Top Ranked Income Stocks to Buy for November 4th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, November 4th:

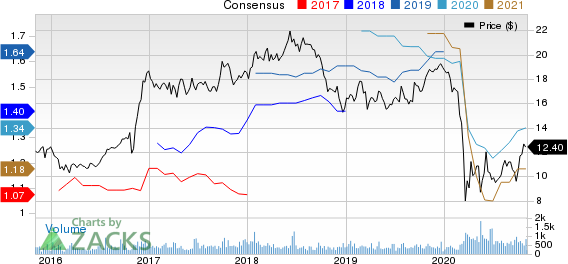

Horizon Bancorp, Inc. (HBNC): This bank holding company for Horizon Bank has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.8% over the last 60 days.

Horizon Bancorp IN Price and Consensus

Horizon Bancorp IN price-consensus-chart | Horizon Bancorp IN Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 3.69%, compared with the industry average of 2.81%. Its five-year average dividend yield is 2.46%.

Horizon Bancorp IN Dividend Yield (TTM)

Horizon Bancorp IN dividend-yield-ttm | Horizon Bancorp IN Quote

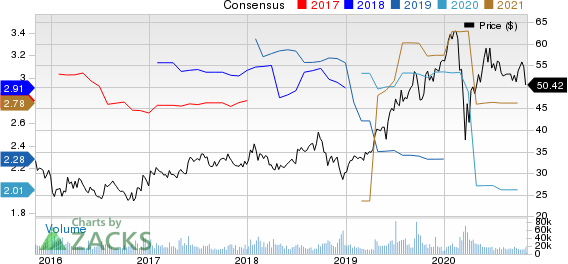

Community Trust Bancorp, Inc. (CTBI): This bank holding company for Community Trust Bank has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.7% over the last 60 days.

Community Trust Bancorp, Inc. Price and Consensus

Community Trust Bancorp, Inc. price-consensus-chart | Community Trust Bancorp, Inc. Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 4.68%, compared with the industry average of 2.56%. Its five-year average dividend yield is 3.39%.

Community Trust Bancorp, Inc. Dividend Yield (TTM)

Community Trust Bancorp, Inc. dividend-yield-ttm | Community Trust Bancorp, Inc. Quote

The Blackstone Group Inc. (BX): This alternative asset management firm has witnessed the Zacks Consensus Estimate for its current year earnings increasing 20.9% over the last 60 days.

Blackstone Group IncThe Price and Consensus

Blackstone Group IncThe price-consensus-chart | Blackstone Group IncThe Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 2.85%, compared with the industry average of 2.06%. Its five-year average dividend yield is 5.77%.

Blackstone Group IncThe Dividend Yield (TTM)

Blackstone Group IncThe dividend-yield-ttm | Blackstone Group IncThe Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Horizon Bancorp IN (HBNC) : Free Stock Analysis Report

Community Trust Bancorp, Inc. (CTBI) : Free Stock Analysis Report

Blackstone Group IncThe (BX) : Free Stock Analysis Report

To read this article on Zacks.com click here.