Top High Growth Stocks This Week

Looking to add potential meaningful upside to your portfolio, but unsure where to start? Stocks such as Shankara Building Products and Jubilant FoodWorks are considered to be high growth in terms of how much they’re expected to earn and return to shareholders, according to the market. If a buoyant growth prospect is what you’re after in your next investment, I’ve put together a list of high-growth stocks you may be interested in, based on the latest financial data from each company.

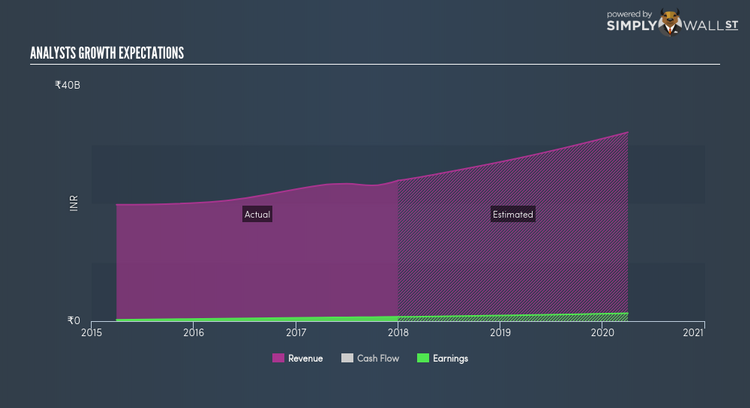

Shankara Building Products Limited (BSE:540425)

Shankara Building Products Limited engages in the retail of home improvement and building products. Formed in 1995, and currently run by Siddhartha Mundra, the company employs 1,381 people and with the stock’s market cap sitting at INR ₹39.58B, it comes under the large-cap stocks category.

540425’s projected future profit growth is a robust 29.91%, with an underlying 29.99% growth from its revenues expected over the upcoming years. It appears that 540425’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 21.29%. 540425’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add 540425 to your portfolio? Have a browse through its key fundamentals here.

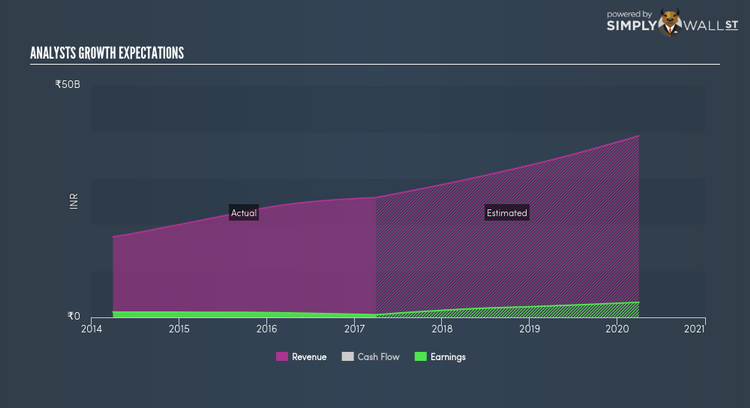

Jubilant FoodWorks Limited (BSE:533155)

Jubilant FoodWorks Limited operates as a food service company. Founded in 1995, and now led by CEO Pratik Pota, the company currently employs 11,514 people and with the company’s market capitalisation at INR ₹135.57B, we can put it in the large-cap category.

Driven by the positive double-digit sales growth of 31.34% over the next few years, 533155 is expected to deliver an excellent earnings growth of 42.65%. It appears that 533155’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 29.39%. 533155 ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Want to know more about 533155? Have a browse through its key fundamentals here.

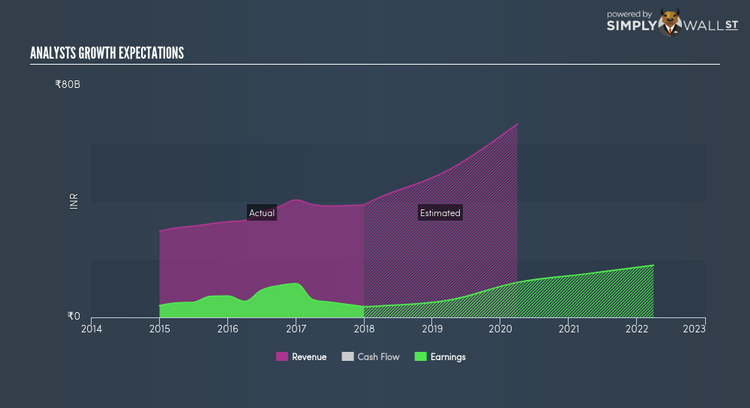

Biocon Limited (BSE:532523)

Biocon Limited, a biopharmaceutical company, develops, manufactures, and sells biopharmaceuticals for diabetes, cancer, and autoimmune conditions. Founded in 1978, and currently lead by Arun Chandavarkar, the company provides employment to 9,234 people and with the market cap of INR ₹350.49B, it falls under the large-cap stocks category.

532523’s forecasted bottom line growth is an optimistic double-digit 38.89%, driven by the underlying 62.04% sales growth over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 24.86%. 532523 ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Should you add 532523 to your portfolio? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.