Top Ranked Growth Stocks to Buy for March 9th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, March 9th:

WNS (Holdings) Limited (WNS): This business process management company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.4% over the last 60 days.

WNS (Holdings) Limited Price and Consensus

WNS (Holdings) Limited price-consensus-chart | WNS (Holdings) Limited Quote

WNS has a PEG ratio 1.53, compared with 1.55 for the industry. The company possesses a Growth Score of A.

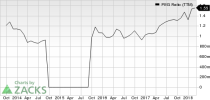

WNS (Holdings) Limited PEG Ratio (TTM)

WNS (Holdings) Limited peg-ratio-ttm | WNS (Holdings) Limited Quote

MCBC Holdings, Inc. (MCFT): This designer of recreational sport boats, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.7% over the last 60 days.

MCBC Holdings, Inc. Price and Consensus

MCBC Holdings, Inc. price-consensus-chart | MCBC Holdings, Inc. Quote

MCBC Holdings has a PEG ratio 0.96, compared with 1.42 for the industry. The company possesses a Growth Score of A.

MCBC Holdings, Inc. PEG Ratio (TTM)

MCBC Holdings, Inc. peg-ratio-ttm | MCBC Holdings, Inc. Quote

Evercore Inc. (EVR): This security and protection services provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12.5% over the last 60 days.

Evercore Inc Price and Consensus

Evercore Inc price-consensus-chart | Evercore Inc Quote

Evercore has a PEG ratio 0.92, compared with 1.00 for the industry. The company possesses a Growth Score of A.

Evercore Inc PEG Ratio (TTM)

Evercore Inc peg-ratio-ttm | Evercore Inc Quote

United States Steel Corporation (X): This flat-rolled and tubular steel products seller, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 39.3% over the last 60 days.

United States Steel Corporation Price and Consensus

United States Steel Corporation price-consensus-chart | United States Steel Corporation Quote

United States Steel has a PEG ratio 1.52, compared with 1.84 for the industry. The company possesses a Growth Score of A.

United States Steel Corporation PEG Ratio (TTM)

United States Steel Corporation peg-ratio-ttm | United States Steel Corporation Quote

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United States Steel Corporation (X) : Free Stock Analysis Report

WNS (Holdings) Limited (WNS) : Free Stock Analysis Report

MCBC Holdings, Inc. (MCFT) : Free Stock Analysis Report

Evercore Inc (EVR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research