Top Picks For Dividend Rockstars

Dah Chong Hong Holdings is one of the top dividend stocks I think are worth considering today. Dividend stocks are a great way to hedge your portfolio as they provide both steady income and cushion against market risks. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. As a long term investor, I favour these great dividend-paying stocks that continues to add value to my portfolio.

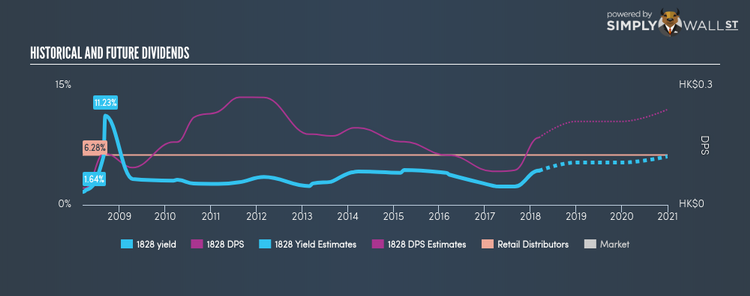

Dah Chong Hong Holdings Limited (SEHK:1828)

Dah Chong Hong Holdings Limited engages in the motor and motor related, food and consumer, LFA, and other businesses in Mainland China, Hong Kong, Macao, Japan, Singapore, Thailand, Malaysia, and Taiwan. Established in 1949, and currently run by Ni Hium Lai, the company provides employment to 17,169 people and has a market cap of HKD HK$7.28B, putting it in the mid-cap group.

1828 has a sumptuous dividend yield of 4.30% and their payout ratio stands at 15.78% , with analysts expecting the payout in three years to be 41.37%. Despite some volatility in the yield, DPS has risen in the last 10 years from HK$0.043 to HK$0.17. Interested in Dah Chong Hong Holdings? Find out more here.

Yuexiu Real Estate Investment Trust (SEHK:405)

Yuexiu Real Estate Investment Trust (“Yuexiu REIT”) and its subsidiaries (together, the “Group”) are mainly engaged in the leasing of commercial properties in Mainland China (“China”). Established in 2005, and currently run by Deliang Lin, the company currently employs 819 people and with the company’s market capitalisation at HKD HK$15.76B, we can put it in the large-cap stocks category.

405 has a great dividend yield of 6.54% and is distributing 56.75% of earnings as dividends , and analysts are expecting a 154.16% payout ratio in the next three years. 405’s dividends have seen an increase over the past 10 years, with payments increasing from CN¥0.22 to CN¥0.34 in that time. Much to the delight of shareholders, the company has not missed a payment during this time. Yuexiu Real Estate Investment Trust also reported a strong earnings growth of 96.04% over the past 12 months, Continue research on Yuexiu Real Estate Investment Trust here.

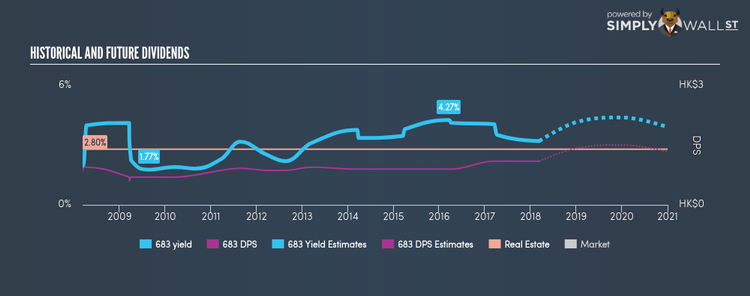

Kerry Properties Limited (SEHK:683)

Kerry Properties Limited, an investment holding company, engages in development, investment, management, and trading of properties in Hong Kong, the People’s Republic of China, and the Asia Pacific region. Established in 1978, and now run by Shut Ho, the company now has 8,100 employees and with the company’s market cap sitting at HKD HK$49.61B, it falls under the large-cap group.

683 has a wholesome dividend yield of 3.21% and their current payout ratio is 23.11% , with analysts expecting the payout ratio in three years to be 41.61%. Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from HK$0.85 to HK$1.10 over the past 10 years. The company recorded earnings growth of 63.22% in the past year, comparing favorably with the hk real estate industry average of 33.00%. Interested in Kerry Properties? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.