Toro (TTC) Q2 Earnings Beat, Sales Lag, '18 EPS View Cut

The Toro Company TTC posted second-quarter fiscal 2018 (ended May 4, 2018) earnings of $1.20 per share, up 22% from 98 cents recorded in the year-ago quarter. Additionally, earnings beat the Zacks Consensus Estimate of $1.19.

On a reported basis, earnings came in at $1.21 per share compared with $1.08 per share recorded in the prior-year quarter.

Toro’s net sales inched up 0.3% year over year to $875 million in the quarter. The top line missed the Zacks Consensus Estimate of $910 million.

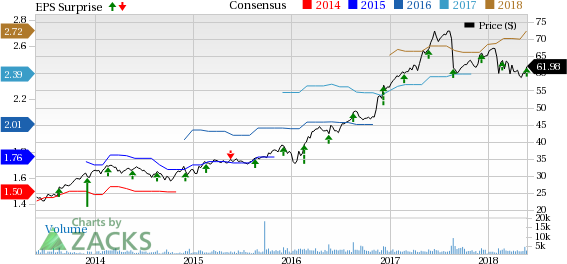

Toro Company (The) Price, Consensus and EPS Surprise

Toro Company (The) Price, Consensus and EPS Surprise | Toro Company (The) Quote

Operational Update

Cost of sales in the quarter edged down 1% year over year to $551 million. Gross profit came in at $324 million, up 2.4% year over year. Gross margin expanded 80 basis points (bps) year over year to 37%.

Selling, general and administrative expenses declined 2% to $154 million. Operating profit improved 7% year over year to $170 million. Operating margin came in at 19.5%, advancing 120 bps year over year.

Segment Performance

The Professional segment’s sales increased 8% year over year to $660 million. Operating profit recorded by the segment came in at $165 million, up 11% from $149 million recorded in the year-ago quarter.

Net sales in the Residential segment declined around 18% year over year to $212 million. Operating profit in the segment was $26 million, down 25% year over year.

Financial Update

At the end of the fiscal second quarter, Toro generated cash and cash equivalents of $206 million, which decreased from $265 million recorded in the year-ago quarter. Cash flow from operations came in at $138 million during the six-month period ended May 4, 2018, compared with $168 million reported in the comparable period last year.

Long-term debt, excluding the current portion, totaled $299 million as of May 4, 2018, compared with $312 million as of May 5, 2017.

Outlook

For fiscal 2018, Toro lowered its earnings per share guidance to $2.66-$2.71 from the previous range of $2.67-$2.73. The company maintained its revenue growth outlook for the fiscal to around 4%. For third-quarter fiscal 2018, the company guides net earnings to be 64-67 cents per share.

Toro is poised to benefit from upbeat trends in the golf business with increased sales of green mowers. Further, the company’s new initiative, Vision 2020, will help focus on driving profitable growth while emphasizing on innovation and serving customers.

Share Price Performance

In a year’s time, shares of Toro have outperformed the industry to which it belongs to. The company’s shares have lost 7.7%, while the industry incurred a loss of 8.2%.

Zacks Rank & Key Picks

Toro currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the same sector are Weight Watchers International Inc WTW, Central Garden & Pet Company CENT and SP Plus Corporation SP. While Weight Watchers sports a Zacks Rank #1 (Strong Buy), Central Garden & Pet Company and SP Plus carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Weight Watchers has a long-term earnings growth rate of 15%. The stock has appreciated 196% in a year’s time.

Central Garden & Pet Company has a long-term earnings growth rate of 10%. The company’s shares have been up 34% during the past year.

SP Plus has a long-term earnings growth rate of 9%. Its shares have rallied 23% in the past year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Central Garden & Pet Company (CENT) : Free Stock Analysis Report

Toro Company (The) (TTC) : Free Stock Analysis Report

Weight Watchers International Inc (WTW) : Free Stock Analysis Report

SP Plus Corporation (SP) : Free Stock Analysis Report

To read this article on Zacks.com click here.