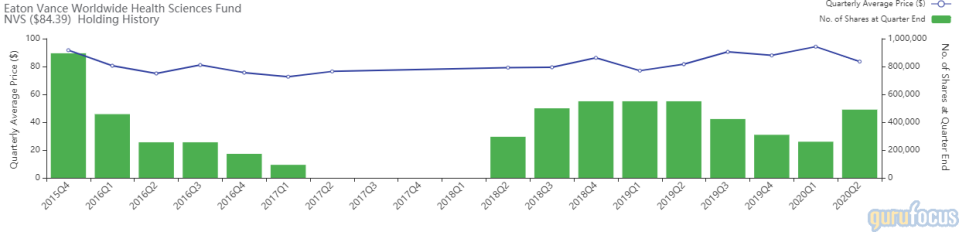

Novartis

With an impact of 1.95% on the equity portfolio, Eaton Vance boosted its position in Novartis by 88.66%, buying 230,300 shares. It now holds a total of 490,069 shares. The stock traded for an average price of $83.54 per share during the quarter.

Representing 4.14% of total assets managed, GuruFocus estimates the fund has lost 5.62% on the investment since the second quarter of 2018.

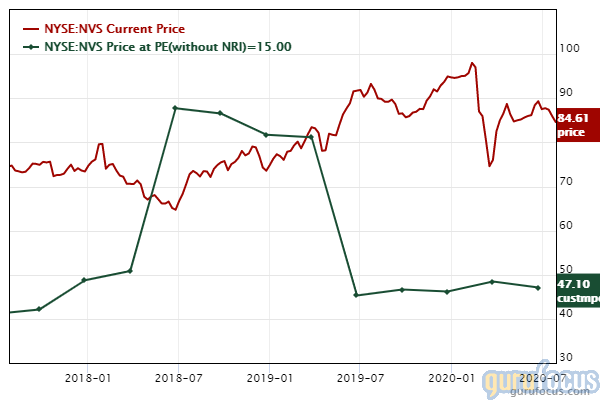

The Swiss pharmaceutical company has a $193.05 billion market cap; its shares were trading around $84.22 on Monday with a price-earnings ratio of 25.64, a price-book ratio of 3.51 and a price-sales ratio of 3.73.

The Peter Lynch chart shows the stock is trading above its fair value, suggesting it is overpriced. The GuruFocus valuation rank of 3 out of 10 also supports this analysis.

GuruFocus rated Novartis' financial strength 5 out of 10, driven by adequate interest coverage. The Altman Z-Score of 2.24, however, suggests the company is under some financial pressure since its revenue per share has declined over the past five years.

The company's profitability scored a 7 out of 10 rating on the back of strong margins and returns that outperform over half of its competitors. Novartis also has a moderate Piotroski F-Score of 6, which indicates operations are stable, and a predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically return an average of 1.1% per annum over a 10-year period.

Of the gurus invested in Novartis, PRIMECAP Management (Trades, Portfolio) has the largest stake with 1.05% of outstanding shares. Other guru shareholders include Dodge & Cox, Ken Fisher (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Sarah Ketterer (Trades, Portfolio), Tweedy Browne (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio), John Rogers (Trades, Portfolio), Chris Davis (Trades, Portfolio), Kahn Brothers (Trades, Portfolio), Lee Ainslie (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Diamond Hill Capital (Trades, Portfolio) and Mairs and Power (Trades, Portfolio).

