Top Defensive Stocks To Buy Today

Defensive investment strategies are those that maintain holdings in safe assets, which include stocks that meet a certain criteria that avoids losses in market value. To do this, you need to find the important traits present in these companies, which are namely a robust balance sheet, strong liquidity and a proven ability to earn money over time. I suggest starting with Chong Hing Bank, Zhou Hei Ya International Holdings and Guangzhou Baiyunshan Pharmaceutical Holdings.

Chong Hing Bank Limited (SEHK:1111)

Chong Hing Bank Limited provides banking and related financial services in Hong Kong, Mainland China, Macau, and internationally. Formed in 1948, and currently run by Jianxin Zong, the company employs 1,600 people and with the company’s market capitalisation at HKD HK$10.79B, we can put it in the large-cap stocks category.

1111’s financial management makes the company a solid defensive candidate because its liabilities are predominantly made up of low-risk deposits (88.78%). To add to this, of the loans that they make, only 0.72% are considered as a write-off, giving equity investors greater confidence in the safety of their investment. because it’s a mid-cap stock priced at HK$10.79B and a PE of 9.08x, there is an adequately liquid market for the stock which is relatively undervalued compared to the market, which minimises the potential for rapid share price falls in down cycles. With that has also been annualised earnings growth of 14.21% for the last 5 years and an even greater 30.90% last year, which demonstrates 1111 is a strong candidate for a bear market based on these defensive tenets. Continue research on Chong Hing Bank here.

Zhou Hei Ya International Holdings Company Limited (SEHK:1458)

Zhou Hei Ya International Holdings Company Limited produces, markets, and retails casual braised food in China. Formed in 2002, and headed by CEO Lixiao Hao, the company employs 4,283 people and has a market cap of HKD HK$19.71B, putting it in the large-cap stocks category.

1458’s financial management makes the company a solid defensive candidate , with the entire capital base funded by equity investors – meaning zero debt and lower risk of financial distress during tough market conditions. Furthermore, at a HK$19.71B market cap , the company benefits from greater liquidity and trading volumes than similar companies of smaller size, helping curtail the rate of decline in share price during periods of mass selling. The past 5 years show the company has grown earnings by 24.16% annually and recorded a ROA of 16.64% over the previous twelve months (compared to the industry’s 6.31%), showing 1458 holds many of the keys to avoiding the potentially destructive forces of a bear market. Continue research on Zhou Hei Ya International Holdings here.

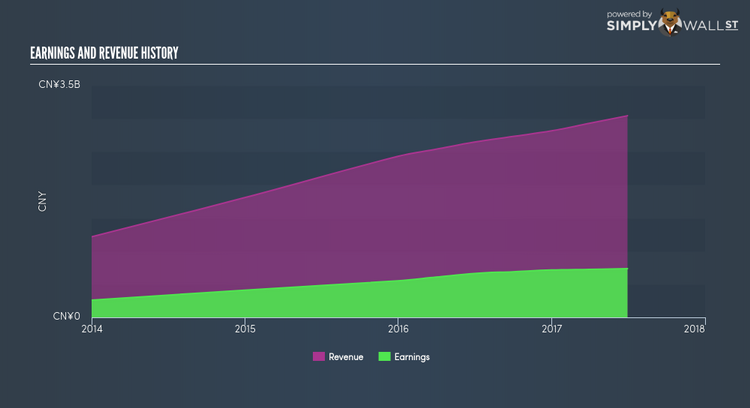

Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited (SEHK:874)

Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited engages in the research, development, manufacture, and sale of Chinese and Western medicines, chemical raw materials, natural medicines, biological medicines, chemical raw material intermediates, and health products in the People’s Republic of China. Formed in 1997, and currently lead by Hong Li, the company provides employment to 21,334 people and with the company’s market cap sitting at HKD HK$52.20B, it falls under the large-cap category.

874 is well-postioned financially , due to the high ratio of current assets to long-term liabilities, which is currently at 27.47x. Additionally, operating cash flow is higher than total debt by over 200%, making an investment in the company a safer bet if the cycle turns against you. With Guangzhou Baiyunshan Pharmaceutical Holdings’s market value of HK$52.20B , more buyers and sellers exist for the stock than there would be if it were smaller, enabling the stock to better withstand selling pressure during market downturns. As earnings have annually compounded at 23.02% over the past 5 years and last year’s growth was 36.71%, the company holds many of the keys to avoiding the potentially destructive forces of a bear market. Dig deeper into Guangzhou Baiyunshan Pharmaceutical Holdings here.

Or create your own list by filtering SEHK companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.