How to Trade Fast Moving US Dollar Pairs Next Week

Recent moves have been wondrous. Next week’s trading may require more skill however. Well-constructed channel lines can help one enter trades in fast moving impulsive markets. Focus is on setups in AUDUSD, NZDUSD, and USDCHF.

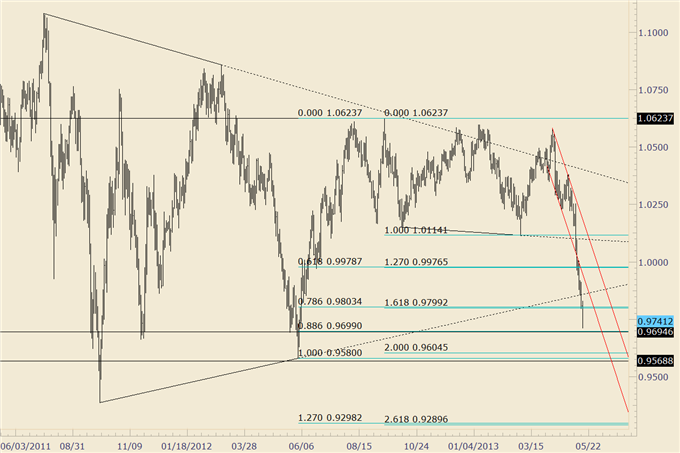

AUDUSD

Daily

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Are you new to FX or curious about your trading IQ?

FOREX Analysis: The AUDUSD is quickly approaching its .9605 target…this is where the decline from under 1.0114 would equal the width of the 1.0624-1.0114 range. Something much more bearish is possible given this week’s break below the trendline that extends off of the 2011 and 2012 lows. .9700 is a level that could produce a bounce into .9800/60. .9700 is the 88.6% retracement, 5/23/12 low, and close of the low day for 2012 (June 1st).

FOREX Trading Strategy: Looking for a low near .9700 and rally into .9800 (Fibonacci confluence) and maybe the intersection of the broken multiyear trendline and underside of the downward sloping channel (in red). That intersection occurs on 5/23 at about .9865. Bottom line – support is .9700 (play as you see fit) and resistance is .9830/60 for those looking to align for a larger drop into .9605. Stops are above 1.0005.

NZDUSD

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Are you new to FX or curious about your trading IQ?

FOREX Analysis:Wrote in the last weekly that “viewed in the context of an impulsive decline from the 2011 high, it is possible that the NZDUSD will trade below .7370 before trading above .8585.” The point here is that there is additional downside although the current level (November 2012 low and internal trendline) is one that may produce a bounce. Near term resistance is difficult to hone in on at this point so all I can do is point to a zone from .8138 to .8228 with the strongest part of that zone .8174-.8208. Of interest on the downside is .7914, .7806 and especially .7640/50. The latter level is a trendline intersection in mid-June and the 78.6% retracement.

FOREX Trading Strategy: Looking to return to short side between .8174 and .8208 with .8275 stop.

NZDUSD

240 Minute

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Are you new to FX or curious about your trading IQ?

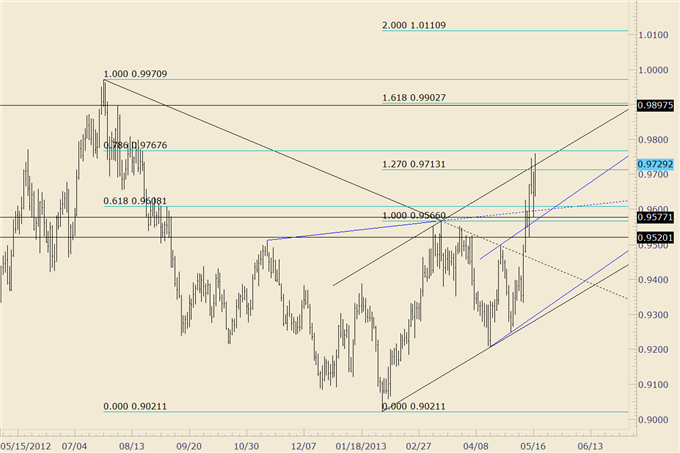

USDCHF

Daily

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Are you new to FX or curious about your trading IQ?

FOREX Analysis: An inverse head and shoulders pattern that began exactly 8 months ago (9/14/12) was confirmed Tuesday in the USDCHF. The target from the pattern is 1.0111. In the ‘year of the breakout’, ignore such patterns at your own risk. Wrote Wednesday that “channel resistance won today but look for support at the broken upward sloping channel line and neckline (both in blue).” The neckline served as support Thursday and price is putting corrective channel resistance to the test. A break above the channel would indicate that the rally is accelerating from that point to much higher levels…and eliminate a corrective interpretation of the advance from .9021. The blue channel is a microcosm of the black channel. Any setbacks are viewed as opportunities to buy against .9520.

FOREX Trading Strategy: Have been increasing longs on near term bullish patterns. Looking for support from .9640 to .9685 (see next chart) to buy more against .9520 for .9900 and a break above .9971 and continuation into 1.0100.

USDCHF

60 Minutes

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Are you new to FX or curious about your trading IQ?

GBPUSD

Weekly

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

Are you new to FX or curious about your trading IQ?

FOREXAnalysis: To review – “When considering the break of the 4 year triangle (red line on chart is former triangle support) in February, it is possible that an incredibly important top is in place at the May 1 high.” Channel support was broken Monday and it’s been downhill since. A return to 1.5321 isn’t impossible but the downside is far greater. A measured level is 1.4055 (1.4830-(1.5606-1.4830)) and a test of 1.3500 is possible.

FOREX Trading Strategy: Big picture short, would sell more above 1.5320 is given the chance…targeting 1.4055 and 1.3500. The Daily Technicals will update shorter term opportunities.

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow him on Twitter @JamieSaettele

Subscribe to Jamie Saettele's distribution list in order to receive actionable FX trading strategy delivered to your inbox.

Jamie is the author of Sentiment in the Forex Market.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.