Top Dividend Paying Stocks

Accord Financial, Calian Group, and TransCanada have one big thing in common. They are on my list of the best dividend stocks which have generously contributed to my portfolio income over the past couple of months. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

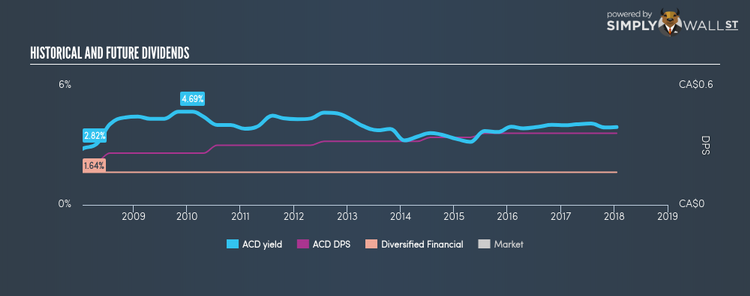

Accord Financial Corp. (TSX:ACD)

Accord Financial Corp., through its subsidiaries, provides asset-based financial services to industrial and commercial enterprises primarily in Canada and the United States. Founded in 1978, and currently run by Thomas Henderson, the company currently employs 84 people and with the company’s market capitalisation at CAD CA$76.43M, we can put it in the small-cap category.

ACD has a wholesome dividend yield of 3.91% and the company has a payout ratio of 51.68% . The company’s DPS has increased from $0.22 to $0.36 over the last 10 years. Much to the delight of shareholders, the company has not missed a payment during this time. Accord Financial is also reasonably priced, with a PE ratio of 13.2 that compares favorably with the Global Diversified Financial average of 18.2. More detail on Accord Financial here.

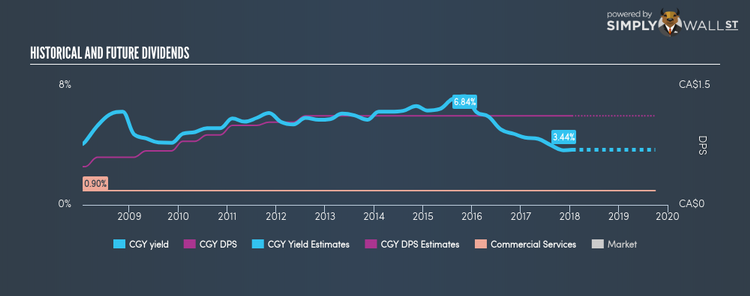

Calian Group Ltd. (TSX:CGY)

Calian Group Ltd. engages in the systems engineering, manufacturing, training, information technology, and health care solutions to industries and government in Canada, the United States, and Europe. Started in 1982, and now run by Kevin Ford, the company currently employs 2,900 people and with the company’s market cap sitting at CAD CA$246.52M, it falls under the small-cap category.

CGY has a nice dividend yield of 3.46% and distributes 55.21% of its earnings to shareholders as dividends . The company’s dividends per share have risen from $0.48 to $1.12 over the last 10 years. They have been dependable too, not missing a single payment in this time. Calian Group’s performance over the last 12 months beat the ca commercial services and supplies industry, with the company reporting 13.22% EPS growth compared to its industry’s figure of 10.60%. Interested in Calian Group? Find out more here.

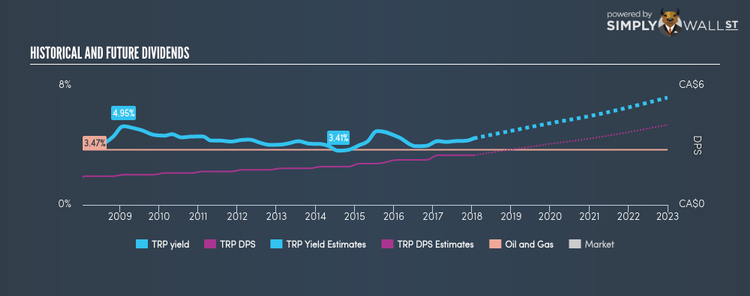

TransCanada Corporation (TSX:TRP)

TransCanada Corporation operates as an energy infrastructure company in North America. Founded in 1951, and headed by CEO Russell Girling, the company employs 7,165 people and with the company’s market capitalisation at CAD CA$52.83B, we can put it in the large-cap category.

TRP has a sumptuous dividend yield of 4.19% and pays 118.16% of it’s earnings as dividends . In the case of TRP, they have increased their dividend per share from $1.36 to $2.5 so in the past 10 years. They have been dependable too, not missing a single payment in this time. Over the next three years, analysts predict double digit earnings growth for TransCanada of 90.83%. Interested in TransCanada? Find out more here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.