Traders Prepare For Earnings Season, Slow Growth Expectations

This article was originally published on ETFTrends.com.

The Q1 2019 earnings season is upon us.

Overall, the expectation is that earnings will decline slightly compared to Q4 2018. This could be the first earnings decline since the second quarter of 2016. Last year saw a tailwind provided by federal tax cut legislation, after steady growth in 2017.

Aggregate earnings for the S&P 500 are projected to be -3.9% lower than the same period last year on 4% higher revenues. Traders may recall that earnings growth in Q4 2018 was 13.4 percent.

Below is some food for thought as outlined by FactSet.

Earnings Growth: For Q1 2019, the estimated earnings decline for the S&P 500 is -3.9%. If -3.9% is the actual decline for the quarter, it will mark the first year-over-year decline in earnings for the index since Q2 2016.

Earnings Revisions: On December 31, the estimated earnings growth rate for Q1 2019 was 2.9%. All eleven sectors have lower growth rates today (compared to December 31) due to downward revisions to EPS estimates.

Earnings Guidance: For Q1 2019, 79 S&P 500 companies have issued negative EPS guidance and 28 S&P 500 companies have issued positive EPS guidance.

Valuation: The forward 12-month P/E ratio for the S&P 500 is 16.3. This P/E ratio is below the 5-year average (16.4) but above the 10-year average (14.7).

Earnings Scorecard: For Q1 2019 (with 20 companies in the S&P 500 reporting actual results for the quarter), 17 S&P 500 companies have reported a positive EPS surprise and 11 have reported a positive revenue surprise.

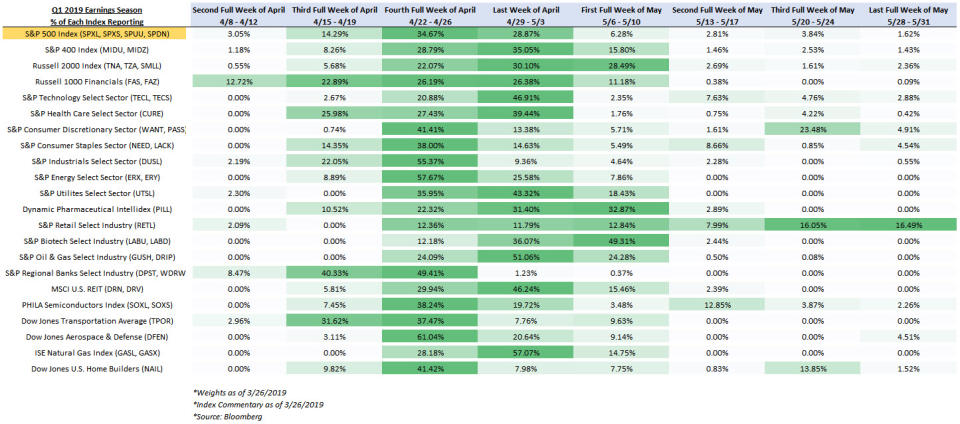

Below is a table identifying the percentage of names in each index that is reporting, arranged by trading week. Following that table is a list of Top Ten Holdings for key indexes, along with their earnings announcement dates, and corresponding bold trades using Direxion Leveraged ETFs.

Source: Bloomberg.

Q1 Quarterly Earnings Calendar

(All index data as of 3/31/2019)

S&P 500 Index (SPXT) | S&P 400 Index (MID) | |||||||

Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | Top 10 Weights | Ticker | Weight in the index | Expected Earnings Release | |

