Top Cheap Stocks To Buy Today

Seroja Investments and Golden Energy and Resources are two of the companies on my list that I consider are undervalued. Investors can profit from the difference by investing in these stocks as the current market prices should eventually move towards their true values. If capital gains are what you’re after in your next investment, I’ve put together a list of undervalued stocks you may be interested in, based on the latest financial data from each company.

Seroja Investments Limited (SGX:IW5)

Seroja Investments Limited, an investment holding company, provides marine cargo and coal transportation services in Indonesia and Singapore. Seroja Investments is run by CEO . With a current market cap of SGD SGD16.79M, we can put IW5 in the small-cap category

IW5’s shares are now hovering at around -33% less than its true level of $0.06, at a price tag of S$0.043, based on my discounted cash flow model. This mismatch indicates a chance to invest in IW5 at a discounted price. In addition to this, IW5’s PE ratio stands at around 11.91x against its its Shipping peer level of, 16.54x indicating that relative to its peers, IW5’s shares can be purchased for a lower price. IW5 is also strong in terms of its financial health, with current assets covering liabilities in the near term and over the long run. It’s debt-to-equity ratio of 20.53% has been falling over the past couple of years showing its ability to pay down its debt. Dig deeper into Seroja Investments here.

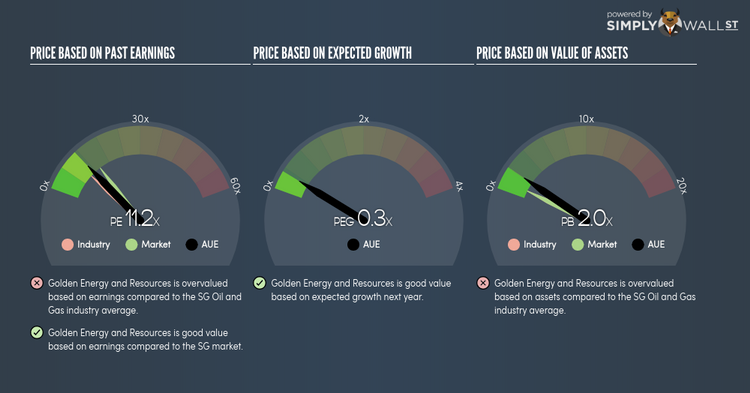

Golden Energy and Resources Limited (SGX:AUE)

Golden Energy and Resources Limited engages in the exploration, mining, and marketing of thermal coal in Indonesia. Established in 1997, and currently lead by Fuganto Widjaja, the company provides employment to 380 people and has a market cap of SGD SGD929.47M, putting it in the small-cap stocks category.

AUE’s shares are now hovering at around -68% lower than its actual level of $1.25, at a price tag of S$0.40, according to my discounted cash flow model. This mismatch indicates a potential opportunity to buy low. Also, AUE’s PE ratio is currently around 11.23x relative to its index peer level of, 13.99x indicating that relative to other stocks in the industry, you can buy AUE’s shares at a cheaper price. AUE is also in good financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

More detail on Golden Energy and Resources here.

Ellipsiz Ltd (SGX:BIX)

Ellipsiz Ltd, an investment holding company, provides probe card, and distribution and service solutions to the semiconductor and electronics manufacturing industries in Singapore, Malaysia, China, Taiwan, the United States, Japan, Europe, and internationally. Founded in 1992, and currently lead by Wen Lum, the company provides employment to 1,200 people and has a market cap of SGD SGD112.81M, putting it in the small-cap group.

BIX’s stock is now floating at around -59% less than its actual value of $1.64, at a price tag of S$0.68, according to my discounted cash flow model. This mismatch indicates a potential opportunity to buy low. What’s even more appeal is that BIX’s PE ratio stands at around 7.29x while its Semiconductor peer level trades at, 12.85x indicating that relative to other stocks in the industry, we can buy BIX’s stock at a cheaper price today. BIX is also a financially healthy company, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. BIX also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. Dig deeper into Ellipsiz here.

Or create your own list by filtering SGX companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.