Top Ranked Growth Stocks to Buy for August 26th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, August 26th:

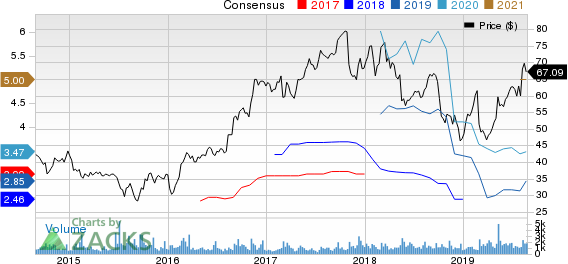

Itron, Inc. (ITRI): This provider of end-to-end solutions that measures, manages, and analyzes energy and water use, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.1% over the last 60 days.

Itron, Inc. Price and Consensus

Itron, Inc. price-consensus-chart | Itron, Inc. Quote

Itron has a PEG ratio of 0.94, compared with 2.01 for the industry. The company possesses a Growth Score of B.

Itron, Inc. PEG Ratio (TTM)

Itron, Inc. peg-ratio-ttm | Itron, Inc. Quote

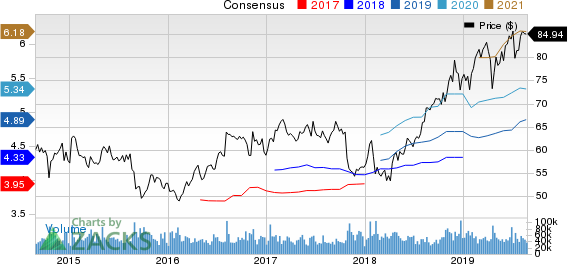

Woodward, Inc. (WWD): This manufacturer of control systems and components for the aerospace and industrial markets, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.4% over the last 60 days.

Woodward, Inc. Price and Consensus

Woodward, Inc. price-consensus-chart | Woodward, Inc. Quote

Woodward has a PEG ratio of 1.63, compared with 2.03 for the industry. The company possesses a Growth Score of B.

Woodward, Inc. PEG Ratio (TTM)

Woodward, Inc. peg-ratio-ttm | Woodward, Inc. Quote

Merck (MRK): This biopharmaceutical company, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 3.2% over the last 60 days.

Merck & Co., Inc. Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

Merck has a PEG ratio of 1.74, compared with 2.01 for the industry. The company possesses a Growth Score of B.

Merck & Co., Inc. PEG Ratio (TTM)

Merck & Co., Inc. peg-ratio-ttm | Merck & Co., Inc. Quote

Teradyne, Inc. (TER): This manufacturer and seller of automatic test equipment, which carries a Zacks Rank #2 (Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5% over the last 60 days.

Teradyne, Inc. Price and Consensus

Teradyne, Inc. price-consensus-chart | Teradyne, Inc. Quote

Teradyne has a PEG ratio of 1.82, compared with 2.01 for the industry. The company possesses a Growth Score of B.

Teradyne, Inc. PEG Ratio (TTM)

Teradyne, Inc. peg-ratio-ttm | Teradyne, Inc. Quote

See the full list of top ranked stocks here

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Woodward, Inc. (WWD) : Free Stock Analysis Report

Teradyne, Inc. (TER) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research