MICROSOFT CORP | MSFT UW | 3.85% | 5/1/2019 | IDEX CORP | IEX UN | 0.69% | 4/29/2019 | |

APPLE INC | AAPL UW | 3.56% | 4/30/2019 | ZEBRA TECHNOLOGIES CORP-CL A | ZBRA UW | 0.68% | 5/7/2019 | |

AMAZON.COM INC | AMZN UW | 3.13% | 4/25/2019 | STERIS PLC | STE UN | 0.63% | 5/8/2019 | |

FACEBOOK INC-CLASS A | FB UW | 1.70% | 4/24/2019 | ULTIMATE SOFTWARE GROUP INC | ULTI UW | 0.63% | 4/30/2019 | |

BERKSHIRE HATHAWAY INC-CL B | BRK/B UN | 1.66% | 5/6/2019 | TRIMBLE INC | TRMB UW | 0.61% | 5/6/2019 | |

JOHNSON & JOHNSON | JNJ UN | 1.57% | 4/16/2019 | DOMINO’S PIZZA INC | DPZ UN | 0.61% | 4/25/2019 | |

ALPHABET INC-CL C | GOOG UW | 1.55% | 4/29/2019 | PTC INC | PTC UW | 0.60% | 4/17/2019 | |

ALPHABET INC-CL A | GOOGL UW | 1.52% | 4/29/2019 | CAMDEN PROPERTY TRUST | CPT UN | 0.59% | 5/5/2019 | |

EXXON MOBIL CORP | XOM UN | 1.46% | 4/26/2019 | UGI CORP | UGI UN | 0.59% | 5/1/2019 | |

JPMORGAN CHASE & CO | JPM UN | 1.39% | 4/12/2019 | NVR INC | NVR UN | 0.58% | 4/18/2019 | |

Related Funds: | ||||||||

Russell 2000® Index (RU20INTR) Russell 1000 Financial Services Index (RGUSFLA) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release ETSY INC ETSY UW 0.40% 5/7/2019 BERKSHIRE HATHAWAY INC-CL B BRK/B UN 7.38% 5/6/2019 FIVE BELOW FIVE UW 0.32% 3/27/2019 JPMORGAN CHASE & CO JPM UN 6.28% 4/12/2019 INTEGRATED DEVICE TECH INC IDTI UW 0.32% 4/29/2019 VISA INC-CLASS A SHARES V UN 5.20% 4/24/2019 TRADE DESK INC/THE -CLASS A TTD UQ 0.31% 5/9/2019 BANK OF AMERICA CORP BAC UN 4.66% 4/16/2019 HUBSPOT INC HUBS UN 0.31% 5/9/2019 MASTERCARD INC – A MA UN 4.03% 5/1/2019 PLANET FITNESS INC – CL A PLNT UN 0.29% 5/7/2019 WELLS FARGO & CO WFC UN 3.84% 4/12/2019 CREE INC CREE UW 0.29% 5/1/2019 CITIGROUP INC C UN 2.76% 4/15/2019 CIENA CORP CIEN UN 0.27% 5/30/2019 PAYPAL HOLDINGS INC PYPL UW 2.30% 4/24/2019 PRIMERICA INC PRI UN 0.26% 5/7/2019 AMERICAN TOWER CORP AMT UN 1.62% 5/1/2019 COUPA SOFTWARE INC COUP UW 0.25% 6/3/2019 AMERICAN EXPRESS CO AXP UN 1.45% 4/18/2019 Related Funds:

Related Funds:

Technology Select Sector Index (IXTTR) Health Care Select Sector Index (IXVTR) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release MICROSOFT CORP MSFT UW 18.22% 5/1/2019 JOHNSON & JOHNSON JNJ UN 10.79% 4/16/2019 APPLE INC AAPL UW 16.85% 4/30/2019 PFIZER INC PFE UN 6.89% 4/30/2019 VISA INC-CLASS A SHARES V UN 5.47% 4/24/2019 UNITEDHEALTH GROUP INC UNH UN 6.83% 4/16/2019 INTEL CORP INTC UW 4.84% 4/25/2019 MERCK & CO. INC. MRK UN 6.26% 4/30/2019 CISCO SYSTEMS INC CSCO UW 4.72% 5/15/2019 ABBOTT LABORATORIES ABT UN 4.06% 4/17/2019 MASTERCARD INC – A MA UN 4.24% 5/1/2019 MEDTRONIC PLC MDT UN 3.57% 5/23/2019 ORACLE CORP ORCL UN 2.73% 6/18/2019 ABBVIE INC ABBV UN 3.48% 5/2/2019 ADOBE INC ADBE UW 2.61% 6/18/2019 AMGEN INC AMGN UW 3.43% 4/23/2019 INTL BUSINESS MACHINES CORP IBM UN 2.51% 4/16/2019 ELI LILLY & CO LLY UN 3.31% 4/30/2019 SALESFORCE.COM INC CRM UN 2.46% 5/28/2019 THERMO FISHER SCIENTIFIC INC TMO UN 3.19% 4/24/2019 Related Funds:

