Top Undervalued Real Estate Stocks To Buy

Performance in the real estate sector generally tracks the economic cycle. During periods of high growth and inflation, real estate investments usually post strong returns. However, during an economic bust, these investments tend to underperform. Currently, Chen Xing Development Holdings and Golden Wheel Tiandi Holdings are real estate companies I’ve identified as potentially undervalued, meaning their share price is below what these companies are actually worth. There’s a few ways you can value a cyclical company. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. Analysing the most recent financial data, I’ve created a list of companies that compare favourably in all criteria, making them potentially good investments.

Chen Xing Development Holdings Limited (SEHK:2286)

Chen Xing Development Holdings Limited, an investment holding company, engages in the development and sale of residential and commercial properties in Mainland China. Formed in 1997, and now run by Wukui Bai, the company now has 181 employees and with the company’s market cap sitting at HKD HK$995.00M, it falls under the small-cap group.

2286’s shares are currently hovering at around -96% beneath its actual value of ¥44.76, at a price tag of HK$1.99, based on its expected future cash flows. The discrepancy signals an opportunity to buy low. What’s even more appeal is that 2286’s PE ratio is trading at around 5.95x relative to its Real Estate peer level of, 8.08x indicating that relative to its comparable company group, you can buy 2286 for a cheaper price. 2286 is also a financially healthy company, as current assets can cover liabilities in the near term and over the long run.

Continue research on Chen Xing Development Holdings here.

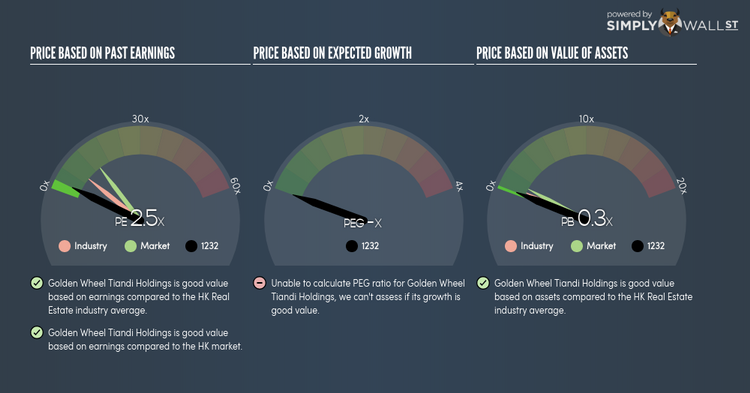

Golden Wheel Tiandi Holdings Company Limited (SEHK:1232)

Golden Wheel Tiandi Holdings Company Limited, an investment holding company, owns, develops, and operates integrated commercial and residential properties in the People’s Republic of China. Established in 1994, and currently run by Kam Wong, the company employs 506 people and with the company’s market capitalisation at HKD HK$1.37B, we can put it in the small-cap stocks category.

1232’s stock is now floating at around -76% lower than its true value of ¥3.17, at the market price of HK$0.76, according to my discounted cash flow model. This mismatch signals an opportunity to buy 1232 shares at a discount. In addition to this, 1232’s PE ratio is trading at around 2.52x against its its Real Estate peer level of, 8.08x indicating that relative to its competitors, 1232’s stock can be bought at a cheaper price. 1232 is also in great financial shape, with near-term assets able to cover upcoming and long-term liabilities.

Interested in Golden Wheel Tiandi Holdings? Find out more here.

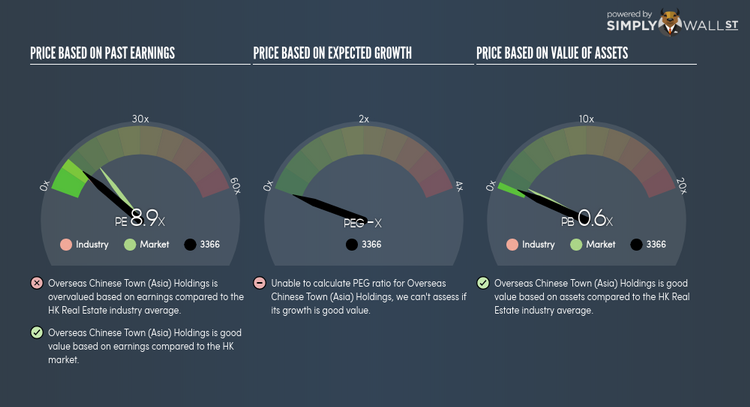

Overseas Chinese Town (Asia) Holdings Limited (SEHK:3366)

Overseas Chinese Town (Asia) Holdings Limited, an investment holding company, develops and operates comprehensive development zone projects in the People’s Republic of China. Formed in 1985, and headed by CEO Mei Xie, the company size now stands at 2,887 people and with the company’s market capitalisation at HKD HK$2.17B, we can put it in the mid-cap group.

3366’s shares are now floating at around -89% below its real value of ¥29.27, at the market price of HK$3.32, based on its expected future cash flows. This discrepancy signals a potential opportunity to buy 3366 shares at a low price. Furthermore, 3366’s PE ratio is currently around 8.86x while its index peer level trades at, 13.97x meaning that relative to other stocks in the industry, you can buy 3366 for a cheaper price. 3366 is also in good financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. It’s debt-to-equity ratio of 132.00% has been falling over time, indicating 3366’s capability to reduce its debt obligations year on year. More detail on Overseas Chinese Town (Asia) Holdings here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks. Or create your own list by filtering SEHK companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.