Top Ranked Value Stocks to Buy for July 7th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, July 7th:

Group 1 Automotive, Inc. (GPI): This company that through its subsidiaries, operates in the automotive retail industry has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 9.4% over the last 60 days.

Group 1 Automotive, Inc. Price and Consensus

Group 1 Automotive, Inc. price-consensus-chart | Group 1 Automotive, Inc. Quote

Group 1 Automotive has a price-to-earnings ratio (P/E) of 7.06, compared with 11.50 for the industry. The company possesses a Value Score of A.

Group 1 Automotive, Inc. PE Ratio (TTM)

Group 1 Automotive, Inc. pe-ratio-ttm | Group 1 Automotive, Inc. Quote

Westlake Chemical Corporation (WLK): This vertically integrated international manufacturer and supplier of petrochemicals, polymers and fabricated products has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 25.5% over the last 60 days.

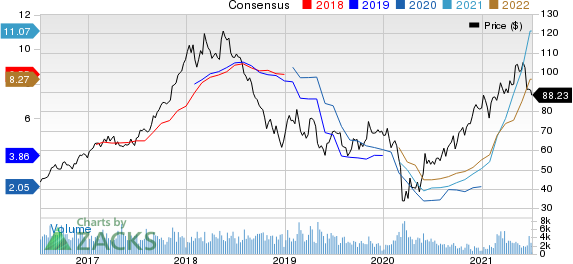

Westlake Chemical Corporation Price and Consensus

Westlake Chemical Corporation price-consensus-chart | Westlake Chemical Corporation Quote

Westlake Chemical has a price-to-earnings ratio (P/E) of 7.97, compared with 14.50 for the industry. The company possesses a Value Score of B.

Westlake Chemical Corporation PE Ratio (TTM)

Westlake Chemical Corporation pe-ratio-ttm | Westlake Chemical Corporation Quote

Textainer Group Holdings Limited (TGH): This company that through its subsidiaries, purchases, owns, manages, leases, and disposes a fleet of intermodal containers has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 23.5% over the last 60 days.

Textainer Group Holdings Limited Price and Consensus

Textainer Group Holdings Limited price-consensus-chart | Textainer Group Holdings Limited Quote

Textainer Group has a price-to-earnings ratio (P/E) of 6.90, compared with 58.00 for the industry. The company possesses a Value Score of B.

Textainer Group Holdings Limited PE Ratio (TTM)

Textainer Group Holdings Limited pe-ratio-ttm | Textainer Group Holdings Limited Quote

Lennar Corporation (LEN): This leading builder of quality new homes in the most desirable real estate markets across the nation has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 19.3% over the last 60 days.

Lennar Corporation Price and Consensus

Lennar Corporation price-consensus-chart | Lennar Corporation Quote

Lennar Corp. has a price-to-earnings ratio (P/E) of 7.34, compared with 8.60 for the industry. The company possesses a Value Score of B.

Lennar Corporation PE Ratio (TTM)

Lennar Corporation pe-ratio-ttm | Lennar Corporation Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Westlake Chemical Corporation (WLK) : Free Stock Analysis Report

Textainer Group Holdings Limited (TGH) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

Group 1 Automotive, Inc. (GPI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research