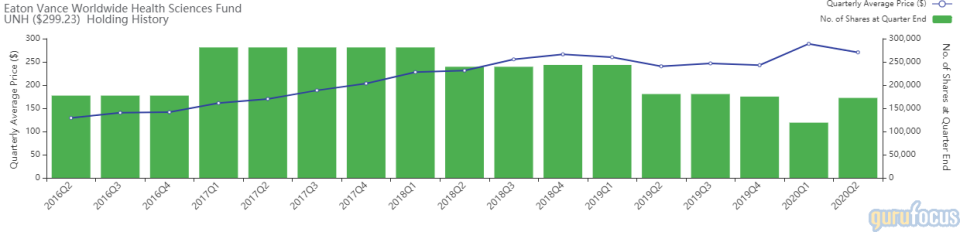

UnitedHealth Group

The second-largest trade for the quarter was the addition of 53,323 shares of UnitedHealth Group, expanding the holding by 44.81%. The fund now holds 172,327 shares total. During the quarter, the stock traded for an average per-share price of $270.55.

Representing 5.72% of total assets managed, GuruFocus data shows the fund has gained 70.33% on the investment since the second quarter of 2016.

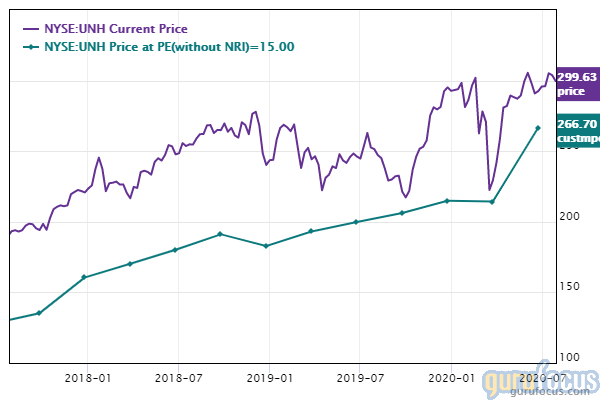

The managed care company, which is headquartered in Minnetonka, Minnesota, has a market cap of $285.26 billion; its shares were trading around $300.79 on Monday with a price-earnings ratio of 16.92, a price-book ratio of 4.34 and a price-sales ratio of 1.18.

According to the Peter Lynch chart, the stock is overvalued. The GuruFocus valuation rank of 2 out of 10 also supports this assessment.

UnitedHealth's financial strength was rated 6 out of 10 by GuruFocus. Although the company has issued approximately $12.9 billion in new long-term debt over the past three years, it is still at a manageable level due to comfortable interest coverage. The Altman Z-Score of 2.99 also suggests it is under some pressure since its assets are building up at a faster rate than revenue is growing.

The company's profitability fared better, scoring a 9 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of industry peers and a high Piotroski F-Score of 7, which implies business conditions are healthy. Boosted by consistent earnings and revenue growth, UnitedHealth also has a five-star predictability rank. GuruFocus says companies with this rank return an average of 12.1% annually.

The Vanguard Health Care Fund (Trades, Portfolio) is the company's largest guru shareholder with a 0.96% stake. Dodge & Cox, Steve Mandel (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, Jeremy Grantham (Trades, Portfolio), Ruane Cunniff (Trades, Portfolio), Hotchkis & Wiley, Pioneer Investments (Trades, Portfolio) and several other gurus also own the stock.

Edwards Lifesciences

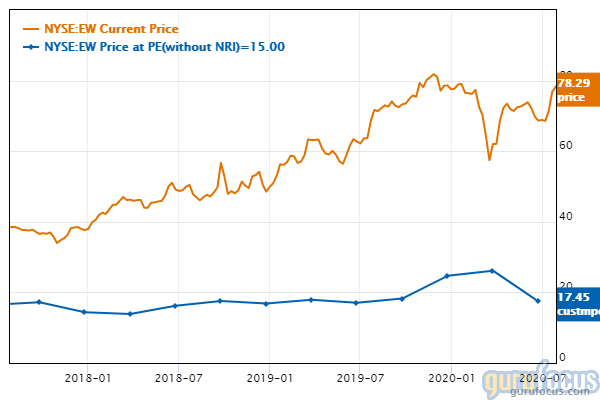

Boosting the Edwards Lifesciences position by 356.89%, the portfolio managers invested in 174,948 shares. The fund now holds a total of 223,968 shares. Shares traded for an average price of $68.58 each during the quarter.

