Top Dividend Paying Companies

Dividend-paying companies such as Northland Power and IGM Financial can help grow your portfolio income through their sizeable dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

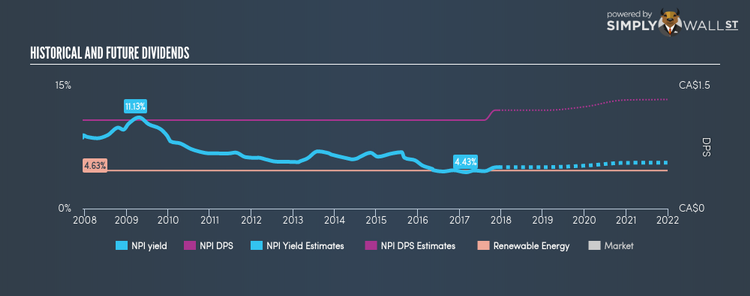

Northland Power Inc. (TSX:NPI)

Northland Power Inc. develops, builds, owns, and operates power generation projects primarily in Canada and Europe. Established in 1987, and run by CEO John Brace, the company size now stands at 300 people and with the stock’s market cap sitting at CAD CA$4.17B, it comes under the mid-cap group.

NPI has a great dividend yield of 5.06% and their payout ratio stands at 70.50% , and analysts are expecting a 90.36% payout ratio in the next three years. NPI’s last dividend payment was $1.2, up from it’s payment 10 years ago of $1.08. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend.

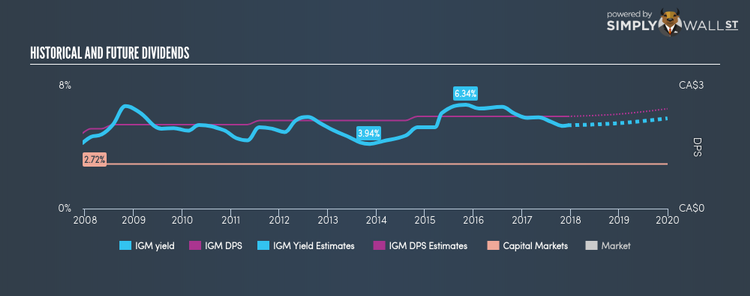

IGM Financial Inc. (TSX:IGM)

IGM Financial Inc. operates as a financial services company in Canada. Founded in 1894, and currently run by Jeffrey Carney, the company provides employment to 3,371 people and with the stock’s market cap sitting at CAD CA$10.65B, it comes under the large-cap group.

IGM has an appealing dividend yield of 5.08% and has a payout ratio of 69.01% . The company’s dividends per share have risen from $1.84 to $2.25 over the last 10 years. The company has been a reliable payer too, not missing a payment during this time.

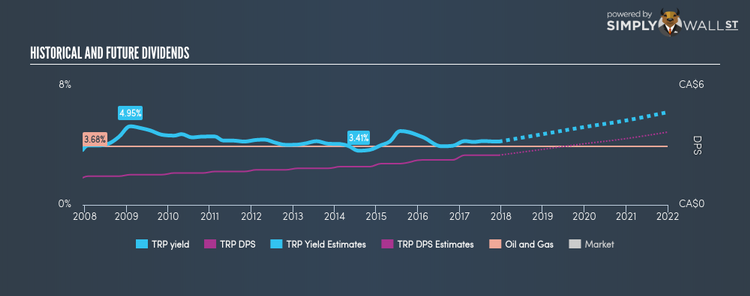

TransCanada Corporation (TSX:TRP)

TransCanada Corporation operates as an energy infrastructure company in North America. Established in 1951, and headed by CEO Russell Girling, the company currently employs 7,165 people and with the stock’s market cap sitting at CAD CA$55.28B, it comes under the large-cap stocks category.

TRP has a decent dividend yield of 3.98% and their payout ratio stands at 118.16% . TRP’s last dividend payment was $2.5, up from it’s payment 10 years ago of $1.36. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. TransCanada is a strong prospect for its future growth, with analysts expecting the company’s earnings to increase by 91.3% over the next three years.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.