Top TSX Dividend Payers

Emera is one of the ten dividend stocks that can help raise your investment income by paying sizeable dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. Today I will share with you my best paying dividend shares you should be considering for your portfolio.

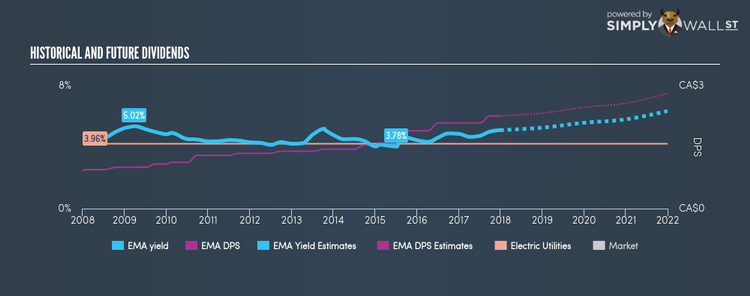

Emera Incorporated (TSX:EMA)

Emera Incorporated, an energy and services company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity to various customers. Formed in 1919, and now led by CEO Christopher Huskilson, the company currently employs 7,442 people and with the market cap of CAD CA$9.95B, it falls under the mid-cap stocks category.

EMA has an alluring dividend yield of 4.79% and the company has a payout ratio of 78.02% , with analysts expecting this ratio in three years to be 80.90%. EMA’s dividends have seen an increase over the past 10 years, with payments increasing from $0.91 to $2.26 in that time. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period.

Canadian Utilities Limited (TSX:CU)

Canadian Utilities Limited engages in the electricity, and pipelines and liquids businesses. Established in 1927, and currently lead by Nancy Southern, the company employs 5,388 people and with the market cap of CAD CA$10.03B, it falls under the large-cap group.

CU has a nice dividend yield of 3.83% and has a payout ratio of 68.55% . CU’s DPS have risen to $1.43 from $0.63 over a 10 year period. To the enjoyment of shareholders, the company hasn’t missed a payment during this period.

Shaw Communications Inc. (TSX:SJR.B)

Shaw Communications Inc. operates as a diversified communications company in North America. Formed in 1966, and now run by Bradley Shaw, the company currently employs 14,000 people and has a market cap of CAD CA$14.41B, putting it in the large-cap stocks category.

SJR.B has a substantial dividend yield of 4.15% and distributes 105.98% of its earnings to shareholders as dividends . The company’s DPS has increased from $0.72 to $1.19 over the last 10 years. They have been consistent too, not missing a payment during this 10 year period.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.