Top Cheap Stocks To Buy Today

Graphic Packaging Holding and Tarena International may be trading at prices below their likely values. This suggests that these stocks are undervalued, meaning we can benefit when the stock price moves to its true valuation. There’s a few ways you can value a company. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good investments.

Graphic Packaging Holding Company (NYSE:GPK)

Graphic Packaging Holding Company, together with its subsidiaries, provides paper-based packaging solutions to food, beverage, and other consumer products companies. Established in 1992, and currently run by Michael Doss, the company size now stands at 13,000 people and with the stock’s market cap sitting at USD $4.62B, it comes under the mid-cap category.

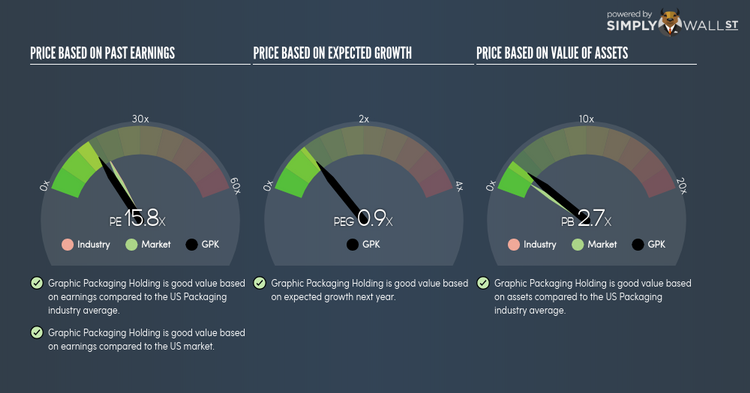

GPK’s shares are currently trading at -10% lower than its real value of $16.58, at the market price of US$14.90, according to my discounted cash flow model. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. Moreover, GPK’s PE ratio is currently around 15.79x compared to its Packaging peer level of, 18.57x implying that relative to its comparable set of companies, GPK’s stock can be bought at a cheaper price. GPK is also in good financial health, as short-term assets amply cover upcoming and long-term liabilities. The stock’s debt-to-equity ratio of 126.86% has been falling for the last couple of years signifying GPK’s capability to pay down its debt. More on Graphic Packaging Holding here.

Tarena International, Inc. (NASDAQ:TEDU)

Tarena International, Inc., through its subsidiaries, provides professional education services through full-time and part-time classes in the People’s Republic of China. Established in 2002, and currently run by Shaoyun Han, the company size now stands at 9,582 people and with the company’s market capitalisation at USD $540.60M, we can put it in the small-cap category.

TEDU’s shares are currently hovering at around -50% less than its intrinsic value of ¥19.32, at a price of US$9.58, based on its expected future cash flows. This discrepancy signals a potential opportunity to buy TEDU shares at a low price. Also, TEDU’s PE ratio is currently around 18.8x while its Consumer Services peer level trades at, 24.45x meaning that relative to its peers, you can buy TEDU for a cheaper price. TEDU is also robust in terms of financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. TEDU has zero debt on its books as well, meaning it has no long term debt obligations to worry about. Dig deeper into Tarena International here.

Bed Bath & Beyond Inc. (NASDAQ:BBBY)

Bed Bath & Beyond Inc., together with its subsidiaries, operates a chain of retail stores. Established in 1971, and currently run by Steven Temares, the company currently employs 65,000 people and with the market cap of USD $2.53B, it falls under the mid-cap group.

BBBY’s shares are now hovering at around -48% below its intrinsic value of $34.65, at a price of US$18.05, based on my discounted cash flow model. This mismatch indicates a chance to invest in BBBY at a discounted price. In terms of relative valuation, BBBY’s PE ratio stands at around 5.92x relative to its Specialty Retail peer level of, 19.5x meaning that relative to its competitors, you can buy BBBY’s shares at a cheaper price. BBBY is also a financially robust company, with near-term assets able to cover upcoming and long-term liabilities.

Interested in Bed Bath & Beyond? Find out more here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.