Top Growth Stocks To Buy Now

Analysts are bullish on these following companies: Echo Resources, BrainChip Holdings, Pro Medicus. These companies are relatively strong financially, and have a great outlook in terms of profits and cash flow. Whether it be a well-known tech stock or a risky small-cap, I believe diversification towards growth can add value to your current holdings. Below I’ve compiled a list of stocks with a bright future ahead.

Echo Resources Limited (ASX:EAR)

Echo Resources Limited engages in the exploration and development of gold properties. The company was established in 2004 and has a market cap of AUD A$180.80M, putting it in the small-cap group.

EAR’s forecasted bottom line growth is an exceptional triple-digit, driven by underlying sales, which is expected to more than double, over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 53.90%. EAR’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. A potential addition to your portfolio? Take a look at its other fundamentals here.

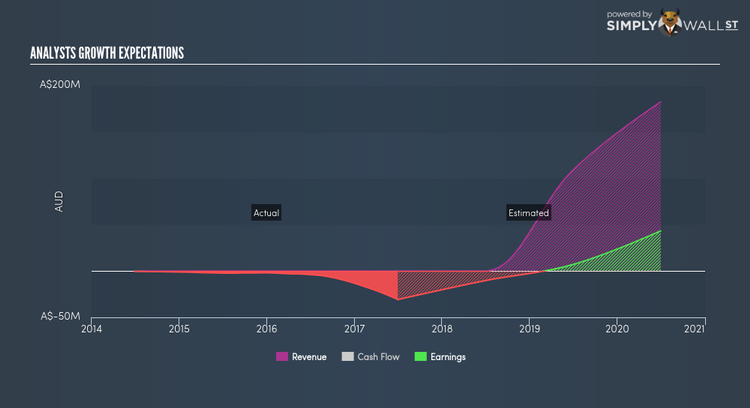

BrainChip Holdings Limited (ASX:BRN)

BrainChip Holdings Limited provides software and hardware solutions for artificial intelligence and machine learning applications in North America and Europe. Founded in 2011, and headed by CEO Louis DiNardo, the company currently employs 21 people and has a market cap of AUD A$213.20M, putting it in the small-cap group.

BRN’s projected future profit growth is an exceptional 66.30%, with an underlying triple-digit growth from its revenues expected over the upcoming years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 25.96%. BRN’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add BRN to your portfolio? I recommend researching its fundamentals here.

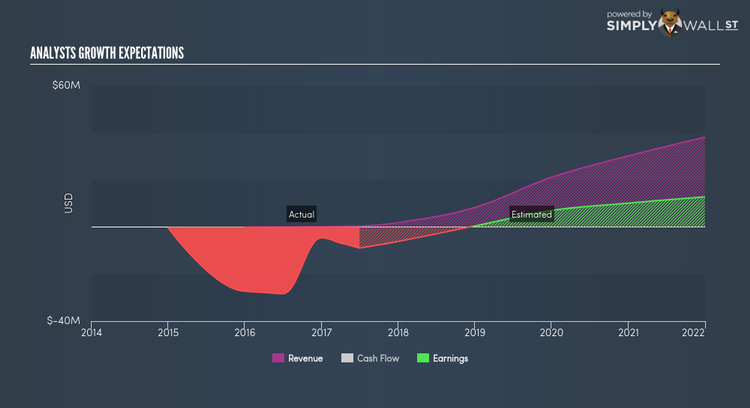

Pro Medicus Limited (ASX:PME)

Pro Medicus Limited provides radiology information systems (RIS), picture archiving and communication systems (PACS), and advanced visualization solutions worldwide. Started in 1983, and currently headed by CEO Sam Hupert, the company now has 69 employees and with the company’s market cap sitting at AUD A$830.89M, it falls under the small-cap category.

PME’s projected future profit growth is a robust 46.94%, with an underlying 75.65% growth from its revenues expected over the upcoming years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 40.50%. PME’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Interested to learn more about PME? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.