Top Cheap Stocks This Week

Companies that are recently trading at a market price lower than their real values include Chico’s FAS and Daqo New Energy. There’s a few ways you can determine how much a company is actually worth. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. The discrepancy between the price and value means investors have an opportunity to buy shares at a discount. Below are the stocks I believe are undervalued on all criteria, based on their latest financial data.

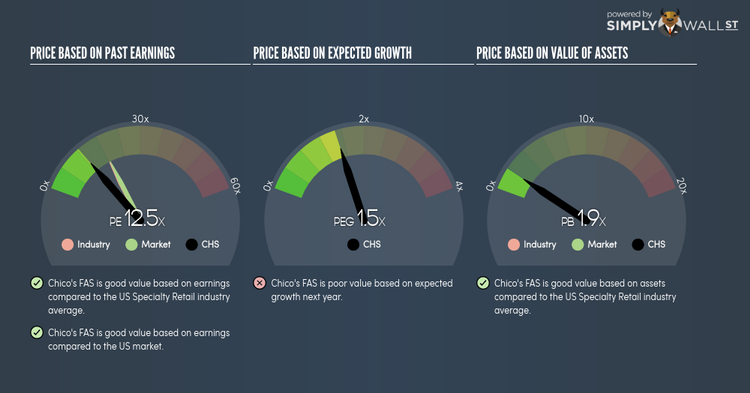

Chico’s FAS, Inc. (NYSE:CHS)

Chico’s FAS, Inc. operates as an omni-channel specialty retailer of women’s private branded, casual-to-dressy clothing, intimates, and complementary accessories. Established in 1983, and currently headed by CEO Shelley Broader, the company employs 12,350 people and with the market cap of USD $1.30B, it falls under the small-cap category.

CHS’s stock is now floating at around -42% below its actual worth of $17.01, at a price of US$9.85, based on its expected future cash flows. This mismatch indicates a potential opportunity to buy low. Also, CHS’s PE ratio stands at around 12.51x while its Specialty Retail peer level trades at, 18.09x implying that relative to its comparable set of companies, we can purchase CHS’s shares for cheaper. CHS is also robust in terms of financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

More detail on Chico’s FAS here.

Daqo New Energy Corp. (NYSE:DQ)

Daqo New Energy Corp., together with its subsidiaries, manufactures and sells polysilicon and wafers in the People’s Republic of China. Started in 2006, and currently headed by CEO Longgen Zhang, the company currently employs 1,702 people and with the company’s market capitalisation at USD $702.88M, we can put it in the small-cap category.

DQ’s stock is currently trading at -43% under its actual worth of $93.09, at a price tag of US$53.32, based on its expected future cash flows. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. In terms of relative valuation, DQ’s PE ratio is trading at 6.09x while its Semiconductor peer level trades at, 24.38x meaning that relative to its peers, you can buy DQ for a cheaper price. DQ is also a financially healthy company, with current assets covering liabilities in the near term and over the long run. It’s debt-to-equity ratio of 53.98% has been diminishing for the past few years showing its capability to pay down its debt. Dig deeper into Daqo New Energy here.

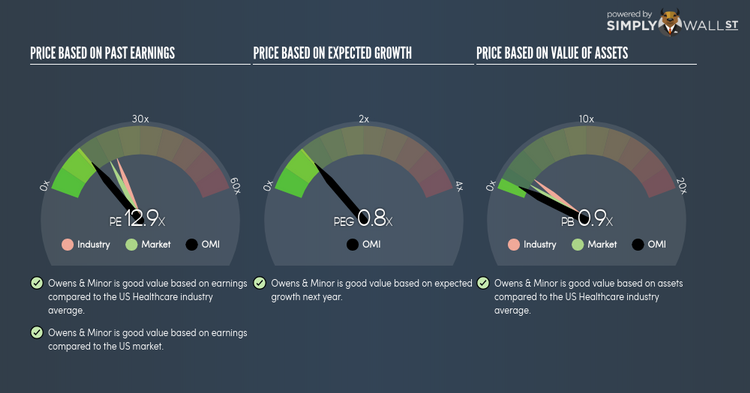

Owens & Minor, Inc. (NYSE:OMI)

Owens & Minor, Inc., together with its subsidiaries, operates as a healthcare services company in the United States, the United Kingdom, Ireland, France, Germany, and other European countries. Founded in 1882, and now run by Paul Phipps, the company provides employment to 8,600 people and with the company’s market cap sitting at USD $1.01B, it falls under the small-cap stocks category.

OMI’s stock is currently trading at -27% lower than its actual value of $21.23, at a price of US$15.45, according to my discounted cash flow model. The divergence signals an opportunity to buy OMI shares at a low price. What’s even more appeal is that OMI’s PE ratio is around 12.92x against its its Healthcare peer level of, 21.2x suggesting that relative to its peers, we can invest in OMI at a lower price. OMI is also robust in terms of financial health, with short-term assets covering liabilities in the near future as well as in the long run.

Continue research on Owens & Minor here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.