Top Ranked Value Stocks to Buy for March 29th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, March 29th:

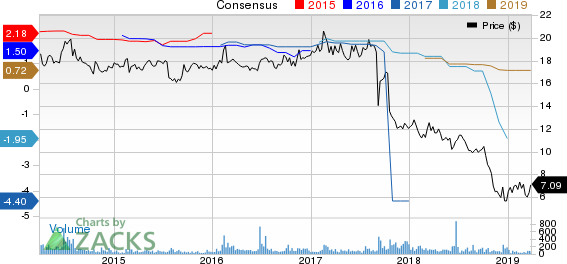

Blue Capital Reinsurance Holdings Ltd. (BCRH): This provider of reinsurance in the property catastrophe market has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 7.4% over the last 60 days.

Blue Capital Reinsurance Holdings Ltd. Price and Consensus

Blue Capital Reinsurance Holdings Ltd. price-consensus-chart | Blue Capital Reinsurance Holdings Ltd. Quote

Blue Capital has a price-to-earnings ratio (P/E) of 9.78 compared with 24.30 for the industry. The company possesses a Value Scoreof B.

Blue Capital Reinsurance Holdings Ltd. PE Ratio (TTM)

Blue Capital Reinsurance Holdings Ltd. pe-ratio-ttm | Blue Capital Reinsurance Holdings Ltd. Quote

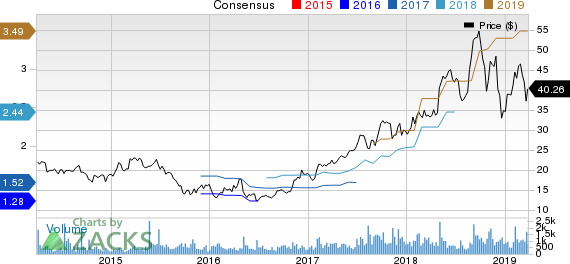

Malibu Boats, Inc. (MBUU): This manufacturer of recreational powerboats has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 2.7% over the last 60 days.

Malibu Boats, Inc. Price and Consensus

Malibu Boats, Inc. price-consensus-chart | Malibu Boats, Inc. Quote

Malibu Boats has a price-to-earnings ratio (P/E) of 11.52 compared with 15.50 for the industry. The company possesses a Value Score of A.

Malibu Boats, Inc. PE Ratio (TTM)

Malibu Boats, Inc. pe-ratio-ttm | Malibu Boats, Inc. Quote

Celgene Corporation (CELG): This biopharmaceutical company has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 3.5% over the last 60 days.

Celgene Corporation Price and Consensus

Celgene Corporation price-consensus-chart | Celgene Corporation Quote

Celgene has a price-to-earnings ratio (P/E) of 8.15 compared with 9.60 for the industry. The company possesses a Value Score of B.

Celgene Corporation PE Ratio (TTM)

Celgene Corporation pe-ratio-ttm | Celgene Corporation Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Malibu Boats, Inc. (MBUU) : Free Stock Analysis Report

Celgene Corporation (CELG) : Free Stock Analysis Report

Blue Capital Reinsurance Holdings Ltd. (BCRH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research