Top Picks For Staples Dividend Rockstars

Consumer staples demand are considered to be inelastic which means it doesn’t change much over time as consumers treat these products as necessities. This sector is considered a solid, reliable and less volatile sector for investors who are seeking slow and steady returns. If you’re a buy-and-hold investor, these healthy dividend stocks in the consumer staples industry can generously contribute to your monthly portfolio income.

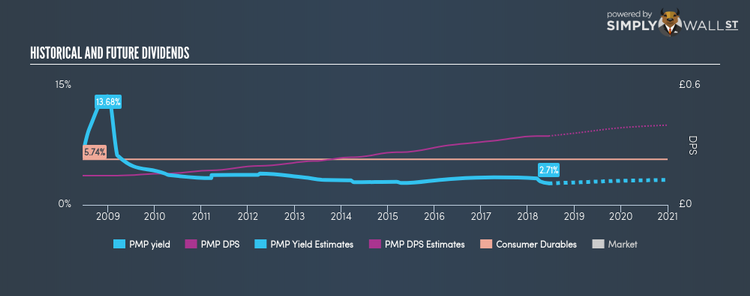

Portmeirion Group plc (AIM:PMP)

PMP has a nice dividend yield of 2.71% and pays out 53.27% of its profit as dividends . The company’s DPS have increased from UK£0.15 to UK£0.35 over the last 10 years. They have been consistent too, not missing a payment during this 10 year period. More detail on Portmeirion Group here.

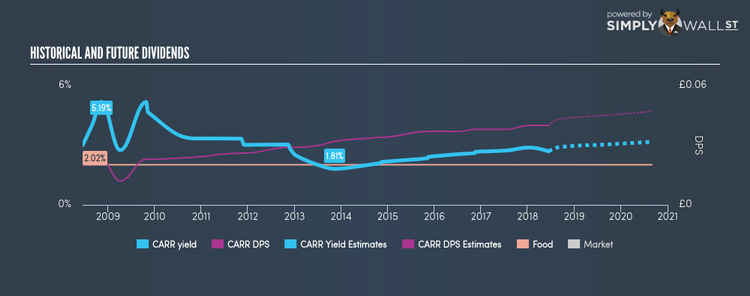

Carr’s Group plc (LSE:CARR)

CARR has a decent dividend yield of 2.70% and their current payout ratio is 40.14% . Despite there being some hiccups, dividends per share have increased during the past 10 years. Interested in Carr’s Group? Find out more here.

McColl’s Retail Group plc (LSE:MCLS)

MCLS has a substantial dividend yield of 4.64% and the company has a payout ratio of 83.59% . With a yield above the savings rate, bank account beating investors will be happy, but perhaps even happier knowing that MCLS is in the top quartile of market payers. When we compare McColl’s Retail Group’s PE ratio with its industry, the company appears favorable. The GB Consumer Retailing industry’s average ratio of 18.3 is above that of McColl’s Retail Group’s (18). Dig deeper into McColl’s Retail Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.