Top Real Estate Dividend Picks For The Day

Performance in the real estate sector generally tracks the economic cycle. During periods of high growth and inflation, real estate investments usually post strong returns. However, during an economic bust, these investments tend to underperform. During these times, companies such as Tanger Factory Outlet Centers and National Health Investors generate high dividend income to shareholders. Here are my top dividend stocks in the real estate industry that could be valuable additions to your current holdings.

Tanger Factory Outlet Centers, Inc. (NYSE:SKT)

SKT has an alluring dividend yield of 5.34% with a large payout ratio . SKT’s dividends have seen an increase over the past 10 years, with payments increasing from $0.72 to $1.37 in that time. They have been dependable too, not missing a single payment in this time. It also looks like Tanger Factory Outlet Centers has some promising growth in store for the next year, with analysts expecting the company’s earnings to increase by 54.82% over the next 12 months. Interested in Tanger Factory Outlet Centers? Find out more here.

National Health Investors, Inc. (NYSE:NHI)

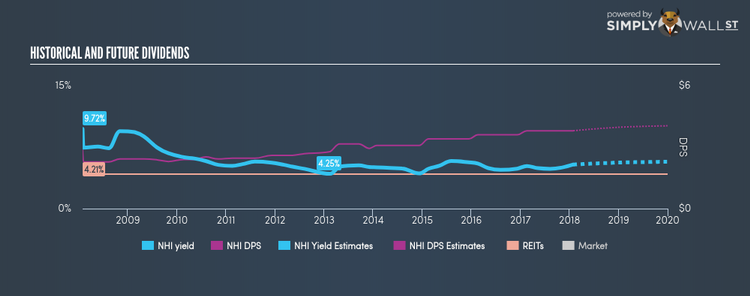

NHI has a substantial dividend yield of 5.38% and is paying out 93.25% of profits as dividends , with the expected payout in three years hitting 103.44%. Although investors would have seen a few years of reduced payments, it has so far always picked up again, with dividends increasing from $2.85 to $3.8 over the past 10 years. National Health Investors is also reasonably priced, with a PE ratio of 17.6 that compares favorably with the US REITs average of 22.7. More on National Health Investors here.

Senior Housing Properties Trust (NASDAQ:SNH)

SNH has an alluring dividend yield of 8.87% with a high payout ratio . The company’s dividends per share have risen from $1.4 to $1.56 over the last 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. More detail on Senior Housing Properties Trust here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.