Top Ranked Growth Stocks to Buy for October 14th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, October 14th:

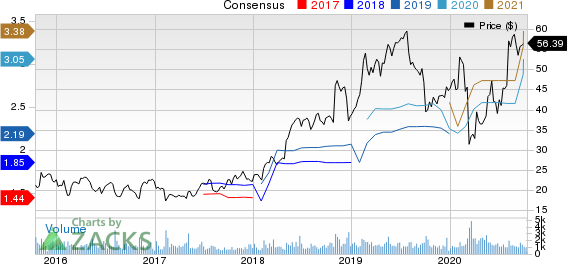

The Ensign Group, Inc. (ENSG): This provider of health care services in the post-acute care continuum and other ancillary businesses, which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.9% over the last 60 days.

The Ensign Group, Inc. Price and Consensus

The Ensign Group, Inc. price-consensus-chart | The Ensign Group, Inc. Quote

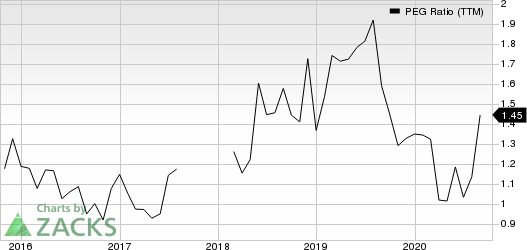

Ensign has a PEG ratio of 1.30, compared with 0.07 for the industry. The company possesses a Growth Score of A.

The Ensign Group, Inc. PEG Ratio (TTM)

The Ensign Group, Inc. peg-ratio-ttm | The Ensign Group, Inc. Quote

Owens & Minor, Inc. (OMI): This healthcare solutions company which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 66.4% over the last 60 days.

Owens Minor, Inc. Price and Consensus

Owens Minor, Inc. price-consensus-chart | Owens Minor, Inc. Quote

Owens & Minor has a PEG ratio of 0.31, compared with 1.66 for the industry. The company possesses a Growth Score of B.

Owens Minor, Inc. PEG Ratio (TTM)

Owens Minor, Inc. peg-ratio-ttm | Owens Minor, Inc. Quote

RPM International Inc. (RPM): This manufacturer and seller of specialty chemicals, which carries a Zacks Rank #2, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.5% over the last 60 days.

RPM International Inc. Price and Consensus

RPM International Inc. price-consensus-chart | RPM International Inc. Quote

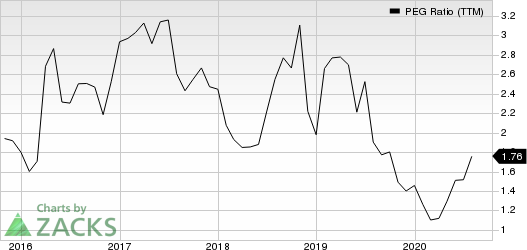

RPM has a PEG ratio of 1.57, compared with 2.82 for the industry. The company possesses a Growth Score of A.

RPM International Inc. PEG Ratio (TTM)

RPM International Inc. peg-ratio-ttm | RPM International Inc. Quote

See the full list of top ranked stocks here

Learn more about the Growth score and how it is calculated here.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RPM International Inc. (RPM) : Free Stock Analysis Report

Owens Minor, Inc. (OMI) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research