Top AIM High Growth Stock

Analysts are bullish on these following companies: CAP-XX, Eve Sleep, IQE. These companies are relatively strong financially, and have a great outlook in terms of profits and cash flow. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good additions to your portfolio.

CAP-XX Limited (AIM:CPX)

CAP-XX Limited, together with its subsidiaries, develops, manufactures, and sells supercapacitors primarily in Australia, the Americas, the Asia Pacific, Europe, the Middle East, and Africa. CAP-XX was formed in 1997 and with the company’s market capitalisation at GBP £38.37M, we can put it in the small-cap stocks category.

CPX is expected to deliver an extremely high earnings growth over the next couple of years of 100.00%, bolstered by an equally impressive revenue growth of 85.91%. It appears that CPX’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 24.65%. CPX ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about CPX? I recommend researching its fundamentals here.

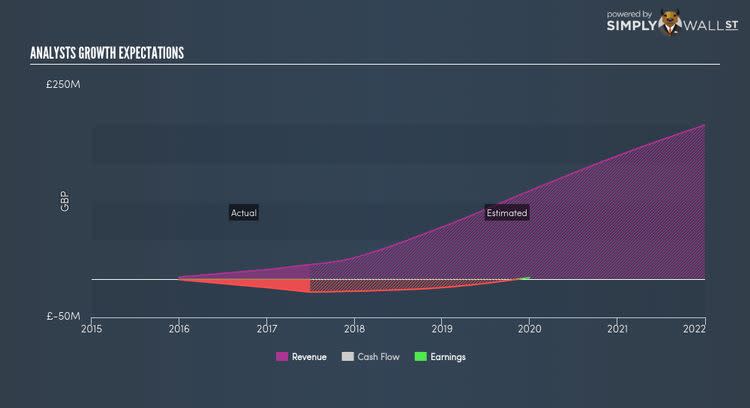

Eve Sleep Plc (AIM:EVE)

Eve Sleep Plc operates as an e-commerce focused direct to consumer sleep brand worldwide. Formed in 2014, and now led by CEO Jas Bagniewski, the company currently employs 51 people and with the company’s market capitalisation at GBP £126.85M, we can put it in the small-cap stocks category.

EVE is expected to deliver an extremely high earnings growth over the next couple of years of 70.40%, bolstered by a significant revenue which is expected to more than double. It appears that EVE’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. Moreover, the 53.19% growth in operating cash flows shows that a decent part of earnings is driven by robust cash generation from operational activities, not one-off or non-core activities. EVE ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Thinking of investing in EVE? I recommend researching its fundamentals here.

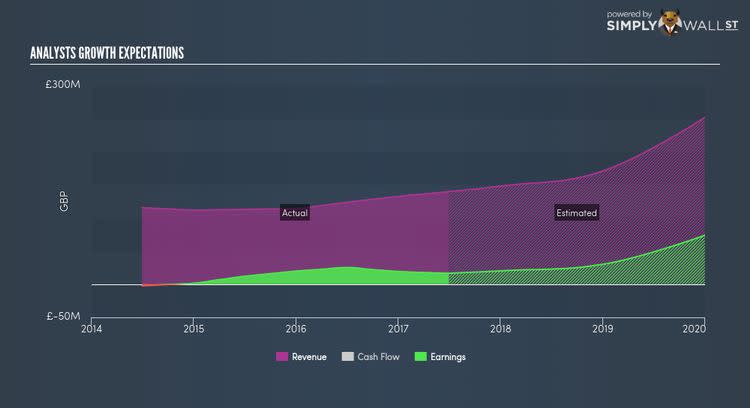

IQE plc (AIM:IQE)

IQE plc develops, manufactures, and sells advanced semiconductor materials worldwide. Founded in 1988, and currently headed by CEO Andrew Nelson, the company size now stands at 475 people and with the company’s market cap sitting at GBP £1.23B, it falls under the small-cap stocks category.

Extreme optimism for IQE, as market analysts projected an outstanding earnings growth, which is expected to more than double, supported by an equally strong sales growth of 50.77%. It appears that IQE’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. Furthermore, the high growth of over 100% in operating cash flows indicates that a large portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. IQE’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. A potential addition to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.