According to GuruFocus, the fund has gained an estimated 171.4% on the investment since the second quarter of 2016. It represents 1.63% of Eaton Vance's equity portfolio.

The Irvine, California-based company, which specializes in producing artificial heart valves and hemodynamic monitoring systems, has a $49.69 billion market cap; its shares were trading around $78.13 on Monday with a price-earnings ratio of 67.18, a price-book ratio of 12.62 and a price-sales ratio of 11.44.

Based on the Peter Lynch chart and GuruFocus valuation rank of 2 out of 10, the stock appears to be overvalued.

GuruFocus rated Edwards Lifesciences' financial strength 8 out of 10, driven by comfortable interest coverage and a robust Altman Z-Score of 16.42. Even though assets are building up at a faster rate than revenue is growing, the return on invested capital surpasses the weighted average cost of capital by a wide margin, suggesting good profitability.

The company's profitability scored a 9 out of 10 rating on the back of an expanding operating margin, strong returns that outperform a majority of competitors and a high Piotroski F-Score of 7. Boosted by steady earnings and revenue growth, Edwards Lifesciences also has a three-star predictability rank. GuruFocus says companies with this rank typically return 8.2% on average annually.

With a 2.08% stake, Frank Sands (Trades, Portfolio) is the company's largest guru shareholder. Other top investors include Vanguard, Pioneer, Fisher, PRIMECAP, Simons' firm, David Rolfe (Trades, Portfolio), Steven Cohen (Trades, Portfolio) and Ron Baron (Trades, Portfolio).

Bristol-Myers Squibb

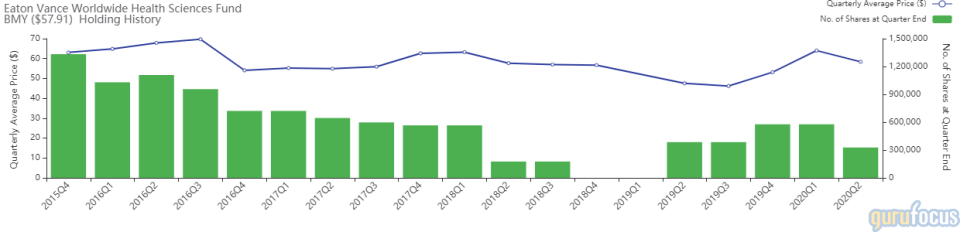

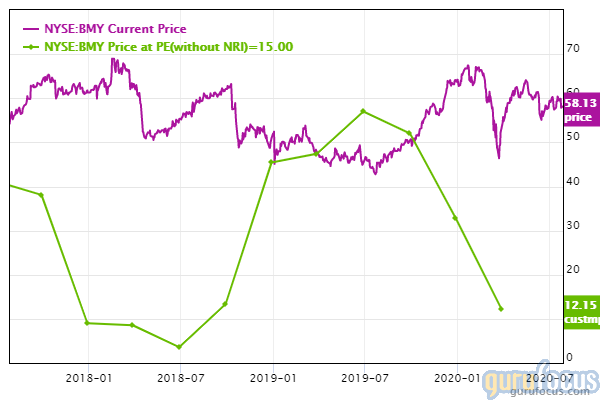

With an impact of -1.55% on the equity portfolio, the Worldwide Health Sciences Fund reduced its holding of Bristol-Myers Squibb by 250,279 shares, or -0.79%. It now holds 326,964 shares total. During the quarter, the stock traded for an average price of $58.37.

Accounting for 1.89% of total assets managed, GuruFocus says the fund has lost 0.07% on the investment since the second quarter of 2019.

The pharmaceutical company, which is headquartered in New York City, has a market cap of $130.9 billion; its shares were trading around $57.85 on Monday with a price-earnings ratio of 71.42, a price-book ratio of 2.62 and a price-sales ratio of 3.53.

