Top Ranked Income Stocks to Buy for March 26th

Here are four stocks with buy rank and strong income characteristics for investors to consider today, March 26th:

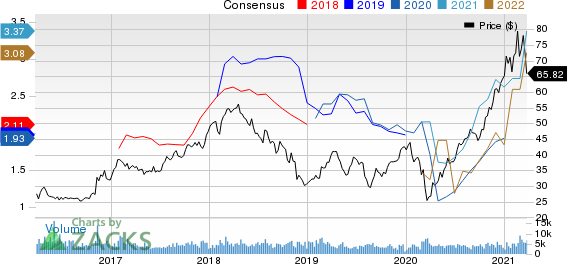

Southern Copper Corporation (SCCO): This company that engages in mining, exploring, smelting, and refining copper and other minerals has witnessed the Zacks Consensus Estimate for its current year earnings increasing 19.9% over the last 60 days.

Southern Copper Corporation Price and Consensus

Southern Copper Corporation price-consensus-chart | Southern Copper Corporation Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.65%, compared with the industry average of 0.00%. Its five-year average dividend yield is 2.60%.

Southern Copper Corporation Dividend Yield (TTM)

Southern Copper Corporation dividend-yield-ttm | Southern Copper Corporation Quote

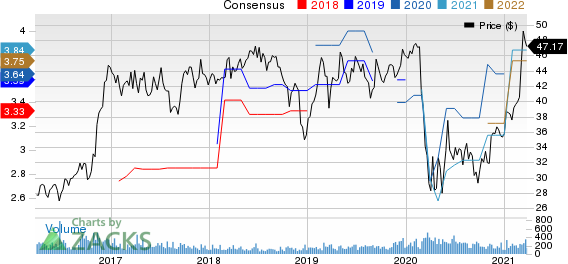

Camden National Corporation (CAC): This bank holding company for Camden National Bank has witnessed the Zacks Consensus Estimate for its current year earnings increasing 22.7% over the last 60 days.

Camden National Corporation Price and Consensus

Camden National Corporation price-consensus-chart | Camden National Corporation Quote

This Zacks Rank #1 company has a dividend yield of 2.80%, compared with the industry average of 1.94%. Its five-year average dividend yield is 2.79%.

Camden National Corporation Dividend Yield (TTM)

Camden National Corporation dividend-yield-ttm | Camden National Corporation Quote

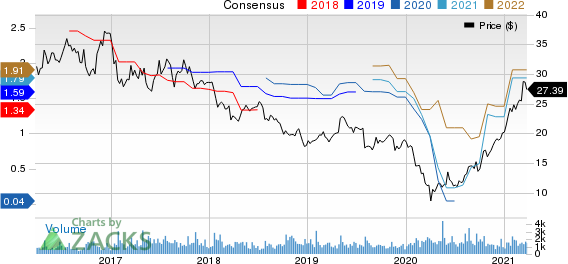

Ethan Allen Interiors Inc. (ETH): This interior design company, and manufacturer and retailer of home furnishings has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 17% over the last 60 days.

Ethan Allen Interiors Inc. Price and Consensus

Ethan Allen Interiors Inc. price-consensus-chart | Ethan Allen Interiors Inc. Quote

This Zacks Rank #1 company has a dividend yield of 3.65%, compared with the industry average of 0.00%. Its five-year average dividend yield is 2.97%.

Ethan Allen Interiors Inc. Dividend Yield (TTM)

Ethan Allen Interiors Inc. dividend-yield-ttm | Ethan Allen Interiors Inc. Quote

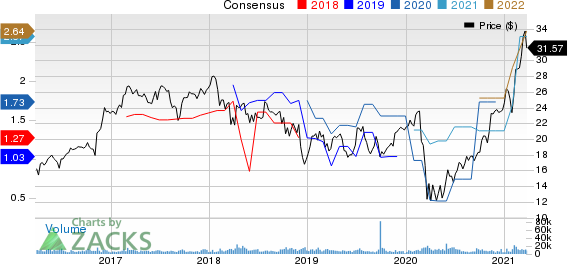

Jefferies Financial Group Inc. (JEF): This company that engages in the investment banking and capital markets, asset management, and direct investing businesses has witnessed the Zacks Consensus Estimate for its current year earnings increasing 52.1% over the last 60 days.

Jefferies Financial Group Inc. Price and Consensus

Jefferies Financial Group Inc. price-consensus-chart | Jefferies Financial Group Inc. Quote

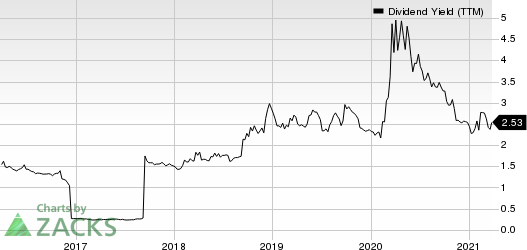

This Zacks Rank #1 company has a dividend yield of 2.53%, compared with the industry average of 0.00%. Its five-year average dividend yield is 2.09%.

Jefferies Financial Group Inc. Dividend Yield (TTM)

Jefferies Financial Group Inc. dividend-yield-ttm | Jefferies Financial Group Inc. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southern Copper Corporation (SCCO) : Free Stock Analysis Report

Jefferies Financial Group Inc. (JEF) : Free Stock Analysis Report

Ethan Allen Interiors Inc. (ETH) : Free Stock Analysis Report

Camden National Corporation (CAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research