Top Ranked Value Stocks to Buy for August 13th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, August 13th:

Group 1 Automotive, Inc. (GPI): This company that is engaged in the automotive retail industry has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 21.6% over the last 60 days.

Group 1 Automotive, Inc. Price and Consensus

Group 1 Automotive, Inc. price-consensus-chart | Group 1 Automotive, Inc. Quote

Group 1 Automotive has a price-to-earnings ratio (P/E) of 11.44 compared with 14.40 for the industry. The company possesses a Value Score of A.

Group 1 Automotive, Inc. PE Ratio (TTM)

Group 1 Automotive, Inc. pe-ratio-ttm | Group 1 Automotive, Inc. Quote

Danaos Corporation (DAC): This owner and operator of containerships in Australia, Asia, Europe, and the United States has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 5% over the last 90 days.

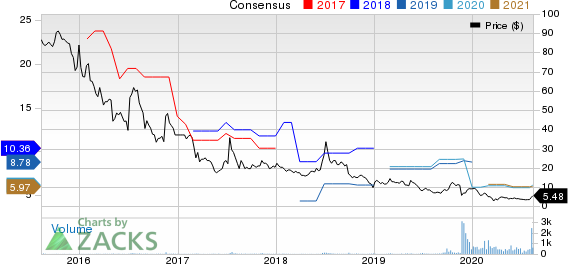

Danaos Corporation Price and Consensus

Danaos Corporation price-consensus-chart | Danaos Corporation Quote

Danaos has a price-to-earnings ratio (P/E) of 0.89 compared with 2.80 for the industry. The company possesses a Value Score of A.

Danaos Corporation PE Ratio (TTM)

Danaos Corporation pe-ratio-ttm | Danaos Corporation Quote

Atlas Air Worldwide Holdings, Inc. (AAWW): This provider of outsourced aircraft and aviation operating services has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 37.9% over the last 90 days.

Atlas Air Worldwide Holdings Price and Consensus

Atlas Air Worldwide Holdings price-consensus-chart | Atlas Air Worldwide Holdings Quote

Atlas Air Worldwide has a price-to-earnings ratio (P/E) of 5.15 compared with 39.40 for the industry. The company possesses a Value Score of A.

Atlas Air Worldwide Holdings PE Ratio (TTM)

Atlas Air Worldwide Holdings pe-ratio-ttm | Atlas Air Worldwide Holdings Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Find more top income stocks with some of our great premium screens.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

Danaos Corporation (DAC) : Free Stock Analysis Report

Atlas Air Worldwide Holdings (AAWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research