Related Funds:

S&P Consumer Discretionary Index (IXYTR) S&P Consumer Staples Index (IXRTR) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release AMAZON.COM INC AMZN UW 24.27% 4/25/2019 PROCTER & GAMBLE CO/THE PG UN 14.98% 4/23/2019 HOME DEPOT INC HD UN 9.87% 5/21/2019 COCA-COLA CO/THE KO UN 10.43% 4/23/2019 MCDONALD’S CORP MCD UN 6.62% 4/30/2019 PEPSICO INC PEP UW 9.96% 4/17/2019 NIKE INC -CL B NKE UN 4.84% 6/27/2019 WALMART INC WMT UN 8.14% 5/16/2019 STARBUCKS CORP SBUX UW 4.19% 4/25/2019 MONDELEZ INTERNATIONAL INC-A MDLZ UW 4.63% 4/30/2019 LOWE’S COS INC LOW UN 3.92% 5/22/2019 COSTCO WHOLESALE CORP COST UW 4.54% 5/30/2019 BOOKING HOLDINGS INC BKNG UW 3.67% 5/8/2019 ALTRIA GROUP INC MO UN 4.46% 4/25/2019 TJX COMPANIES INC TJX UN 3.02% 5/21/2019 PHILIP MORRIS INTERNATIONAL PM UN 4.39% 4/18/2019 GENERAL MOTORS CO GM UN 2.23% 4/30/2019 COLGATE-PALMOLIVE CO CL UN 4.05% 4/26/2019 TARGET CORP TGT UN 1.92% 5/22/2019 WALGREENS BOOTS ALLIANCE INC WBA UW 3.48% 4/2/2019 Related Funds:

Related Funds:

S&P Industrials Select Sector Index (IXITR) S&P Energy Select Sector Index (IXETR) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release BOEING CO/THE BA UN 8.86% 4/24/2019 EXXON MOBIL CORP XOM UN 22.48% 4/26/2019 3M CO MMM UN 5.43% 4/23/2019 CHEVRON CORP CVX UN 19.35% 4/26/2019 UNION PACIFIC CORP UNP UN 5.32% 4/18/2019 CONOCOPHILLIPS COP UN 6.38% 4/26/2019 HONEYWELL INTERNATIONAL INC HON UN 5.23% 4/18/2019 EOG RESOURCES INC EOG UN 4.55% 5/2/2019 UNITED TECHNOLOGIES CORP UTX UN 4.65% 4/23/2019 SCHLUMBERGER LTD SLB UN 4.48% 4/18/2019 GENERAL ELECTRIC CO GE UN 4.00% 4/18/2019 OCCIDENTAL PETROLEUM CORP OXY UN 4.16% 5/7/2019 CATERPILLAR INC CAT UN 3.45% 4/24/2019 MARATHON PETROLEUM CORP MPC UN 3.46% 4/29/2019 UNITED PARCEL SERVICE-CL B UPS UN 3.43% 4/25/2019 PHILLIPS 66 PSX UN 3.40% 4/30/2019 LOCKHEED MARTIN CORP LMT UN 3.30% 4/23/2019 KINDER MORGAN INC KMI UN 3.24% 4/17/2019 CSX CORP CSX UW 2.58% 4/16/2019 VALERO ENERGY CORP VLO UN 3.01% 4/25/2019 Related Funds:

Related Funds:

S&P Utilities Select Sector Index (IXUTR) Dynamic Pharmaceutical Intellidex Index (DZRTR) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release NEXTERA ENERGY INC NEE UN 11.70% 4/23/2019 ELI LILLY & CO LLY US 5.41% 4/30/2019 DUKE ENERGY CORP DUK UN 8.35% 5/9/2019 ABBOTT LABORATORIES ABT US 5.33% 4/17/2019 DOMINION ENERGY INC D UN 7.71% 4/26/2019 MERCK & CO. INC. MRK US 5.27% 4/30/2019 SOUTHERN CO/THE SO UN 6.82% 5/1/2019 JOHNSON & JOHNSON JNJ US 5.19% 4/16/2019 EXELON CORP EXC UN 6.17% 5/1/2019 AMGEN INC AMGN US 5.15% 4/23/2019 AMERICAN ELECTRIC POWER AEP UN 5.32% 4/25/2019 PFIZER INC PFE US 5.11% 4/30/2019 SEMPRA ENERGY SRE UN 4.31% 5/6/2019 BRISTOL-MYERS SQUIBB CO BMY US 4.89% 4/25/2019 PUBLIC SERVICE ENTERPRISE GP PEG UN 3.80% 4/29/2019 BIOGEN INC BIIB US 3.68% 4/24/2019 XCEL ENERGY INC XEL UW 3.70% 4/25/2019 HORIZON PHARMA PLC HZNP US 3.47% 5/8/2019 CONSOLIDATED EDISON INC ED UN 3.45% 5/2/2019 ALLERGAN PLC AGN US 3.03% 4/26/2019 Related Funds:

Related Funds:

S&P Retail Select Industry Index (SPSIRETR) S&P Biotechnology Select Industry Index (SPSIBITR) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release CARVANA CO CVNA UN 1.36% 5/8/2019 LIGAND PHARMACEUTICALS LGND UQ 1.75% 5/7/2019 ULTA BEAUTY INC ULTA UW 1.30% 5/30/2019 MIRATI THERAPEUTICS INC MRTX UW 1.72% 5/7/2019 ADVANCE AUTO PARTS INC AAP UN 1.29% 5/23/2019 IONIS PHARMACEUTICALS INC IONS UW 1.72% 5/3/2019 AMAZON.COM INC AMZN UW 1.28% 4/25/2019 NEUROCRINE BIOSCIENCES INC NBIX UW 1.71% 4/29/2019 TIFFANY & CO TIF UN 1.27% 6/4/2019 IMMUNOMEDICS INC IMMU UQ 1.67% 5/9/2019 OFFICE DEPOT INC ODP UW 1.26% 5/8/2019 INTERCEPT PHARMACEUTICALS IN ICPT UW 1.66% 5/7/2019 L BRANDS INC LB UN 1.25% 5/22/2019 BLUEBIRD BIO INC BLUE UW 1.66% 5/1/2019 BJ’S WHOLESALE CLUB HOLDINGS BJ UN 1.25% 6/15/2019 SEATTLE GENETICS INC SGEN UW 1.64% 4/25/2019 CARMAX INC KMX UN 1.25% 3/29/2019 SAGE THERAPEUTICS INC SAGE UQ 1.64% 5/2/2019 STITCH FIX INC-CLASS A SFIX UW 1.25% 6/10/2019 ARRAY BIOPHARMA INC ARRY UQ 1.63% 5/7/2019 Related Funds:

Related Funds:

