Toyota (TM) Recalls 2.4M Vehicles on Flawed Hybrid System

Toyota Motor Company TM announced a massive safety recall of 2.43 million gasoline hybrid vehicles in Japan, the United States and other markets. The recalled vehicles have a system issue that may lead to halting of cars.

Notably, the recalled cars include Toyota’s Prius and Auris models, which were manufactured between October 2008 and November 2014. Out of the total cars recalled, 1.25 million were sold in Japan, 830,000 in North America and 290,000 in Europe. The additional recalled vehicles were sold in China, Africa, Oceania and other regions.

In unusual situations, the recalled cars might fail to switch to failsafe driving mode on the hybrid system faults, which may result in stalling of the car. This, at higher speeds, increases the risk of a car crash even if the power steering and braking system remain operational.

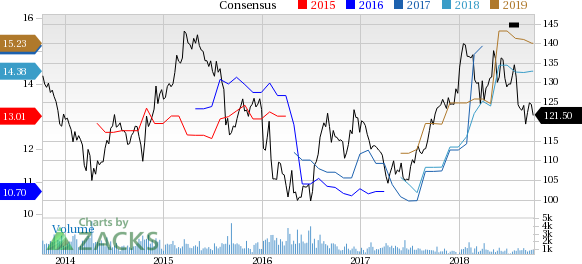

Toyota Motor Corporation Price and Consensus

Toyota Motor Corporation Price and Consensus | Toyota Motor Corporation Quote

Toyota dealers will update the software in all the recalled vehicles without any charge from the customers.

Almost within a month, this marks the second massive recall by the company, which is not related to the Takata airbag issue. Last month, Toyota was recalling more than 1 million of its Prius and C-HR compact crossover cars. The affected vehicle’s engine wire harness, which is linked to the power control unit, might damage over time resulting in a short circuit or catch fire.

Such frequent vehicle recalls in large numbers not only add to expenses for Toyota but also hurts the company’s reputation, which might weigh on vehicle sales.

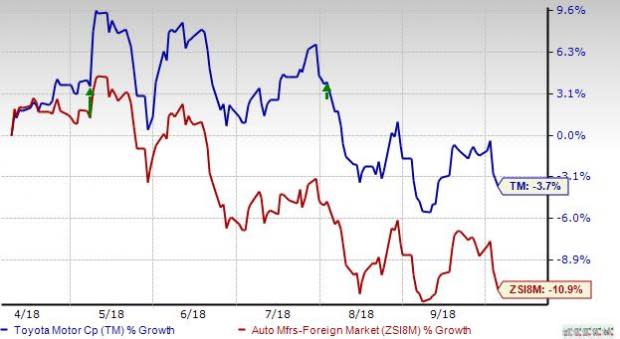

Price Performance

In the past six months, Toyota’s stock has lost 3.7%, outperforming 10.9% decrease recorded by the industry it belongs to.

Zacks Rank & Key Picks

Toyota currently carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the Auto space are AutoZone, Inc. AZO, Navistar International Corporation NAV and Advance Auto Parts, Inc. AAP. AutoZone and Navistar carry a Zacks Rank #2 (Buy), while Advance Auto Parts sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AutoZone has an expected long-term growth rate of 12.2%. Over the past six months, shares of the company have gained 25.4%.

Navistar has an expected long-term growth rate of 5%. Shares of the company have increased 12.6% over the past six months.

Advance Auto Parts has an expected long-term growth rate of 12.3%. Shares of the company have rallied 50.2% over the past six months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toyota Motor Corporation (TM) : Free Stock Analysis Report

AutoZone, Inc. (AZO) : Free Stock Analysis Report

Advance Auto Parts, Inc. (AAP) : Free Stock Analysis Report

Navistar International Corporation (NAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research