Top Ranked Income Stocks to Buy for April 8th

Here are four stocks with buy rank and strong income characteristics for investors to consider today, April 8th:

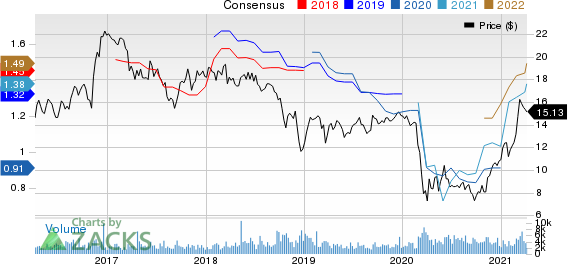

Hope Bancorp, Inc. (HOPE): This banking services provider for small and medium-sized businesses, and individuals has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.2% over the last 60 days.

Hope Bancorp, Inc. Price and Consensus

Hope Bancorp, Inc. price-consensus-chart | Hope Bancorp, Inc. Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.68%, compared with the industry average of 1.85%. Its five-year average dividend yield is 3.81%.

Hope Bancorp, Inc. Dividend Yield (TTM)

Hope Bancorp, Inc. dividend-yield-ttm | Hope Bancorp, Inc. Quote

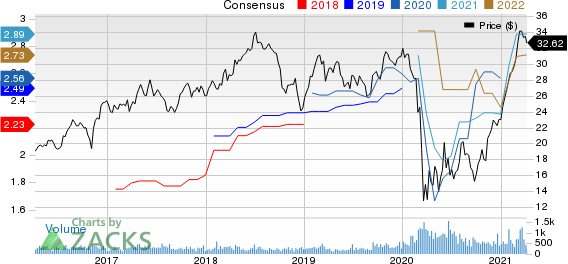

Nutrien Ltd. (NTR): This company that provides crop inputs, services, and solutions has witnessed the Zacks Consensus Estimate for its current year earnings increasing 19.4% over the last 60 days.

Nutrien Ltd. Price and Consensus

Nutrien Ltd. price-consensus-chart | Nutrien Ltd. Quote

This Zacks Rank #1 company has a dividend yield of 3.23%, compared with the industry average of 0.27%. Its five-year average dividend yield is 3.55%.

Nutrien Ltd. Dividend Yield (TTM)

Nutrien Ltd. dividend-yield-ttm | Nutrien Ltd. Quote

Premier Financial Corp. (PFC): This company that provides community banking and financial services has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.7% over the last 60 days.

Premier Financial Corp. Price and Consensus

Premier Financial Corp. price-consensus-chart | Premier Financial Corp. Quote

This Zacks Rank #1 company has a dividend yield of 2.88%, compared with the industry average of 1.98%. Its five-year average dividend yield is 2.75%.

Premier Financial Corp. Dividend Yield (TTM)

Premier Financial Corp. dividend-yield-ttm | Premier Financial Corp. Quote

Moelis & Company (MC): This investment banking advisory firm has witnessed the Zacks Consensus Estimate for its current year earnings increasing 14.3% over the last 60 days.

Moelis & Company Price and Consensus

Moelis & Company price-consensus-chart | Moelis & Company Quote

This Zacks Rank #1 company has a dividend yield of 3.86%, compared with the industry average of 0.21%. Its five-year average dividend yield is 4.31%.

Moelis & Company Dividend Yield (TTM)

Moelis & Company dividend-yield-ttm | Moelis & Company Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

Moelis & Company (MC) : Free Stock Analysis Report

Hope Bancorp, Inc. (HOPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research