S&P Oil & Gas Exploration and Production Index (SPSIOP) S&P Regional Banks Select Industry Index (SPSIRBKT) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release CALIFORNIA RESOURCES CORP CRC UN 2.43% 5/2/2019 FIRST REPUBLIC BANK/CA FRC UN 1.84% 4/12/2019 OASIS PETROLEUM INC OAS UN 2.27% 5/6/2019 CIT GROUP INC CIT UN 1.80% 4/23/2019 DEVON ENERGY CORP DVN UN 2.26% 5/1/2019 PNC FINANCIAL SERVICES GROUP PNC UN 1.78% 4/12/2019 NOBLE ENERGY INC NBL UN 2.23% 4/30/2019 SIGNATURE BANK SBNY UW 1.78% 4/18/2019 CHESAPEAKE ENERGY CORP CHK UN 2.23% 5/1/2019 STERLING BANCORP/DE STL UN 1.78% 4/23/2019 WHITING PETROLEUM CORP WLL UN 2.19% 4/30/2019 PEOPLE’S UNITED FINANCIAL PBCT UW 1.77% 4/18/2019 RANGE RESOURCES CORP RRC UN 2.16% 4/25/2019 CULLEN/FROST BANKERS INC CFR UN 1.76% 4/25/2019 SM ENERGY CO SM UN 2.15% 5/2/2019 PACWEST BANCORP PACW UW 1.76% 4/16/2019 WPX ENERGY INC WPX UN 2.15% 5/1/2019 FIFTH THIRD BANCORP FITB UW 1.74% 4/23/2019 APACHE CORP APA UN 2.13% 5/1/2019 FIRST HORIZON NATIONAL CORP FHN UN 1.74% 4/12/2019 Related Funds:

Related Funds:

MSCI US REIT Index (RMSG) PHLX Semiconductor Sector Index (XSOX) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release SIMON PROPERTY GROUP INC SPG UN 6.14% 4/25/2019 NVIDIA CORP NVDA UW 8.85% 5/15/2019 PROLOGIS INC PLD UN 4.97% 4/16/2019 QUALCOMM INC QCOM UW 8.39% 5/1/2019 EQUINIX INC EQIX UW 3.94% 5/1/2019 BROADCOM INC AVGO UW 8.33% 6/6/2019 PUBLIC STORAGE PSA UN 3.78% 4/25/2019 TEXAS INSTRUMENTS INC TXN UW 7.91% 4/23/2019 WELLTOWER INC WELL UN 3.24% 4/28/2019 INTEL CORP INTC UW 7.79% 4/25/2019 AVALONBAY COMMUNITIES INC AVB UN 3.04% 4/25/2019 ADVANCED MICRO DEVICES AMD UW 4.22% 4/24/2019 EQUITY RESIDENTIAL EQR UN 3.03% 4/30/2019 TAIWAN SEMICONDUCTOR-SP ADR TSM UN 3.99% 4/18/2019 DIGITAL REALTY TRUST INC DLR UN 2.68% 4/28/2019 APPLIED MATERIALS INC AMAT UW 3.99% 5/16/2019 VENTAS INC VTR UN 2.54% 4/25/2019 LAM RESEARCH CORP LRCX UW 3.95% 4/24/2019 REALTY INCOME CORP O UN 2.39% 5/8/2019 XILINX INC XLNX UW 3.90% 4/24/2019 Related Funds:

Related Funds:

