Top Ranked Value Stocks to Buy for February 5th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, February 5th:

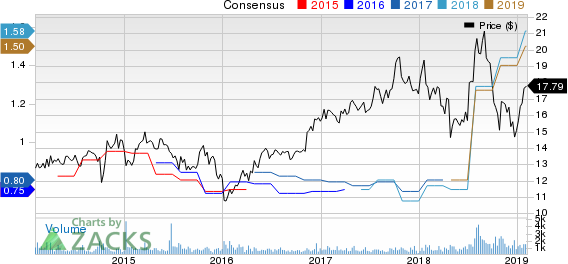

AVX Corporation (AVX): This electronic products manufacturer has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 9.7% over the last 60 days.

AVX Corporation Price and Consensus

AVX Corporation price-consensus-chart | AVX Corporation Quote

AVX has a price-to-earnings ratio (P/E) of 11.26, compared with 15.30 for the industry. The company possesses a Value Score of A.

AVX Corporation PE Ratio (TTM)

AVX Corporation pe-ratio-ttm | AVX Corporation Quote

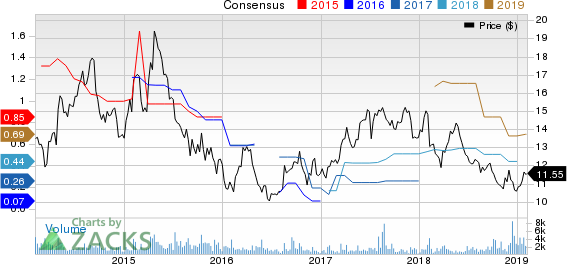

Ardagh Group S.A. (ARD): This rigid packaging solutions manufacturer has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 1% over the last 60 days.

Ardagh Group S.A. Price and Consensus

Ardagh Group S.A. price-consensus-chart | Ardagh Group S.A. Quote

Ardagh has a price-to-earnings ratio (P/E) of 7.09, compared with 10.90 for the industry. The company possesses a Value Score of A.

Ardagh Group S.A. PE Ratio (TTM)

Ardagh Group S.A. pe-ratio-ttm | Ardagh Group S.A. Quote

China Unicom (Hong Kong) Limited (CHU): This telecommunications services provider has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 1.5% over the last 60 days.

China Unicom (Hong Kong) Ltd Price and Consensus

China Unicom (Hong Kong) Ltd price-consensus-chart | China Unicom (Hong Kong) Ltd Quote

China Unicom has a price-to-earnings ratio (P/E) of 16.74, compared with 61.50 for the industry. The company possesses a Value Score of A.

China Unicom (Hong Kong) Ltd PE Ratio (TTM)

China Unicom (Hong Kong) Ltd pe-ratio-ttm | China Unicom (Hong Kong) Ltd Quote

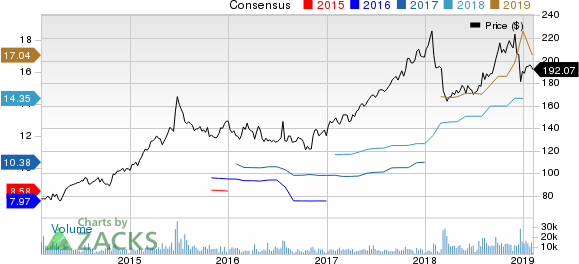

Cigna Corporation (CI): This health services company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 5.3% over the last 60 days.

Cigna Corporation Price and Consensus

Cigna Corporation price-consensus-chart | Cigna Corporation Quote

Cigna has a price-to-earnings ratio (P/E) of 11.27, compared with 17.40 for the industry. The company possesses a Value Score of B.

Cigna Corporation PE Ratio (TTM)

Cigna Corporation pe-ratio-ttm | Cigna Corporation Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

China Unicom (Hong Kong) Ltd (CHU) : Free Stock Analysis Report

Ardagh Group S.A. (ARD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research