Top Ranked Value Stocks to Buy for November 20th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, November 20th:

Danaos Corporation (DAC): This owner and operator of containerships has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 15.5% over the last 60 days.

Danaos Corporation Price and Consensus

Danaos Corporation price-consensus-chart | Danaos Corporation Quote

Danaos has a price-to-earnings ratio (P/E) of 2.08 compared with 5.00 for the industry. The company possesses a Value Score of A.

Danaos Corporation PE Ratio (TTM)

Danaos Corporation pe-ratio-ttm | Danaos Corporation Quote

Green Plains Partners LP (GPP): This provider of fuel storage and transportation services has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 2.3% over the last 60 days.

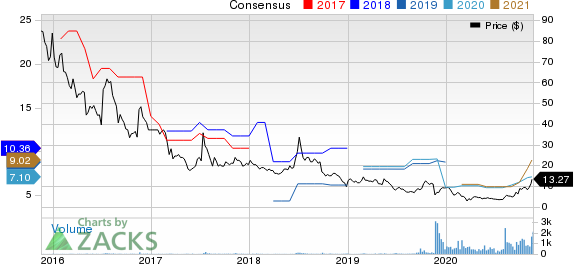

Green Plains Partners LP Price and Consensus

Green Plains Partners LP price-consensus-chart | Green Plains Partners LP Quote

Green Plains has a price-to-earnings ratio (P/E) of 4.69 compared with 19.30 for the industry. The company possesses a Value Score of A.

Green Plains Partners LP PE Ratio (TTM)

Green Plains Partners LP pe-ratio-ttm | Green Plains Partners LP Quote

M/I Homes, Inc. (MHO): This builder of single-family homes has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 33.3% over the last 60 days.

MI Homes, Inc. Price and Consensus

MI Homes, Inc. price-consensus-chart | MI Homes, Inc. Quote

M/I Homes has a price-to-earnings ratio (P/E) of 5.19 compared with 11.70 for the industry. The company possesses a Value Score of A.

MI Homes, Inc. PE Ratio (TTM)

MI Homes, Inc. pe-ratio-ttm | MI Homes, Inc. Quote

Nomura Holdings, Inc. (NMR): This provider of a variety of financial services has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 19.8% over the last 60 days.

Nomura Holdings Inc ADR Price and Consensus

Nomura Holdings Inc ADR price-consensus-chart | Nomura Holdings Inc ADR Quote

Nomura has a price-to-earnings ratio (P/E) of 5.11 compared with 13.00 for the industry. The company possesses a Value Score of A.

Nomura Holdings Inc ADR PE Ratio (TTM)

Nomura Holdings Inc ADR pe-ratio-ttm | Nomura Holdings Inc ADR Quote

See the full list of top ranked stocks here

Learn more about the Value score and how it is calculated here.

Find more top income stocks with some of our great premium screens.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nomura Holdings Inc ADR (NMR) : Free Stock Analysis Report

MI Homes, Inc. (MHO) : Free Stock Analysis Report

Green Plains Partners LP (GPP) : Free Stock Analysis Report

Danaos Corporation (DAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research