Dow Jones Transportation Average (DJTTR) Dow Jones U.S. Select Aerospace & Defense Index (DJSASDT) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release NORFOLK SOUTHERN CORP NSC UN 10.94% 4/24/2019 BOEING CO/THE BA UN 20.60% 4/24/2019 FEDEX CORP FDX UN 10.56% 6/25/2019 UNITED TECHNOLOGIES CORP UTX UN 17.43% 4/23/2019 UNION PACIFIC CORP UNP UN 9.76% 4/18/2019 LOCKHEED MARTIN CORP LMT UN 6.12% 4/23/2019 KANSAS CITY SOUTHERN KSU UN 6.86% 4/17/2019 TRANSDIGM GROUP INC TDG UN 4.49% 5/7/2019 UNITED PARCEL SERVICE-CL B UPS UN 6.54% 4/25/2019 GENERAL DYNAMICS CORP GD UN 4.31% 4/24/2019 LANDSTAR SYSTEM INC LSTR UW 6.43% 4/24/2019 L3 TECHNOLOGIES INC LLL UN 4.30% 5/1/2019 HUNT (JB) TRANSPRT SVCS INC JBHT UW 5.92% 4/15/2019 RAYTHEON COMPANY RTN UN 4.28% 4/25/2019 C.H. ROBINSON WORLDWIDE INC CHRW UW 5.16% 5/7/2019 HARRIS CORP HRS UN 4.27% 5/1/2019 UNITED CONTINENTAL HOLDINGS UAL UW 4.67% 4/16/2019 NORTHROP GRUMMAN CORP NOC UN 4.07% 4/24/2019 KIRBY CORP KEX UN 4.59% 4/24/2019 TEXTRON INC TXT UN 3.11% 4/17/2019 Related Funds:

Related Funds:

ISE Natural Gas Index (FUMTR) Dow Jones U.S. Select Home Builders Index (DJSHMBT) Top 10 Weights Ticker Weight in the index Expected Earnings Release Top 10 Weights Ticker Weight in the index Expected Earnings Release NOBLE ENERGY INC NBL UN 4.94% 4/30/2019 DR HORTON INC DHI UN 14.03% 4/25/2019 EQT CORP EQT UN 4.84% 4/25/2019 LENNAR CORP-A LEN UN 13.51% 3/27/2019 CABOT OIL & GAS CORP COG UN 4.67% 4/26/2019 NVR INC NVR UN 9.54% 4/18/2019 DEVON ENERGY CORP DVN UN 4.67% 5/1/2019 PULTEGROUP INC PHM UN 6.93% 4/23/2019 RANGE RESOURCES CORP RRC UN 4.51% 4/25/2019 TOLL BROTHERS INC TOL UN 4.85% 5/21/2019 MURPHY OIL CORP MUR UN 4.41% 5/1/2019 LOWE’S COS INC LOW UN 4.52% 5/22/2019 ENCANA CORP ECA UN 4.34% 5/1/2019 HOME DEPOT INC HD UN 4.48% 5/21/2019 NATIONAL FUEL GAS CO NFG UN 4.32% 5/2/2019 SHERWIN-WILLIAMS CO/THE SHW UN 3.29% 4/23/2019 CONCHO RESOURCES INC CXO UN 4.30% 5/5/2019 MASCO CORP MAS UN 2.64% 4/25/2019 ANTERO RESOURCES CORP AR UN 4.28% 4/24/2019 LENNOX INTERNATIONAL INC LII UN 2.35% 4/22/2019 Related Funds:

Related Funds:

ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investments. Due to the daily nature of the leverage employed, there is no guarantee of amplified long-term returns. Past performance is not indicative of future results.

An investor should consider the investment objectives, risks, charges, and expenses of Direxion Shares carefully before investing. The prospectus and summary prospectus contain this and other information about Direxion Shares. Click here to obtain a prospectus or contact Direxion at (877) 437-9363. The prospectus or summary prospectus should be read carefully before investing.

Direxion Shares Risks – An investment in the ETFs involves risk, including the possible loss of principal. Each ETF is non-diversified and includes risks associated with the ETF concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are a multiple of the return of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Counterparty Risk, Intra-Day Investment Risk, for each Bull Fund, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, for each Bear Fund, Daily Inverse Index Correlation/Tracking Risk and risks related to Shorting and Cash Transactions. In addition to these risks, there are risks associated with an ETF’s investment in a specific sector, industry, or stocks that comprise each Fund’s underlying index. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

The views in this material represent an assessment of the current market conditions and is not intended to be a forecast of future events. These views are intended to educated the reader and do not constitute investment advice regarding the funds or any security in particular. Past performance does not guarantee future results.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM