Top Ranked Value Stocks to Buy for December 24th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, December 24th:

Clearwater Paper Corporation (CLW): This producer and seller of private label tissue and bleached paperboard products has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 17.8% over the last 60 days.

Clearwater Paper Corporation Price and Consensus

Clearwater Paper Corporation price-consensus-chart | Clearwater Paper Corporation Quote

Clearwater Paper has a price-to-earnings ratio (P/E) of 6.83, compared with 27.70 for the industry. The company possesses a Value Score of A.

Clearwater Paper Corporation PE Ratio (TTM)

Clearwater Paper Corporation pe-ratio-ttm | Clearwater Paper Corporation Quote

The Michaels Companies, Inc. (MIK): This owner and operater of arts and crafts specialty retail stores has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 27.6% over the last 60 days.

The Michaels Companies, Inc. Price and Consensus

The Michaels Companies, Inc. price-consensus-chart | The Michaels Companies, Inc. Quote

Michaels has a price-to-earnings ratio (P/E) of 5.25, compared with 12.00 for the industry. The company possesses a Value Score of A.

The Michaels Companies, Inc. PE Ratio (TTM)

The Michaels Companies, Inc. pe-ratio-ttm | The Michaels Companies, Inc. Quote

Innoviva, Inc. (INVA): This company that engages in the development and commercialization of pharmaceuticals has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 24.3% over the last 60 days.

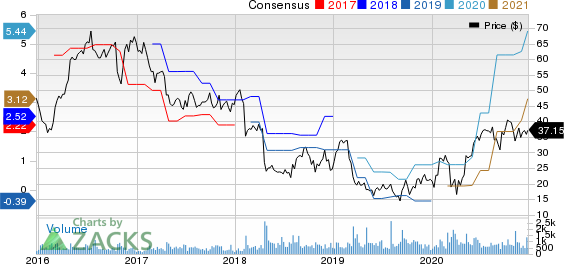

Innoviva, Inc. Price and Consensus

Innoviva, Inc. price-consensus-chart | Innoviva, Inc. Quote

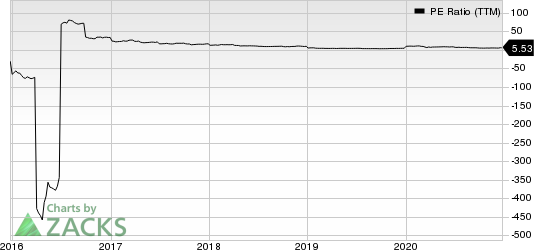

Innoviva has a price-to-earnings ratio (P/E) of 5.43, compared with 14.60 for the industry. The company possesses a Value Score of A.

Innoviva, Inc. PE Ratio (TTM)

Innoviva, Inc. pe-ratio-ttm | Innoviva, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Michaels Companies, Inc. (MIK) : Free Stock Analysis Report

Innoviva, Inc. (INVA) : Free Stock Analysis Report

Clearwater Paper Corporation (CLW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research