Top ASX Staples Dividend Picks For The Day

Consumer staples demand are considered to be inelastic which means it doesn’t change much over time as consumers treat these products as necessities. When the economy is struggling and cyclical companies begin showing signs of weakness, investors often try to put their money into consumer defensive companies in an effort to protect their portfolio during a downturn. Below is my list of huge dividend-paying stocks in the consumer staples industry that continues to add value to my portfolio holdings.

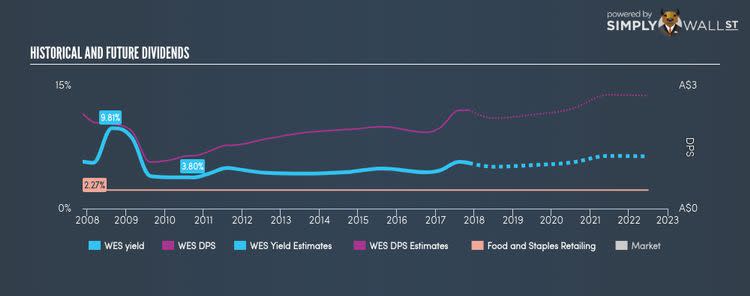

Wesfarmers Limited (ASX:WES)

WES has an appealing dividend yield of 5.56% and is distributing 87.56% of earnings as dividends . While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time.

Woolworths Limited (ASX:WOW)

WOW has a good dividend yield of 3.20% and has a payout ratio of 75.84% . Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from $0.78 to $0.84 over the past 10 years.

Coca-Cola Amatil Limited (ASX:CCL)

CCL has a sumptuous dividend yield of 5.68% and the company currently pays out 186.26% of its profits as dividends . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from $0.335 to $0.46. Coca-Cola Amatil is also a strong prospect for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next three years.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.