Who Are The Top Investors In Andina Acquisition Corp II (ANDA)?

In this article, I’m going to take a look at Andina Acquisition Corp II’s (NASDAQ:ANDA) latest ownership structure, a non-fundamental factor which is important, but remains a less discussed subject among investors. The impact of a company’s ownership structure affects both its short- and long-term performance. Differences in ownership structure of companies can have a profound effect on how management’s incentives are aligned with shareholder returns, which is why we’ll take a moment to analyse ANDA’s shareholder registry. All data provided is as of the most recent financial year end.

Check out our latest analysis for Andina Acquisition II

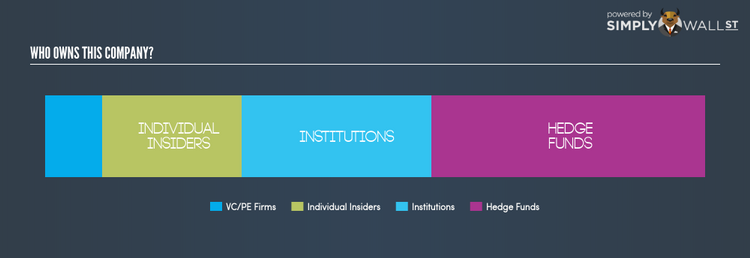

Institutional Ownership

Institutions account for 57.73% of ANDA’s outstanding shares, a significant enough holding to move stock prices if they start buying and selling in large quantities, especially when there are relatively small amounts of shares available on the market to trade. These moves, at least in the short-term, are generally observed in an institutional ownership mix comprising of active stock pickers, in particular levered hedge funds, which can cause large price swings. With hedge funds holding a 83.05% stake in the company, its share price can experience heightened volatility. But I also examine other ownership types and their potential impact on ANDA’s investment case.

Insider Ownership

Insiders form another group of important ownership types as they manage the company’s operations and decide the best use of capital. Insider ownership has been linked to better alignment between management and shareholders. A major group of owners of ANDA is individual insiders, sitting with a hefty 42.56% stake in the company. Broadly, insider ownership of this level has been found to negatively affect companies with consistently low PE ratio (underperforming). And a positive impact has been seen on companies with a high PE ratio (outperforming). Another aspect of insider ownership is to learn about their recent transactions. Insider buying may be a sign of upbeat future expectations, however, selling doesn’t necessarily mean the opposite as insiders may be motivated by their personal financial needs.

Private Equity Ownership

Private equity firms hold a 17.52% stake in ANDA. With a stake of this size, they can be influential in key policy decisions. An investor should be encouraged by the ownership of these institutions who are known to be experts in increasing efficiency, improving capital structure and opting for value-accretive policy decisions.

What this means for you:

Are you a shareholder? With significant institutional ownership, including active hedge, existing investors should seek a margin of safety when investing in ANDA. This is to avoid getting trapped in a sustained sell-off that is often observed in stocks with this level of institutional participation. If you’re interested in bolstering your portfolio with new stocks and are looking for ideas, take a look at our free app to see my list of stocks with a strong growth potential.

Are you a potential investor? If you are building an investment case for ANDA, ownership structure alone should not dictate your decision to buy or sell the stock. Rather, you should be examining fundamental factors like the intrinsic valuation of ANDA, which is a key driver of ANDA’s share price. Take a look at our most recent infographic report on ANDA for a more in-depth analysis of these factors to help you make a more well-informed investment decision.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.