The Peter Lynch chart suggests the stock is overvalued. The GuruFocus valuation rank of 5 out of 10, however, indicates it is fairly valued.

Bristol-Myers Squibb's financial strength was rated 5 out of 10 by GuruFocus. Despite the company issuing approximately $16.4 billion in new long-term debt over the past three years, it is at a manageable level as a result of sufficient interest coverage. The Altman Z-Score of 1.79, however, warns the company could be at risk of going bankrupt since its assets are building up at a faster rate than revenue is growing.

The company's profitability fared much better, scoring an 8 out of 10 rating. In addition to an expanding operating margin, Bristol-Myers Squibb is being supported by moderate returns that outperform at least half of its industry peers as well as a moderate Piotroski F-Score of 4. The one-star predictability rank is on watch, however.

Simons' firm has the largest stake in Bristol-Myers Squibb with 2.92% of outstanding shares. Other top guru shareholders include Vanguard, Dodge & Cox, PRIMECAP, Pionner, Richard Pzena (Trades, Portfolio), NWQ Managers (Trades, Portfolio), the T Rowe Price Equity Income Fund (Trades, Portfolio), Gabelli and Joel Greenblatt (Trades, Portfolio).

Centene

After previously selling out of Centene in the second quarter of 2019, the fund entered a new 191,474-share position, allocating 1.23% of the equity portfolio to the holding. The stock traded for an average per-share price of $62.57 during the quarter.

The St. Louis-based health insurance company has a $39.1 billion market cap; its shares were trading around $67.51 on Monday with a price-earnings ratio of 34.1, a price-book ratio of 1.66 and a price-sales ratio of 0.37.

According to the Peter Lynch chart, the stock is overvalued. The GuruFocus valuation rank of 3 out of 10 also leans toward overvaluation.

GuruFocus rated Centene's financial strength 5 out of 10. In addition to issuing $10.4 billion in new long-term debt over the past three years, the company's assets are building at a faster rate than its revenue is growing. As such, it has weak interest coverage and the Altman Z-Score of 2.03 indicates it is under some pressure. The company may also be spending more money than it makes since its WACC significantly outperforms its ROIC.

The company's profitability scored a 7 out of 10 rating despite having declining margins, returns that underperform a majority of competitors and a low Piotroski F-Score of 2, which implies operations are in poor shape. Consistent earnings and revenue growth contribute to a three-star predictability rank, which is on watch.

Of the gurus invested in Centene, Andreas Halvorsen (Trades, Portfolio) has the largest stake with 2.8% of outstaning shares. Vanguard, Daniel Loeb (Trades, Portfolio), Hotchkis & Wiley, Cohen, Pioneer, Larry Robbins (Trades, Portfolio), Ainslie, Leon Cooperman (Trades, Portfolio), Richard Snow (Trades, Portfolio), David Einhorn (Trades, Portfolio), the FPA Capital Fund (Trades, Portfolio) and First Pacific Advisors (Trades, Portfolio) also own the stock.

Additional trades and portfolio performance

Other positions the Worldwide Health Sciences Fund established during the quarter were Ipsen SA (XPAR:IPN), Abiomed Inc. (NASDAQ:ABMD), Tandem Diabetes Care Inc. (NASDAQ:TNDM), LHC Group Inc. (NASDAQ:LHCG),Cellectis SA (NASDAQ:CLLS) and Inari Medical Inc. (NARI).

Eaton Vance's $1.03 billion equity portfolio, which is composed of 63 stocks, is largely invested in the drug manufacturing industry with a weight of 40.28%.

According to its fact sheet, the fund outperformed its benchmark in 2019 with a return of 25.99%. The MSCI World Health Care Index posted a 23.24% return.

Disclosure: No positions.

Read more here:

Steven Cohen Homes in on Otonomy

5 Energy Companies to Consider as New Coronavirus Cases Cause Concern

Mason Hawkins' Firm Divests of Dillard's Stake

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.