Top Ranked Growth Stocks to Buy for March 12th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, March 12th:

Copa Holdings, S.A. (CPA): This airline passenger and cargo services provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.7% over the last 60 days.

Copa Holdings, S.A. Price and Consensus

Copa Holdings, S.A. Price and Consensus | Copa Holdings, S.A. Quote

Copa has a PEG ratio of 0.86, compared with 1.01 for the industry. The company possesses a Growth Score of A.

Copa Holdings, S.A. PEG Ratio (TTM)

Copa Holdings, S.A. PEG Ratio (TTM) | Copa Holdings, S.A. Quote

Rudolph Technologies, Inc. (RTEC): This designer of scientific and technical instruments, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 15.6% over the last 60 days.

Rudolph Technologies, Inc. Price and Consensus

Rudolph Technologies, Inc. Price and Consensus | Rudolph Technologies, Inc. Quote

Rudolph Technologies has a PEG ratio of 2.05, compared with 5.96 for the industry. The company possesses a Growth Score of A.

Rudolph Technologies, Inc. PEG Ratio (TTM)

Rudolph Technologies, Inc. PEG Ratio (TTM) | Rudolph Technologies, Inc. Quote

Proto Labs, Inc. (PRLB): This e-commerce enabled digital manufacturer, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings rising 13.9% over the last 60 days.

Proto Labs, Inc. Price and Consensus

Proto Labs, Inc. Price and Consensus | Proto Labs, Inc. Quote

Proto Labs has a PEG ratio of 2.43, compared with 2.51 for the industry. The company possesses a Growth Score of A.

Proto Labs, Inc. PEG Ratio (TTM)

Proto Labs, Inc. PEG Ratio (TTM) | Proto Labs, Inc. Quote

DXC Technology Company (DXC): This information technology services provider, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.5% over the last 60 days.

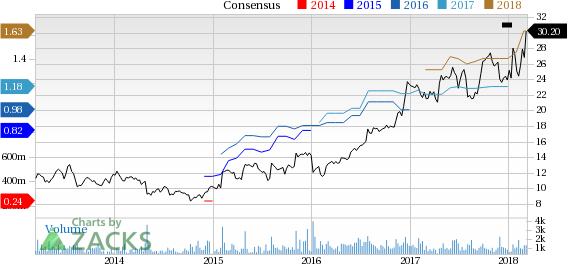

DXC Technology Company. Price and Consensus

DXC Technology Company. Price and Consensus | DXC Technology Company. Quote

DXC has a PEG ratio of 1.30, compared with 8.77 for the industry. The company possesses a Growth Score of A.

DXC Technology Company. PEG Ratio (TTM)

DXC Technology Company. PEG Ratio (TTM) | DXC Technology Company. Quote

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rudolph Technologies, Inc. (RTEC) : Free Stock Analysis Report

Proto Labs, Inc. (PRLB) : Free Stock Analysis Report

DXC Technology Company. (DXC) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research