Top NasdaqGS Dividend Payers

One of the best paying dividend stock on our list is Cracker Barrel Old Country Store. Dividend stocks are a great way to hedge your portfolio as they provide both steady income and cushion against market risks Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. If you’re a buy and hold investor, these healthy dividend stocks can generously contribute to your monthly portfolio income.

Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL)

Cracker Barrel Old Country Store, Inc. develops and operates the Cracker Barrel Old Country Store concept in the United States. Started in 1969, and currently headed by CEO Sandra Cochran, the company currently employs 73,000 people and with the company’s market capitalisation at USD $3.96B, we can put it in the mid-cap category.

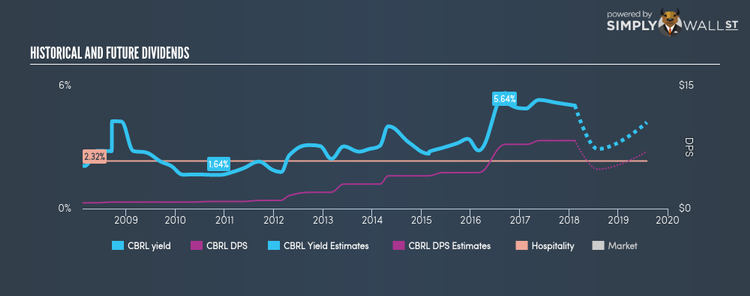

CBRL has an alluring dividend yield of 5.03% and the company has a payout ratio of 56.52% . CBRL’s last dividend payment was $8.3, up from it’s payment 10 years ago of $0.72. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. More detail on Cracker Barrel Old Country Store here.

Flowers Foods, Inc. (NYSE:FLO)

Flowers Foods, Inc. produces and markets bakery products in the United States. Established in 1919, and now led by CEO Allen Shiver, the company now has 10,800 employees and with the stock’s market cap sitting at USD $4.27B, it comes under the mid-cap stocks category.

FLO has a good dividend yield of 3.34% and their current payout ratio is 93.92% . FLO has increased its dividend from $0.22 to $0.68 over the past 10 years. The company has been a reliable payer too, not missing a payment during this time. Flowers Foods is a strong prospect for its future growth, with analysts expecting the company’s earnings to increase by 78.00% over the next three years. Interested in Flowers Foods? Find out more here.

National Fuel Gas Company (NYSE:NFG)

National Fuel Gas Company operates as a diversified energy company. Established in 1902, and currently run by Ronald Tanski, the company currently employs 2,100 people and with the market cap of USD $4.28B, it falls under the mid-cap group.

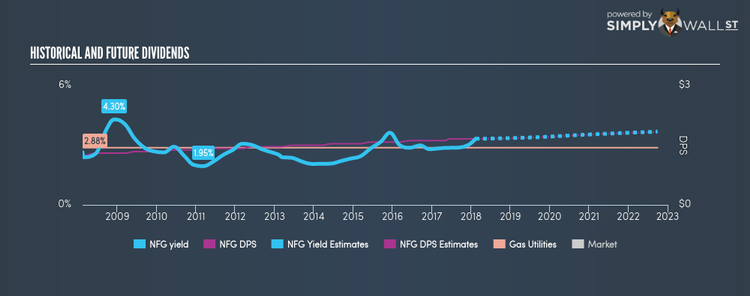

NFG has a wholesome dividend yield of 3.33% and pays out 35.87% of its profit as dividends , with an expected payout of 46.79% in three years. NFG has increased its dividend from $1.24 to $1.66 over the past 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. National Fuel Gas seems reasonably priced when looking at its PE ratio (10.9). The industry average suggests that US Gas Utilities companies are more expensive on average 20. Dig deeper into National Fuel Gas here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.