Top Ranked Value Stocks to Buy for August 31st

Here are four stocks with buy rank and strong value characteristics for investors to consider today, August 31st:

Uniti Group Inc. (UNIT ): This internally managed real estate investment trust has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 14.4% over the last 60 days.

Communications Sales & Leasing,Inc. Price and Consensus

Communications Sales & Leasing,Inc. Price and Consensus | Communications Sales & Leasing,Inc. Quote

Uniti Group has a price-to-earnings ratio (P/E) of 7.62, compared with 29.80 for the industry. The company possesses a Value Score of A.

Communications Sales & Leasing,Inc. PE Ratio (TTM)

Communications Sales & Leasing,Inc. PE Ratio (TTM) | Communications Sales & Leasing,Inc. Quote

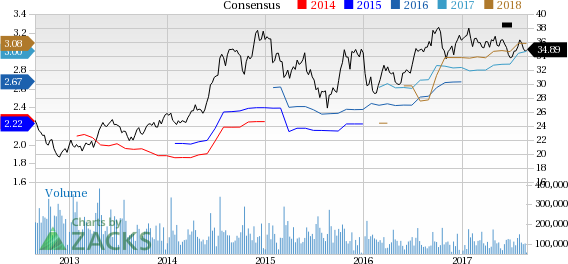

Intel Corporation (INTC ): This manufacturer of computer and communications platformshas a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 4.9% over the last 60 days.

Intel Corporation Price and Consensus

Intel Corporation Price and Consensus | Intel Corporation Quote

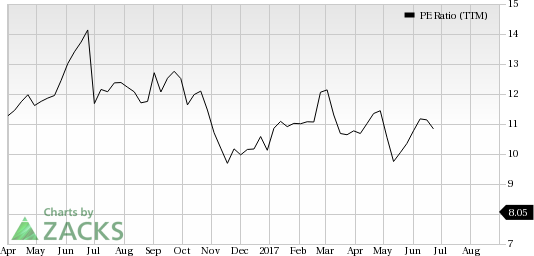

Intel has a price-to-earnings ratio (P/E) of 11.63, compared with 25.10 for the industry. The company possesses a Value Score of A.

Intel Corporation PE Ratio (TTM)

Intel Corporation PE Ratio (TTM) | Intel Corporation Quote

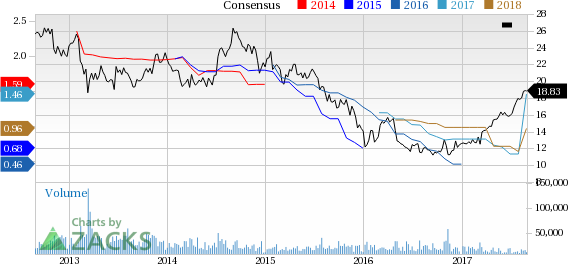

America Movil, S.A.B. de C.V. (AMX ): This telecom services providerhas a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings increasing 69.8% over the last 60 days.

America Movil, S.A.B. de C.V. Price and Consensus

America Movil, S.A.B. de C.V. Price and Consensus | America Movil, S.A.B. de C.V. Quote

America Movil has a price-to-earnings ratio (P/E) of 12.94, compared with 15.90 for the industry. The company possesses a Value Score of A.

America Movil, S.A.B. de C.V. PE Ratio (TTM)

America Movil, S.A.B. de C.V. PE Ratio (TTM) | America Movil, S.A.B. de C.V. Quote

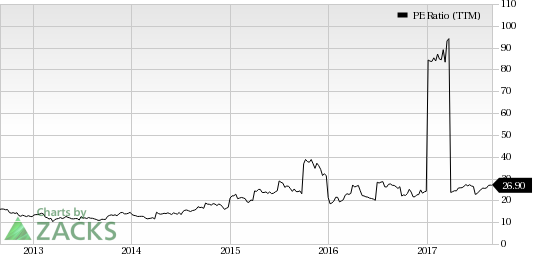

Altisource Portfolio Solutions S.A. (ASPS ): This marketplace and transaction solutions provider has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings advancing 2.5% over the last 60 days.

Altisource Portfolio Solutions S.A. Price and Consensus

Altisource Portfolio Solutions S.A. Price and Consensus | Altisource Portfolio Solutions S.A. Quote

Altisource Portfolio Solutions has a price-to-earnings ratio (P/E) of 7.85, compared with 9.50 for the industry. The company possesses a Value Score of A.

Altisource Portfolio Solutions S.A. PE Ratio (TTM)

Altisource Portfolio Solutions S.A. PE Ratio (TTM) | Altisource Portfolio Solutions S.A. Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Communications Sales & Leasing,Inc. (UNIT) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

Altisource Portfolio Solutions S.A. (ASPS) : Free Stock Analysis Report

America Movil, S.A.B. de C.V. (AMX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research