Top Insider-Bought Stocks This Week

Insiders buying more shares in their own company indicates confidence in management’s outlook in the future. Research from MIT suggests stocks that have recently seen insider buying outperformed the market by 4.5%. These insiders have rare insights into the underlying business, so they are well-placed to profit from potential changes moving forward. Should you followsuit? Below, I’ve chosen three NYSE companies which insiders have recently accumulated more shares in.

The Mosaic Company (NYSE:MOS)

The Mosaic Company, through its subsidiaries, produces and markets concentrated phosphate and potash crop nutrients worldwide. Formed in 2004, and currently headed by CEO James O’Rourke, the company size now stands at 8,500 people and with the company’s market cap sitting at USD $10.80B, it falls under the large-cap stocks category.

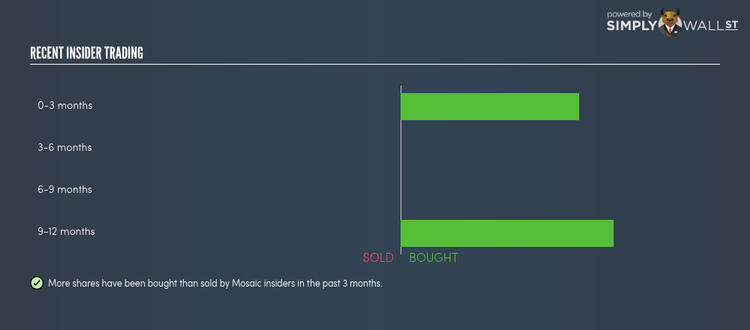

The Mosaic Company (NYSE:MOS) is one of United States’s large-cap stocks that saw some insider buying over the past three months, with insiders investing in 5,855 shares during this period. In total, individual insiders own less than one million shares in the business, or around 0.19% of total shares outstanding.

Latest buying activities involved the following insiders: Kelvin Westbrook . and Robert Lumpkins (board member) .

With a notable expected earnings growth rate of 32.91% per year for the next five years, the current bullish sentiment around the company’s outlook may be a key driver for insiders to rally behind their own stock if they believe this growth potential has not yet been properly factored into the share price. More on Mosaic here.

United Continental Holdings, Inc. (NYSE:UAL)

United Continental Holdings, Inc., together with its subsidiaries, provides air transportation services in North America, the Asia-Pacific, Europe, the Middle East, Africa, and Latin America. Established in 1934, and headed by CEO Oscar Munoz, the company currently employs 90,800 people and with the market cap of USD $19.87B, it falls under the large-cap category.

United Continental Holdings Inc (NYSE:UAL) is one of United States’s large-cap stocks that saw some insider buying over the past three months, with insiders investing in 75,000 shares during this period. In total, individual insiders own less than one million shares in the business, or around 0.34% of total shares outstanding.

The insider that recently bought more shares is Edward Shapiro .

Analysts anticipate an impressive double-digit top-line growth over the next three years, which appears to flow through to a large earnings growth rate of 16.96% from today’s level. If insiders believe these benefits are defensible, this could be a motivation for the net buying activity. More on United Continental Holdings here.

Edgewell Personal Care Company (NYSE:EPC)

Edgewell Personal Care Company manufactures and markets personal care products in the wet shave, sun and skin care, feminine care, and infant care categories the United States and internationally. Founded in 1999, and headed by CEO David Hatfield, the company size now stands at 6,000 people and has a market cap of USD $2.40B, putting it in the mid-cap stocks category.

Edgewell Personal Care Company’s (NYSE:EPC) insiders have invested 2,050 shares in the large-cap stocks within the past three months. In total, individual insiders own less than one million shares in the business, or around 0.44% of total shares outstanding.

The following insiders have recently increased their company holdings: Anthony Bender (board member) . and Roy Hoover (management) .

With a notable expected earnings growth rate of 20.69% per year for the next five years, the current bullish sentiment around the company’s outlook may be a key driver for insiders to rally behind their own stock if they believe this growth potential has not yet been properly factored into the share price. More detail on Edgewell Personal Care here.

For more stocks with high, positive trading volume by insiders, explore this interactive list of stocks with recent insider buying.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.